Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

Would you like to hear 10 of THE BEST episodes so far?

Do you need to work with a BANK ON YOURSELF® PROFESSIONAL?

In this episode, we ask:

- What do you call a … ?

- Are all financial professionals right for your needs?

- How many designations and credentials are available for financial professionals?

- What about the CPA?

- What about the CFA?

- What about enrolled agents?

- What about the CFP®?

- What about Mark’s CFP®?

- What about a generalist designation?

- What about a specialist designation?

- Can anyone call themselves a financial advisor?

- What about life insurance agents?

- Why work with a Bank on Yourself® Professional?

- Where do you find expert help?

- How many Bank on Yourself® Professionals are there in the U.S. and Canada?

- What about maximizing finances?

- How is the Bank on Yourself® Professional program critical to success?

- What about “just googled it” advisors?

- What about ongoing mentoring?

- What about client relationships?

- Do you really have a Bank on Yourself® type life insurance policy?

- How could you know?

- Why does your advisor matter?

What does it take to have a TRUE Bank on Yourself® type life insurance policy?

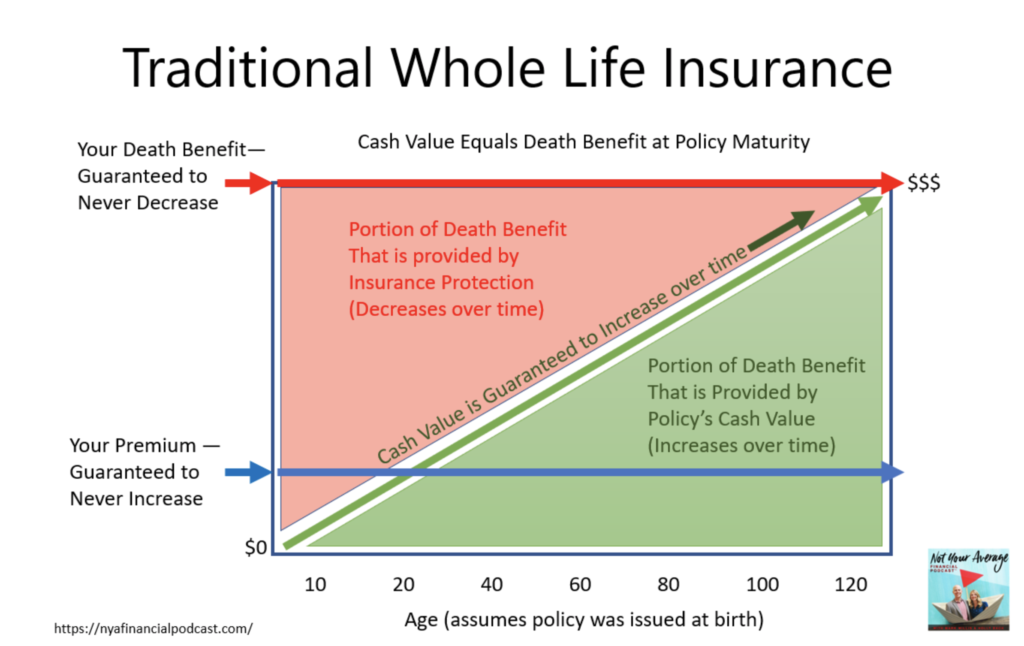

- Is whole life insured offered?

- Is what I have whole life insurance, universal, variable or something else?

- Is the insurance company mutually owned or stock owned?

- Is the insurance company’s customer service educated enough to help me with the ins and outs of policy loans (or is it going to be a nightmare every time I try to call customer service)?

- Does the company have a HIGH COMDEX rating (90+)?

- If I take a loan, will it affect my policy in the short and long term?

