Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

- What are people saying? Would you like a free book?

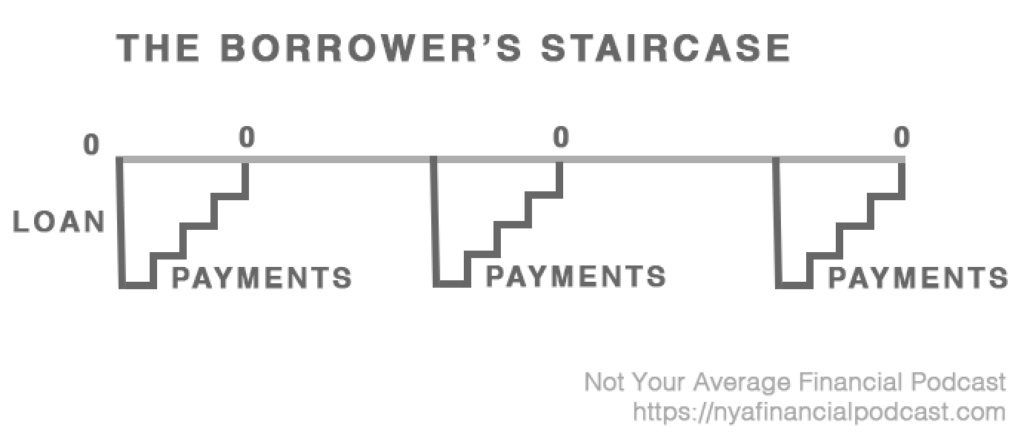

- What about debt?

- What is Dave Ramsey’s debt snowball method?

- How much can you squeeze your lifestyle down to?

- What is the debt avalanche method?

- What is the best course of action?

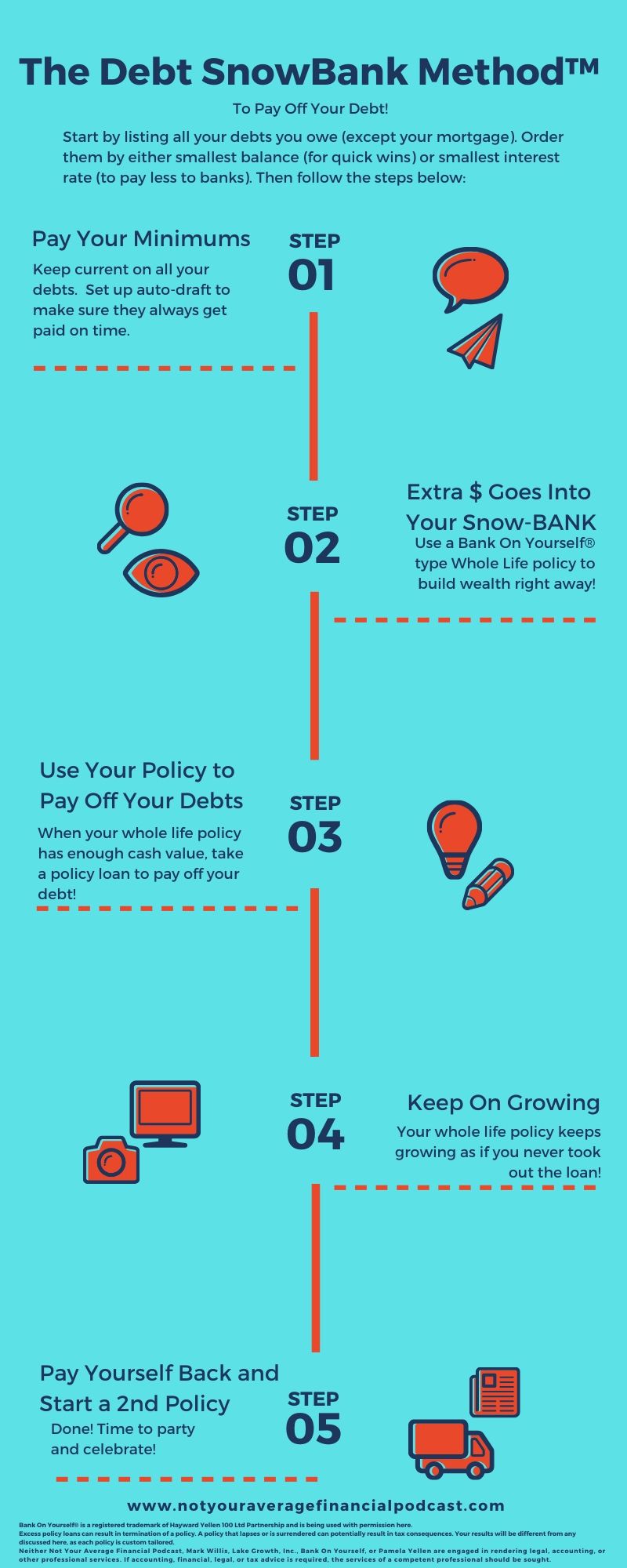

- What is The Debt SnowBank Method™?

