Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

- Can you imagine writing a contract with your future?

- Would you like to hear the live webinar that Mark did for Jay Helm’s W2 Capitalist group?

- What are the two universal laws?

- What about gravity?

- What about entropy?

- What about division?

- What are the risks?

- What about unexpected financial responsibilities?

- What do we know?

- What can we control?

- What about real estate?

- What about the deed?

- Is real estate about bricks and sticks or is real estate about paper?

- What did Mark find at a museum in Chicago?

- What about annuity buying Romans?

- What about a soldier with guaranteed income?

- What tangible, practical systems can you set up for your future?

- What about Jim Carrey?

- What is money?

- What about trust?

- What about contracts?

- What are amateur contracts?

- What about fees?

- What about taxes?

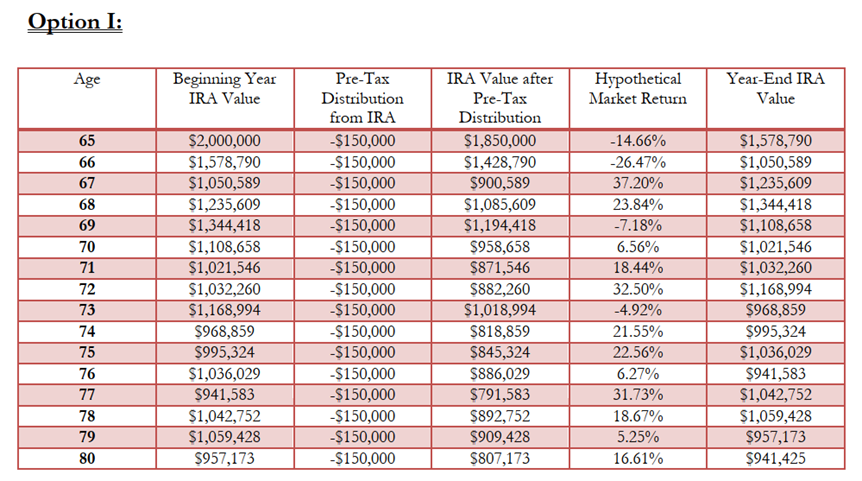

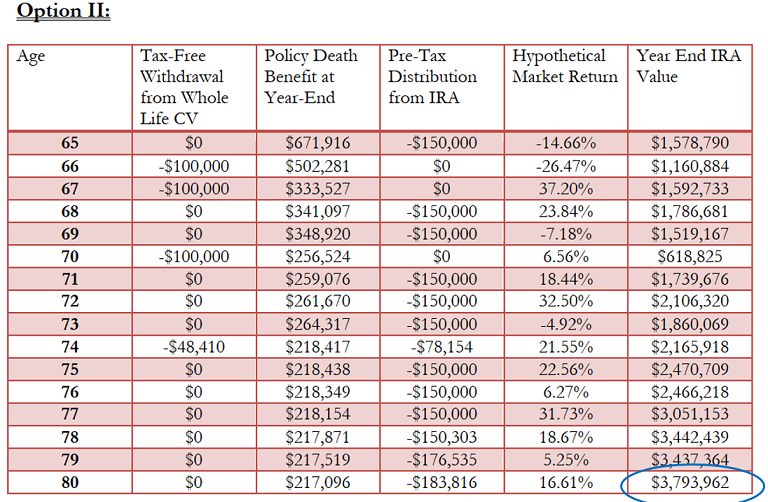

- What about volatility?

- Who has a fee?

- What do fees do to your accounts?

- What does volatility do to your accounts?

- How might taxes affect your accounts?

- How does one live and thrive under the circumstances?

- Where do you put your money?

- Where do you plant your money?

- What about complexity?

- What about simplicity?

- What about security?

- What about liquidity?

- What about systems?

- What about predictable outcomes?

- What is a futures contract?

- What about insurance contracts?

- Who is a wheat farmer?

- Will you have enough cash to send your kid to college?

- What motivates you?

- What excites you?

- What did Mark learn about participating whole life insurance?

- What about Bank on Yourself® type life insurance policies?

- What is steady, boring and predictable?

- What is cash value?

- What about the right design?

- Who should you work with?

- What companies should you work with?

- How much do you want?

- When do you want it?

- What about no longer working with banks?

- What about having a contract with the future you?

- What about private money lending?

- What excites you?

- If this is good, why isn’t everyone doing it?

- How do you go from small to big?

- How does nature work?

- What about a repeating pattern around a center?

- What about easy access?

- Does that acorn have a future contract?

- Have you sat down with a true professional?

- Who might you work with who has this expertise?

- How many Bank on Yourself professionals are in the United States and Canada?

- Would you like to meet with Mark?

- Would you like to join our Not Your Average Financial Community?

Stephen Devlin co-founded two of Canada’s leading companies in creating safe and secure wealth-building systems for personal use and business, taking advantage of an underutilized strategy with whole life policies. With offices across Canada and as President and Chief Financial Officer with

Stephen Devlin co-founded two of Canada’s leading companies in creating safe and secure wealth-building systems for personal use and business, taking advantage of an underutilized strategy with whole life policies. With offices across Canada and as President and Chief Financial Officer with

Pamela Yellen, Financial security expert and best-selling author, investigated more than 450 savings and retirement planning strategies seeking an alternative to the risk and volatility of stocks and other investments. Her research led her to a time-tested, predictable method of growing and protecting wealth she calls Bank On Yourself (

Pamela Yellen, Financial security expert and best-selling author, investigated more than 450 savings and retirement planning strategies seeking an alternative to the risk and volatility of stocks and other investments. Her research led her to a time-tested, predictable method of growing and protecting wealth she calls Bank On Yourself (

Daniel Lapin was born into a prestigious Torah family. He was a student of his father, Rabbi A.H. Lapin, who served the Jewish communities in Johannesburg and Cape Town, South Africa, eventually immigrating to America with his wife where they established the Am Echad synagogue in San Jose, CA.

Daniel Lapin was born into a prestigious Torah family. He was a student of his father, Rabbi A.H. Lapin, who served the Jewish communities in Johannesburg and Cape Town, South Africa, eventually immigrating to America with his wife where they established the Am Echad synagogue in San Jose, CA.