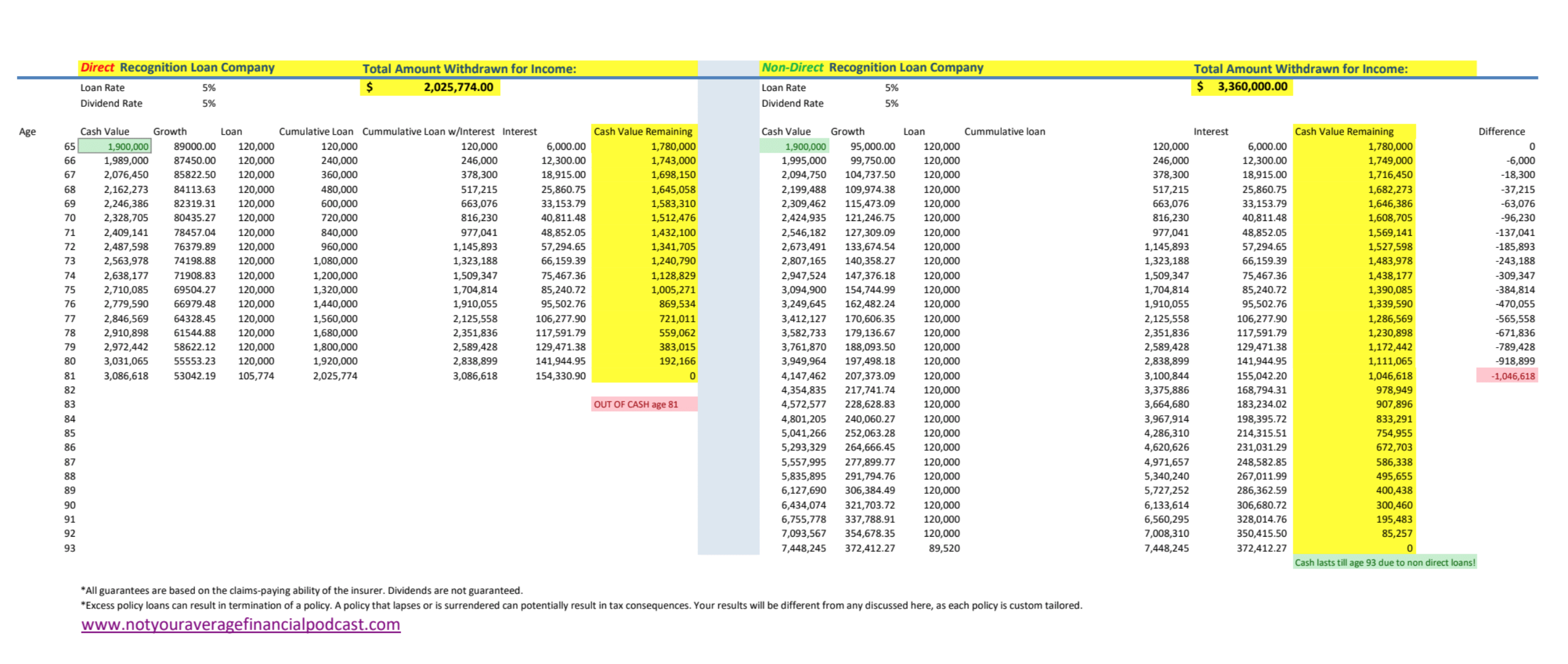

- If I take a loan, do I have non direct or direct recognition loans?

- If I take a loan, how will it affect the policy, short-term and long-term?