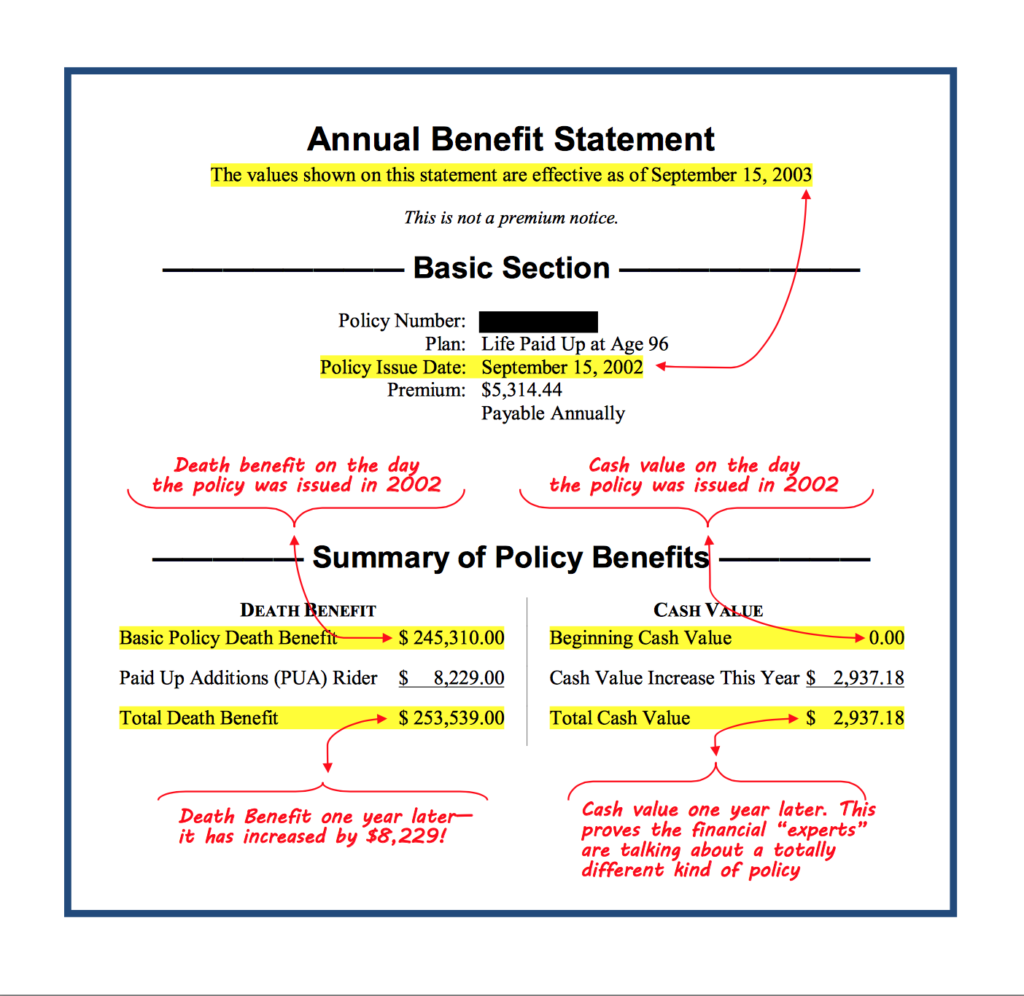

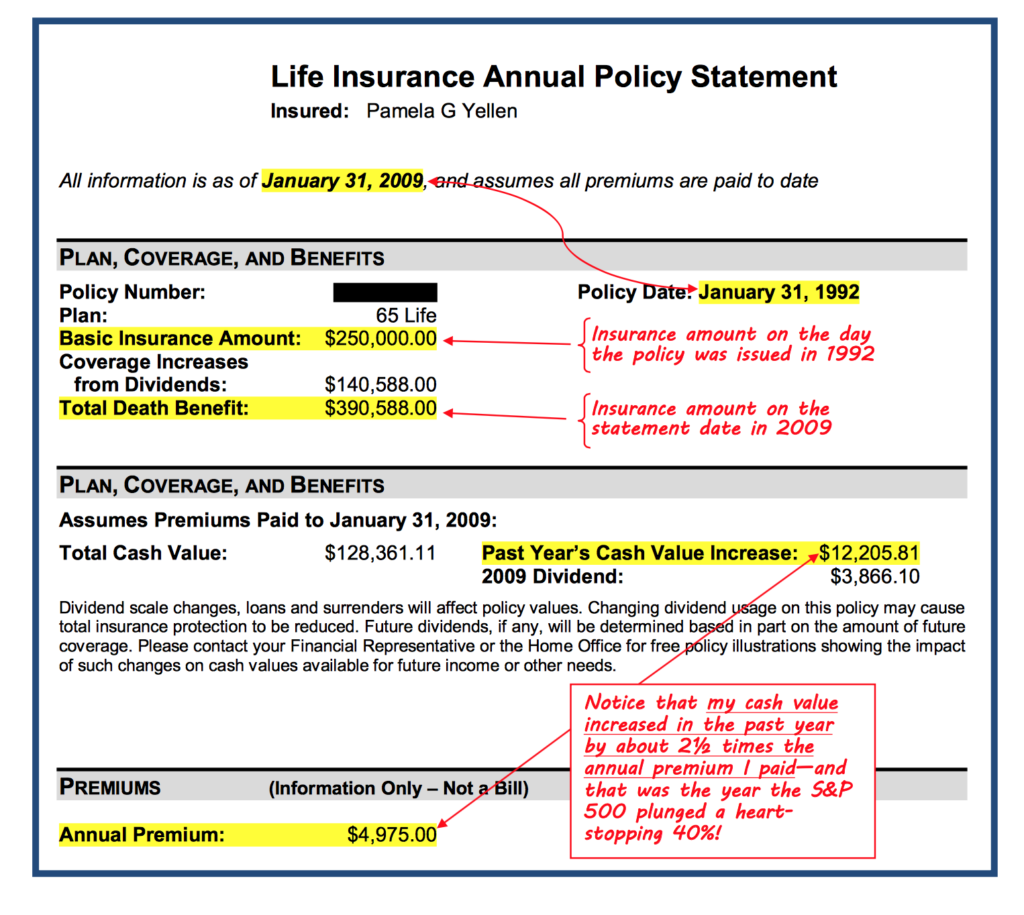

