Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

Would you like to hear 10 of THE BEST episodes so far?

What makes a Bank On Yourself® Type Whole Life Insurance Policy work?

In this episode, we ask:

- How nerdy can we be?

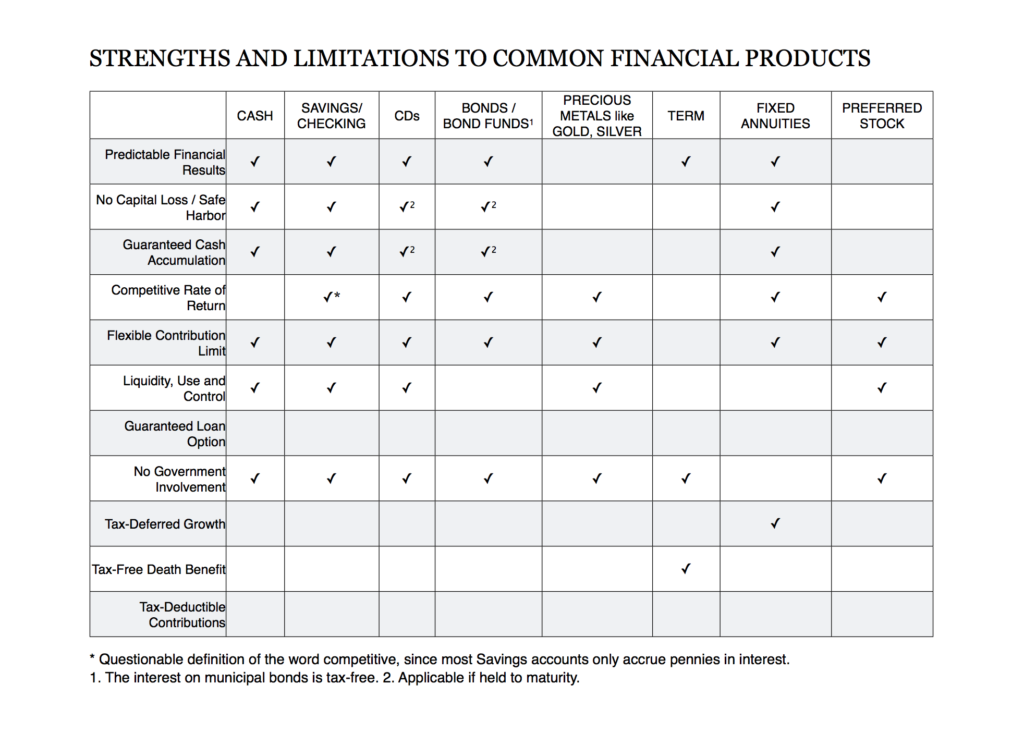

- What financial asset has increased in value every year for the last 160 years?

- Why, in the early 20th century, did 50% of Americans have their savings in life insurance products?

- Does your financial planner have to use Google to answer your questions?

- What is the Bank On Yourself® concept?