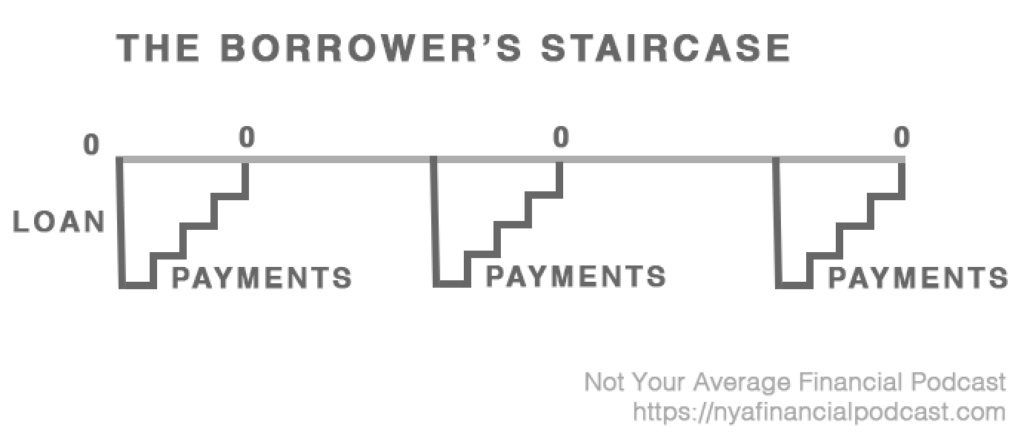

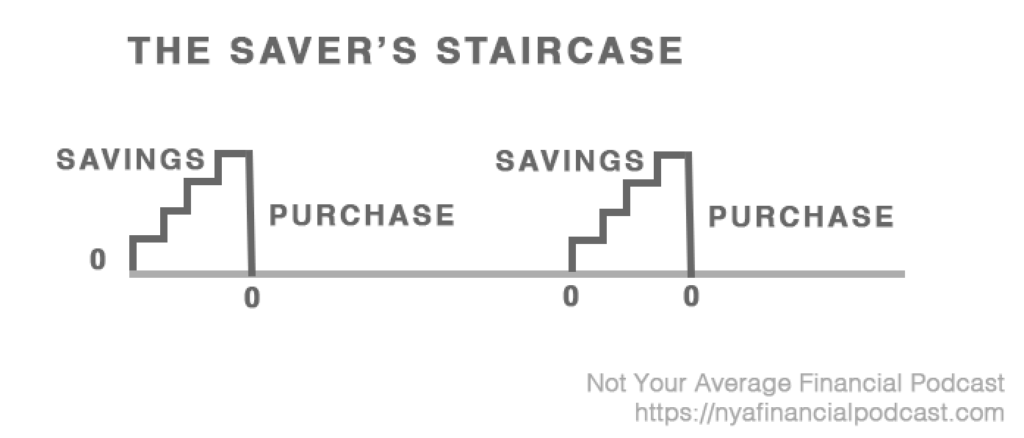

- Do I have Non-Direct Recognition loans (which crucially allows my cash value to grow even on the cash value I’ve borrowed against) or Direct Recognition Loans (which stop the growth of my cash when I borrow from the policy)?

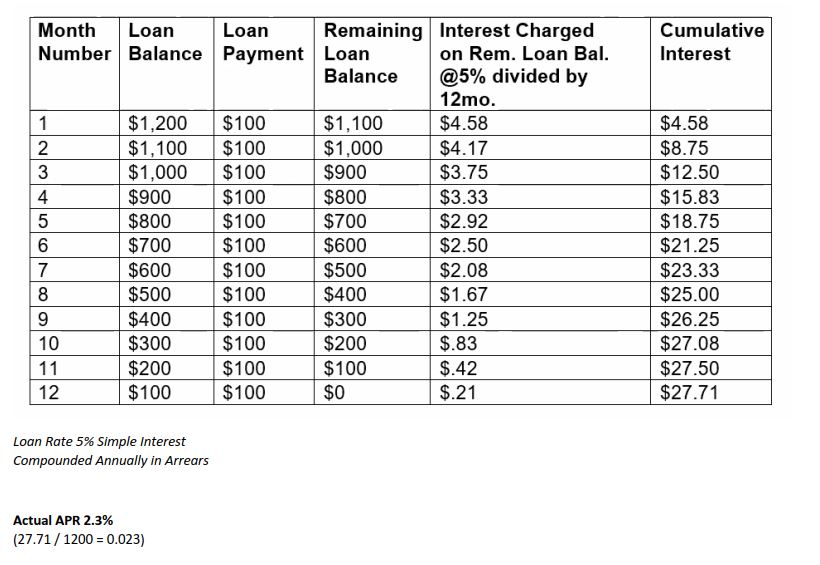

- When will I pay loan interest (at the end of year or immediately?)

- What are my loan limitations (what they’ll allow me to borrow)?

- What is my loan interest rate on this policy? (Is it above industry average?)

- Is the loan simple interest all year long, or is it compounding against me?

- Does my whole life product pay dividends?

- Is the dividend based on company performance, with me participating as an owner, or is it merely “interest sensitive”, based on industry competition and pre-formulation?

- Has the insurance company paid dividends 100 years straight?

- Are paid-up additions (PUA) offered through premiums or just through dividends?

- What is the insurance company’s PUA load cost? How does it compare to other whole life products?

- What are the PUA limits and gotchas? (When and why must we reduce our PUAs even if we don’t want to?)

- Were any other riders available to help accelerate my cash value growth? (e.g. term rider)

- If I miss a premium payment, are there any protections? What will happen to the policy guarantees?

- Was there a Chronic Illness Rider or similar available? What are the fees for this rider?

- What are the limitations on Chronic Illness/ Long Term Care / Accelerated Death Benefit riders?

- Was there significant dividend variability (e.g. over the last 12 years) suggesting risk to future cash value growth?

- Will this policy MEC, and do I want it to lose specific tax advantages?

- Will both principal and gains be accessible tax-free under current law?

- What about the agent?

- Am I having to educate the agent?

- Is my agent among the 200 Bank on Yourself® professionals in good standing?

- Do labels matter to you?

- What about your family member who has a life insurance license?

- Would you like Mark to review an inforce policy for FREE?

- Would you like to join our mailing list?

- Would you like a FREE book? Send us a screenshot of your review to hello@nyafinancialpodcast.com, and we’ll send you a book!