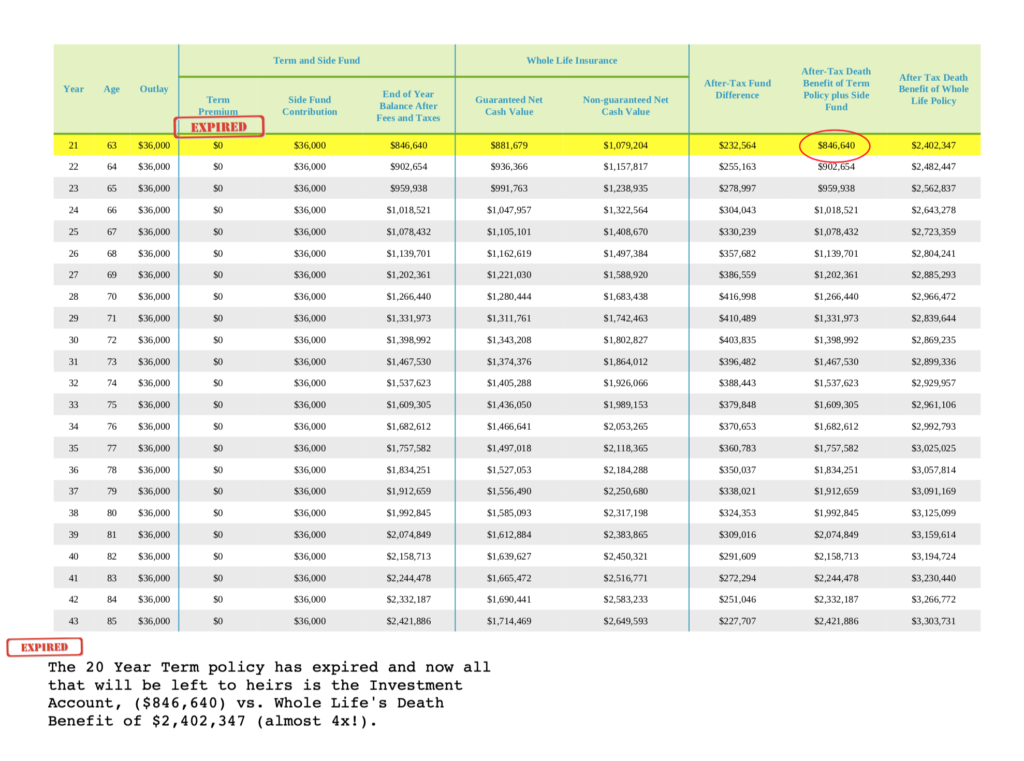

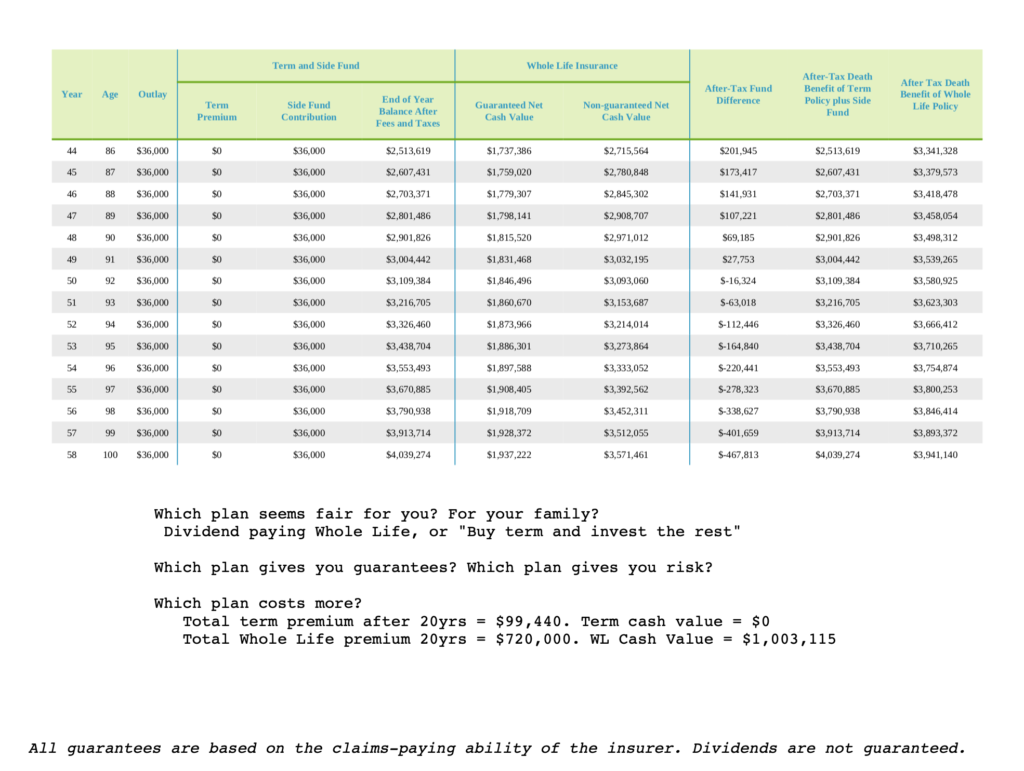