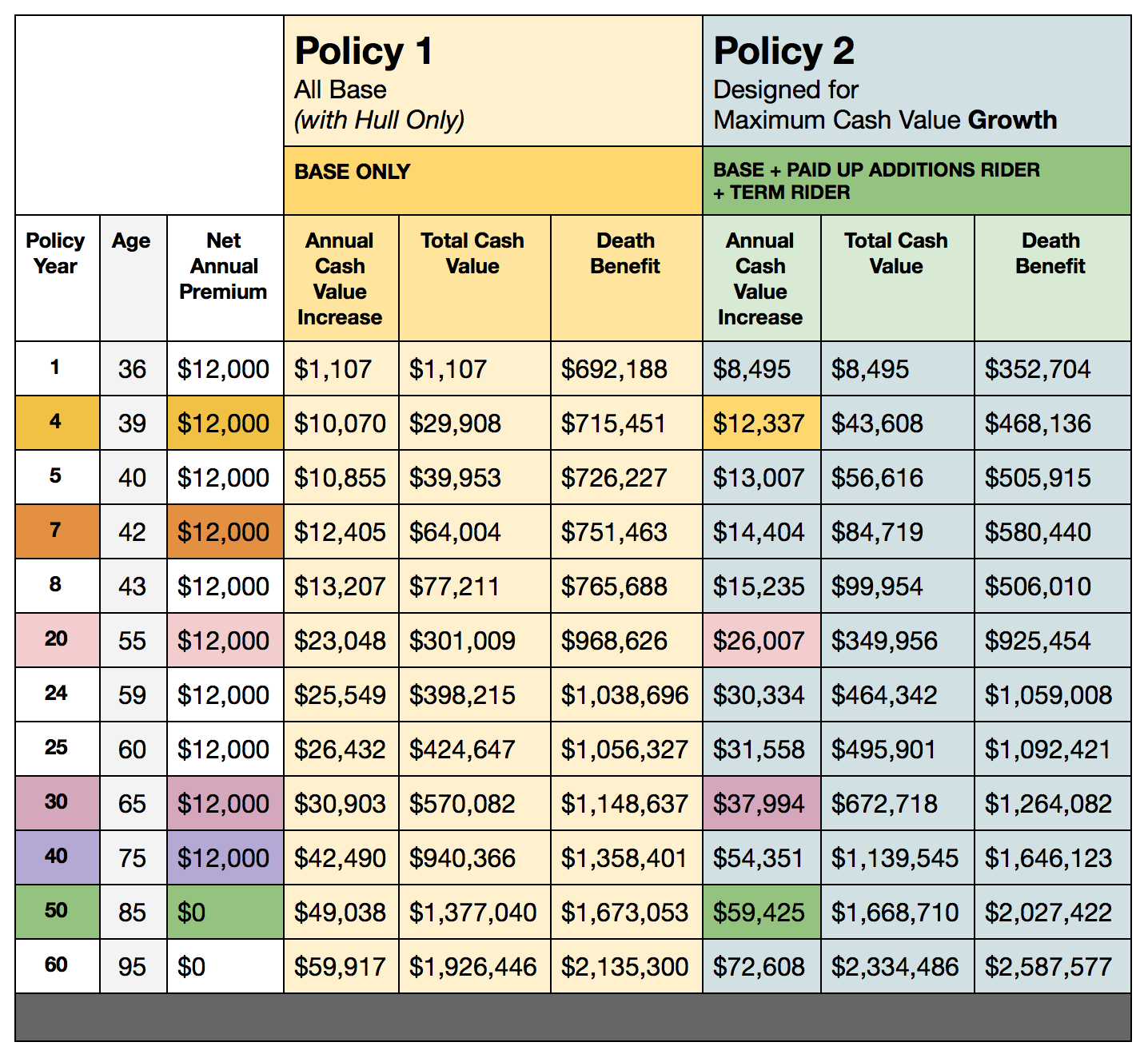

- How is a Bank On Yourself® policy constructed?

- What biases do we have toward Whole Life Insurance?

- How is a Bank On Yourself® design similar to an all base Whole Life design? How is it different?

- What does Bank On Yourself® Engineering have to do with a sailboat?

- What companies are Bank On Yourself® friendly?

- How do businesses use Bank On Yourself®?

- Why does good design matter?

- … More!