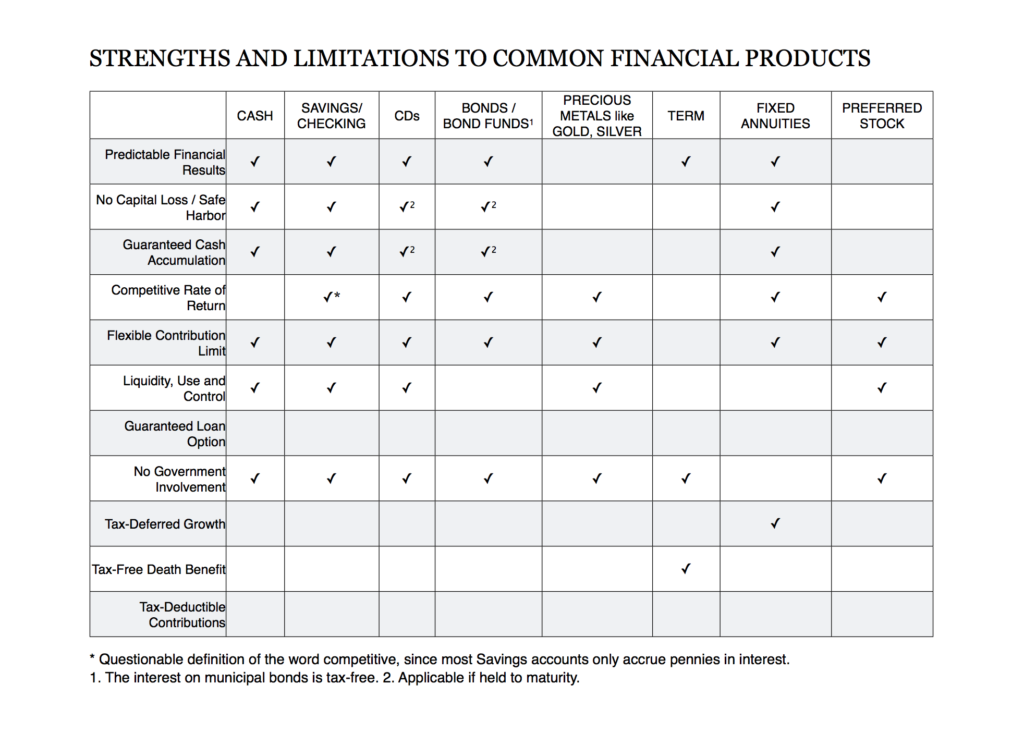

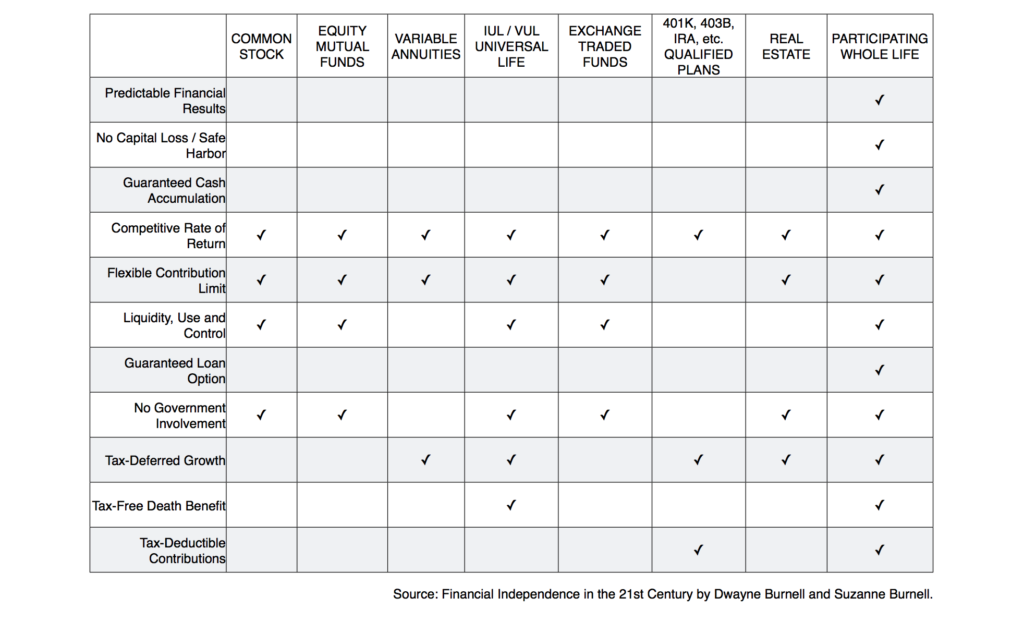

Pamela Yellen, Financial security expert and best-selling author, investigated more than 450 savings and retirement planning strategies seeking an alternative to the risk and volatility of stocks and other investments. Her research led her to a time-tested, predictable method of growing and protecting wealth she calls Bank On Yourself (

Pamela Yellen, Financial security expert and best-selling author, investigated more than 450 savings and retirement planning strategies seeking an alternative to the risk and volatility of stocks and other investments. Her research led her to a time-tested, predictable method of growing and protecting wealth she calls Bank On Yourself (