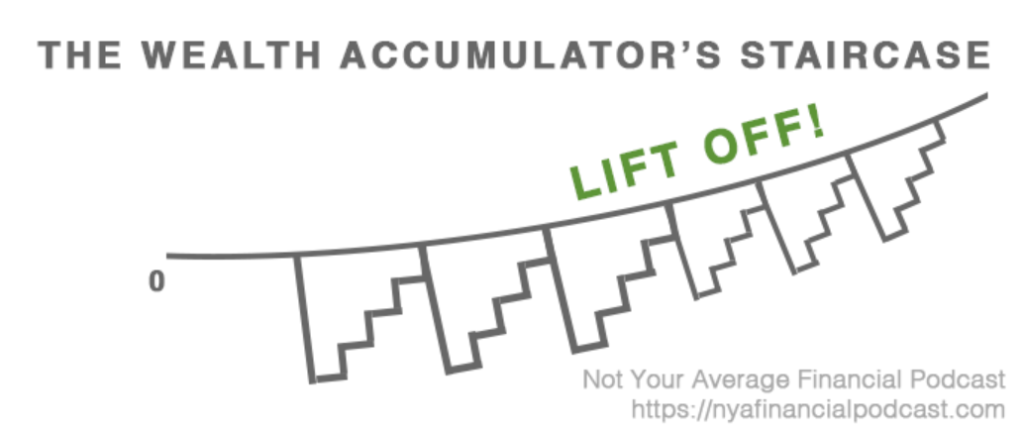

- Is it possible to be better than debt free?

