Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

- Can you rely on someone else to create your financial plan?

- Have you heard Episode 122?

- Who is your money guru?

- Who is Jack Gerstner?

- What about financial education?

- What about research?

- What about being open to new ideas?

- What about challenging assumptions constructively?

- What is Jack’s story with money?

- What’s Jack’s story with crypto?

- What happened when Jack read the Bank on Yourself Revolution book?

- How does Jack use and leverage the whole life insurance policies?

- What about renovations on properties?

- What about medical bills?

- What about speculation?

- What about leaving a legacy?

- What about property taxes?

- What about compounding power?

- How are taxes life’s greatest expense?

- What makes all the sense in the world?

- What is Jack’s strategy with whole life insurance and crypto?

- What about Bitcoin?

- What about speculation and volatility?

- What about dollar cost averaging?

- What about risk?

- What about dividend paying whole life insurance?

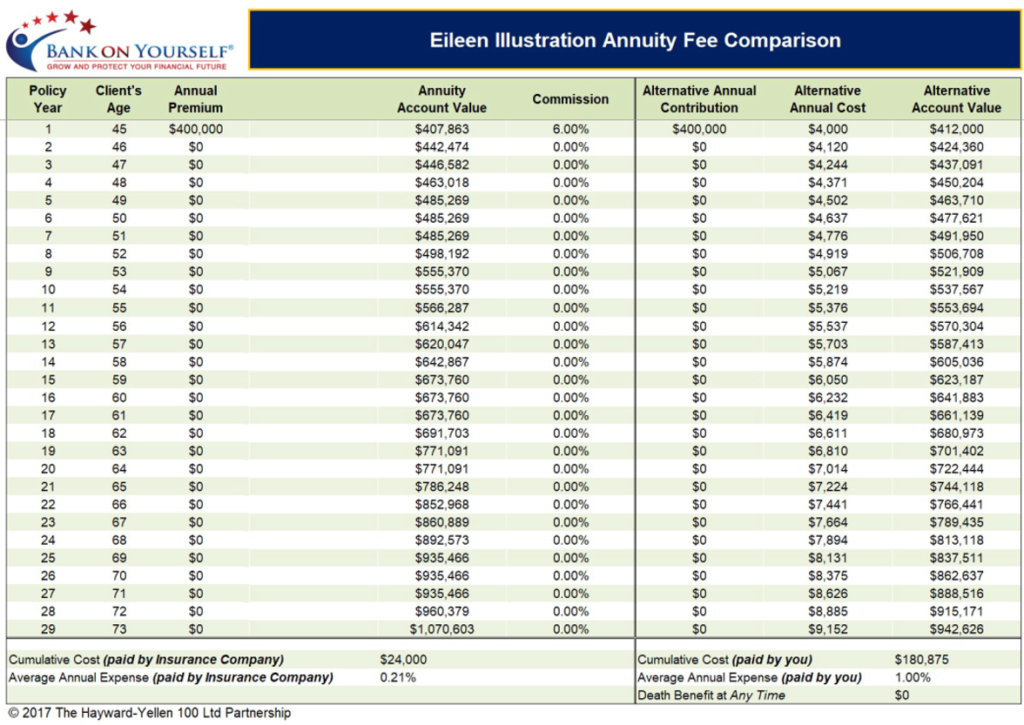

- What about annuities?

- What about “anchor” assets?

- What is Jack’s framework for allocation?

- What about an emergency fund of three to six months of living expenses in your whole life insurance policy?

- What about giving your money a job?

- What about Jack’s philosophy for finance?

- How is money a tool?

- What about trusting and verifying?

- What is a wise allocation of time?

- What about a healthy distrust of mainstream advice, in general?

- What about financial responsibility?

- How about owning and learning the right way?

- How do Bank on Yourself® type whole life insurance policies allow you to take more responsibility?

- Who cares the most about your money?