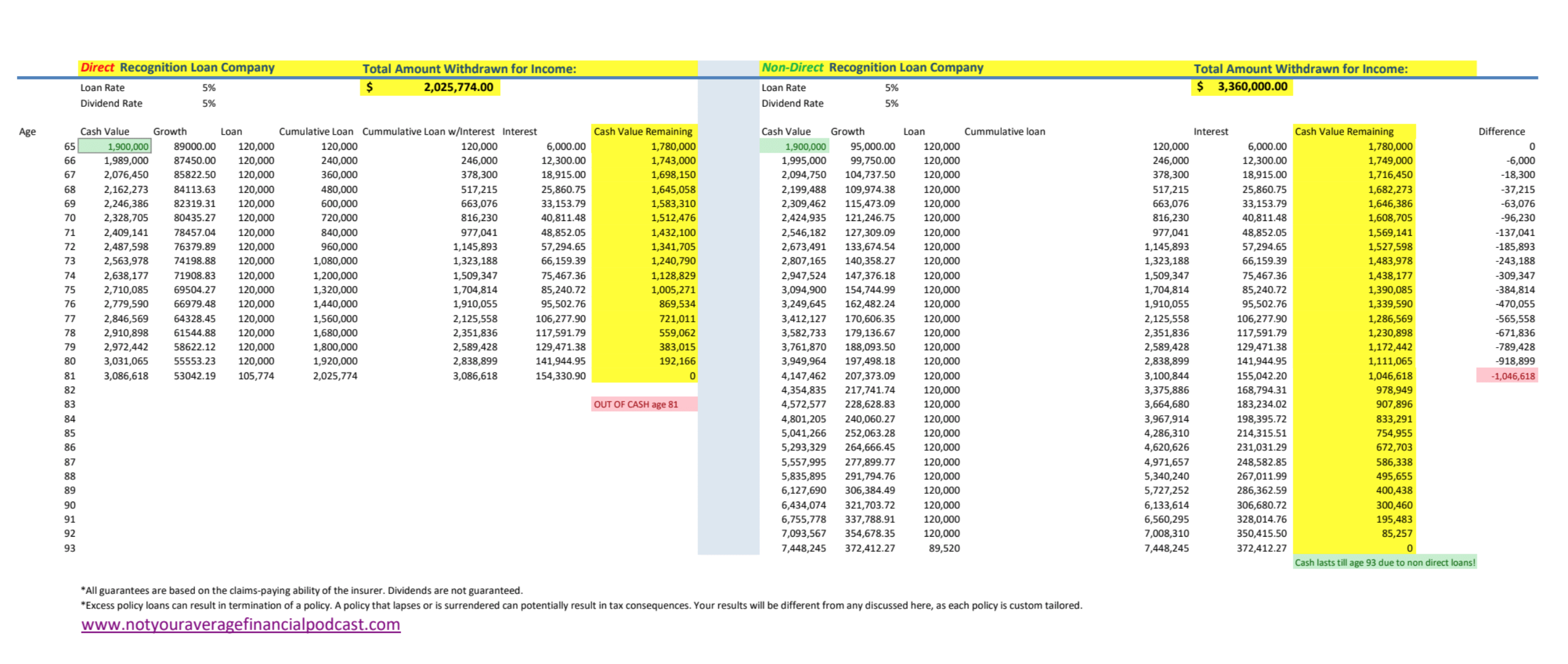

The numbers presented here are for example purposes only. Please reach out to us to learn more about what’s possible in your specific situation.

The numbers presented here are for example purposes only. Please reach out to us to learn more about what’s possible in your specific situation.

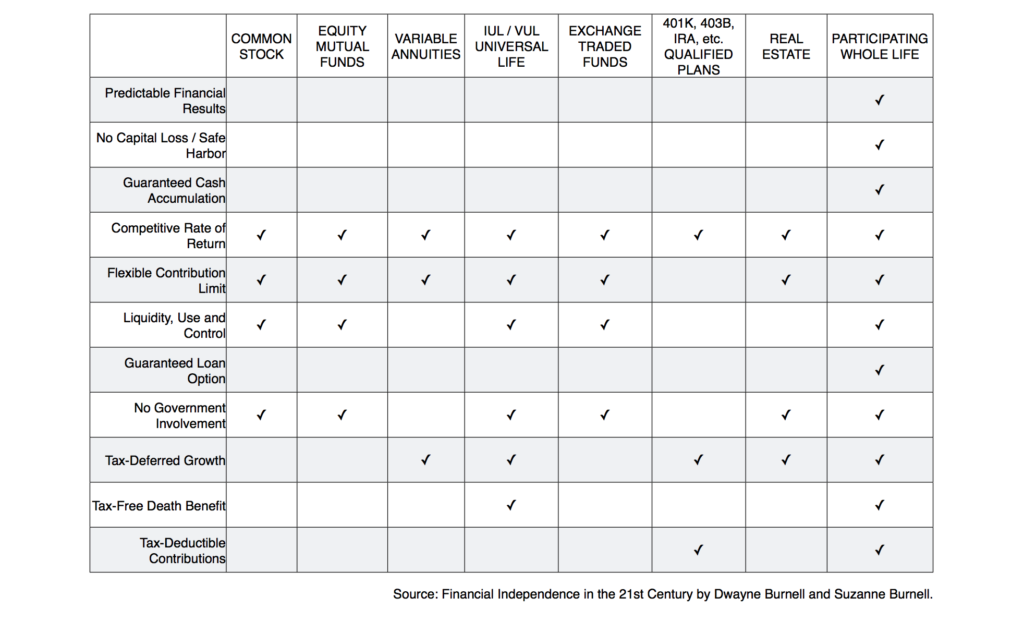

Pamela Yellen, Financial security expert and best-selling author, investigated more than 450 savings and retirement planning strategies seeking an alternative to the risk and volatility of stocks and other investments. Her research led her to a time-tested, predictable method of growing and protecting wealth she calls Bank On Yourself (

Pamela Yellen, Financial security expert and best-selling author, investigated more than 450 savings and retirement planning strategies seeking an alternative to the risk and volatility of stocks and other investments. Her research led her to a time-tested, predictable method of growing and protecting wealth she calls Bank On Yourself (