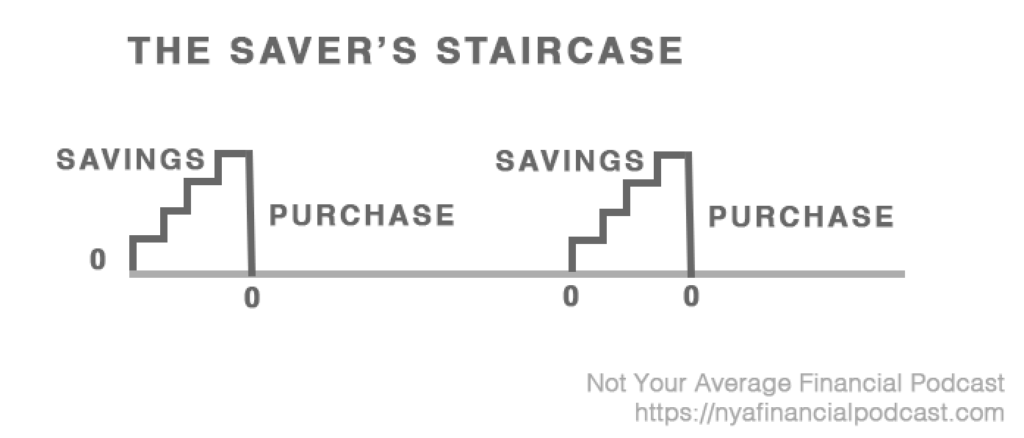

- What are the two piles in The Debt SnowBank Method™?

- Do you have a pool of cash for an emergency?

- What should you keep an eye on?

- Does paying off your debts a slightly different way make a difference?

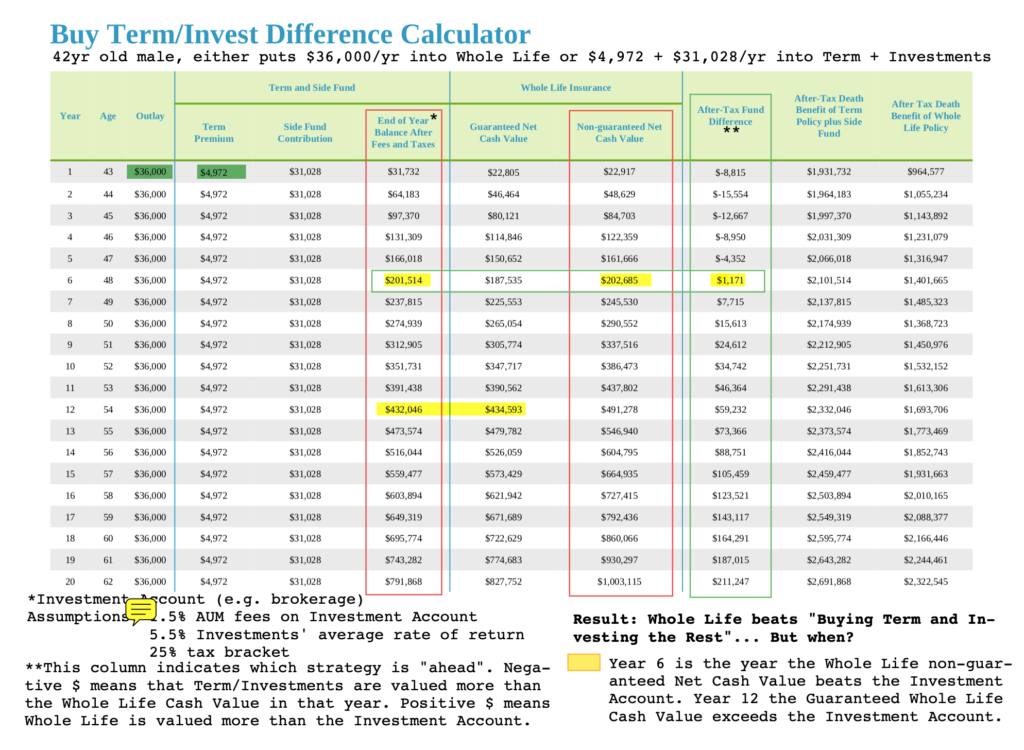

- Should you follow the snow ball method or The Debt SnowBank Method™?

- How do the different methods compare?