Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

- What are banks?

- How do banks work?

- What happens when you put your money with a bank?

- Is a checking account safe?

- What about interest bearing savings account?

- If you put ten thousand dollars into the interest bearing savings account, how much do you get credited to your account?

- What is the bank’s business?

- Why do they lend money?

- How far does modern banking go back?

- What was Jekyll Island? Who was there?

- What is the Federal Reserve?

- How much do banks have to keep on reserve?

- When did the FED update the requirements for the reserves?

- Where is all of your money?

- What happens when you deposit money into the bank?

- Why do we call deposit accounts the “safe” place?

- Is there another way?

- What are mutually owned life insurance companies?

- How long have these companies been in force?

- What does Benjamin Franklin have to do with insurance?

- How are these different from a bank?

- Are life insurance companies allowed to inflate the money supply?

- Are life insurance companies allowed to participate in fractional reserve banking?

- What are the reserve requirements for an insurance company?

- Which is safer? The institution who has 10% or less on reserve or the company that has to keep over 100% on reserve?

- How many banks went bankrupt in 2008?

- How many life insurance companies in 2008?

- If banks are so safe, why did so many fail?

- If there isn’t going to be a bailout next time, how many more banks are we going to see go down?

- Have you ever looked into who owns banks?

- Have you ever heard of BOLI (Bank Owned Life Insurance)?

- How much life insurance do banks purchase, according to the FDIC?

- How do banks benefit from BOLI?

- Should you do with your money what banks are doing with theirs?

- What is COLI? Corporate Owned Life Insurance

- Is a mutual life insurance company policy SAFER than a bank?

- What happens if a life insurance company fails?

- How are life insurance companies regulated?

- What are insurance companies invested in?

- Are life insurance companies convenient?

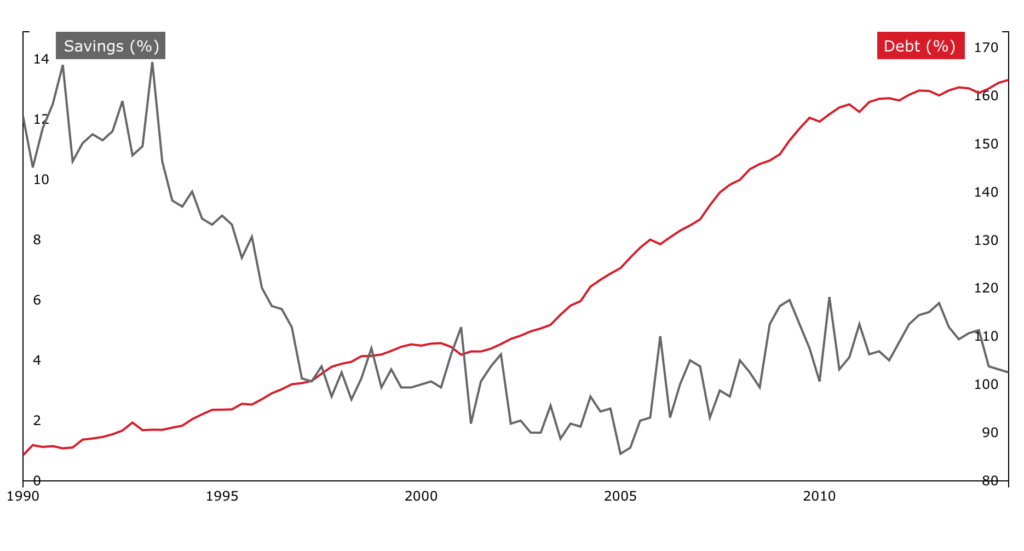

- Do we spend more or less as availability to money becomes more convenient?

- How would a life-insurance driven debit card affect dividends?