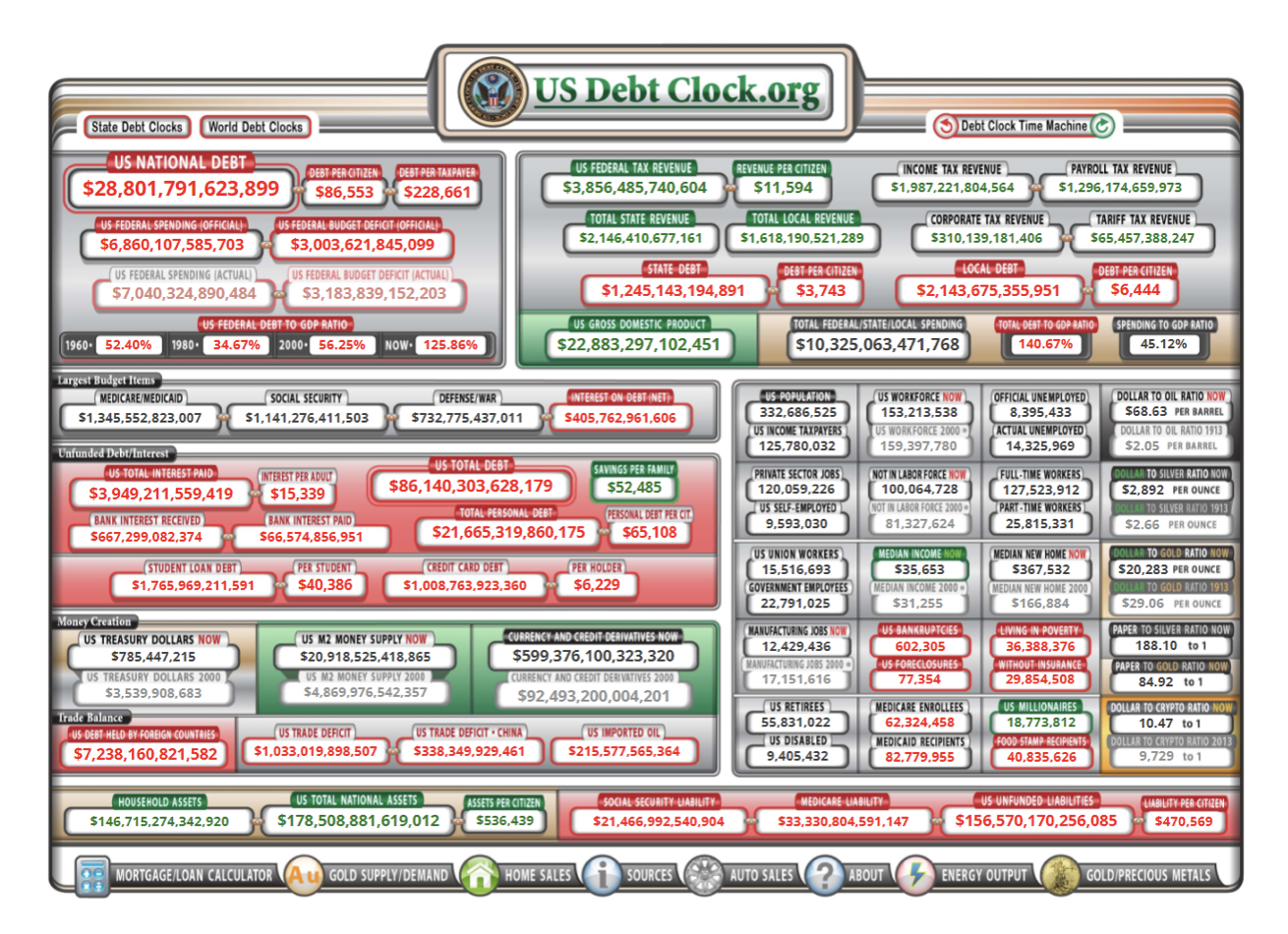

- What about purchasing power?

- What about inflation?

- What about inflation as a tax?

- What happens to dividends on policies when interest rates rise?

- Why did Jack join the Navy?

- What would Jack tell his 18-year-old self?

- What about paying attention to time?

- What about responsibility?

- What is reliable?

- What is within your control?

- What about your internal locus of control?

Jack Gerstner lives in Elmhurst, IL with his beautiful wife Lauren and their daughter Mia. They have a baby boy due in November 2021. Jack is an Illinois native and has lived here his entire life. He is a Transportation and Logistics professional and an Officer in the Navy Reserve. When he’s not spending time with his family or working, Jack enjoys running, reading, and learning about finance. Jack started his Bank on Yourself journey in June 2014 with Lake Growth Financial and now has multiple policies on him and his family.

Jack Gerstner lives in Elmhurst, IL with his beautiful wife Lauren and their daughter Mia. They have a baby boy due in November 2021. Jack is an Illinois native and has lived here his entire life. He is a Transportation and Logistics professional and an Officer in the Navy Reserve. When he’s not spending time with his family or working, Jack enjoys running, reading, and learning about finance. Jack started his Bank on Yourself journey in June 2014 with Lake Growth Financial and now has multiple policies on him and his family.

Contact Jack on LinkedIn

Chris Thurman is the co-owner of Thompson & Thurman in Amarillo TX and one of only 200 Bank on Yourself

Chris Thurman is the co-owner of Thompson & Thurman in Amarillo TX and one of only 200 Bank on Yourself Laurence J. Kotlikoff is a Professor of Economics at Boston University, a Fellow of the American Academy of Arts and Sciences, a Fellow of the Econometric Society, a Research Associate of the National Bureau of Economic Research, and President of Economic Security Planning, Inc., a company specializing in financial planning software. An active columnist, Professor Kotlikoff’s columns and blogs appear in the Financial Times, Bloomberg, Forbes, Vox, The Economist, Yahoo.com, and the Huffington Post. Professor Kotlikoff received his B.A. in Economics from the University of Pennsylvania in 1973 and his Ph.D. in Economics from Harvard University in 1977.

Laurence J. Kotlikoff is a Professor of Economics at Boston University, a Fellow of the American Academy of Arts and Sciences, a Fellow of the Econometric Society, a Research Associate of the National Bureau of Economic Research, and President of Economic Security Planning, Inc., a company specializing in financial planning software. An active columnist, Professor Kotlikoff’s columns and blogs appear in the Financial Times, Bloomberg, Forbes, Vox, The Economist, Yahoo.com, and the Huffington Post. Professor Kotlikoff received his B.A. in Economics from the University of Pennsylvania in 1973 and his Ph.D. in Economics from Harvard University in 1977.