Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

- What are the actual steps of thinking?

- Do you have a process for your thoughts?

- Do we already know it all?

- How does one reverse engineer?

- Have you read The Road Less Stupid by Keith Cunningham?

- Would you like to avoid the arrival syndrome?

- What can we improve?

- How much money would you have in your hands right now, if you could unwind the worst three financial decisions you’ve ever made?

- What about doing fewer dumb things?

- What about reading and thinking?

- What is the skillset?

- What about taking 30-45 minutes centered around a high value question?

- What about pain avoidance?

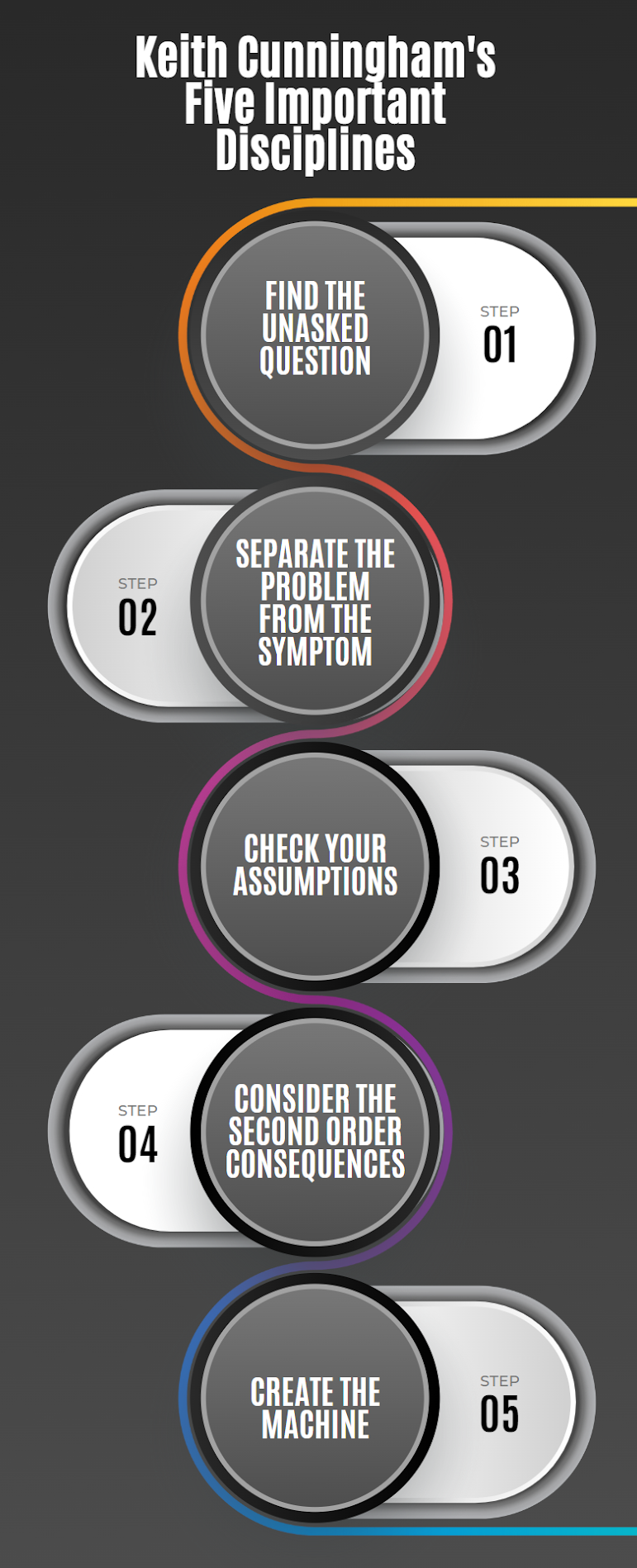

- What are the core disciplines?

- Could we all become a bit better at thinking?

- How many arguments might we avoid?

- How much would it improve our BMI or waistline?

- How about adding zeros to your net worth?

- What is the unasked question?

- What is the right answer?

- What is the real problem?

- What about the right question?

- How might I ______ …. so I can _________ … ?

- Would you like to hear Episode 122?

- How might you separate the problem from the symptom?

- What are the biggest problems?

- What about adventures in missing the point?

- How is the root problem different from the symptom?

- What are the possible reasons I’m noticing this symptom?

- What is not happening, that if it did happen would cause the perceived gap to narrow or disappear?

- What is happening, that if it stopped happening would cause the perceived gap to narrow or disappear?

- Is this an easy task?

- What about brutal honesty and penetrating questions?

- What about checking your unexamined assumptions?

- Where have I been substituting my opinions for real facts?

- What do I not see?

- What about considering the second order consequences?

- What is the downside?

- What is the upside?

- Can I live with the downside?

- What about examining the unintended consequences?

- What about creating the machine?

- What about the change that will close the gap?

- What about getting closer to our desired outcome?

- What about a new strategy?

- How might you use the skill of thinking to your advantage?

- How might you get to the root and take decisive action?

- Will you sit down by yourself and think?

- Would you like to meet with Mark?

Marty Smith is the Regional Vice President of Security Mutual Life Insurance Company of New York.

Marty Smith is the Regional Vice President of Security Mutual Life Insurance Company of New York.

Nick Ku is a Brazilian Jiu-Jitsu and F.I.R.E enthusiast. He is a life long learner, navigating life with his wonderful and beautiful family. Nick has a passion for helping others.

Nick Ku is a Brazilian Jiu-Jitsu and F.I.R.E enthusiast. He is a life long learner, navigating life with his wonderful and beautiful family. Nick has a passion for helping others.