Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

- Do you have a visceral reaction to certain words?

- Who is Tim Foor?

- How did Tim become a loan officer?

- Would you like to hear Episode 157?

- Does Tim own Bank on Yourself® type life insurance policies?

- What does Tim think about Bank on Yourself®?

- What about mixing Bank on Yourself® type whole life policies and mortgage strategies?

- How does Tim help activate home equity towards the client’s advantage?

- What has happened to home values?

- What about a tax free money vehicle?

- How many tax free instruments can you count?

- What about about a cash out refinance?

- What is the history reverse mortgage?

- What is a HECM loan?

- What is a home equity conversion mortgage?

- What is a principal limit?

- How does your age factor into accessing the equity in your home?

- What about social security “not cutting it”?

- What about future proofing a house?

- What about people on a fixed income?

- Why do people have a negative connotation and stigma toward the reverse mortgage?

- What are the renovations on the reverse mortgage?

- What about the mandatory counseling for reverse mortgage?

- What about red tape and fees?

- Isn’t the reverse mortgage just for those in poverty?

- What happens when ultra high net worth individuals take reverse mortgages?

- What about the jumbo reverse mortgage?

- What about fees and closing costs?

- What is a non-recourse loan?

- Is there a way to be underwater on a reverse mortgage?

- What about the family having the first right of refusal?

- Does the bank want to own the home?

- What are the options upon death?

- What about Henry Ford?

- Where did the obsession toward paying off the house come from?

- What is line growth?

- What happens if the housing market tanks?

- Would you like to work with Tim at 866-888-7902?

- Would you like to reach out to PRMI in Wooster, Ohio?

- What are the takeaways?

- Would you like to hear Episode 199?

- Would you like to meet with Mark?

Tim Foor has been in the mortgage business since 2012 after several years in the education and coaching fields. Tim takes a holistic approach to mortgage lending with a focus on strategic equity management. Tim also works with the sales team to ensure efficiency in the loan process. He is a 2007 graduate of Walsh University with deep ties to his hometown of Defiance, OH. He currently resides in Akron, Ohio with his wife, Monica, and daughters, Alison and Cameron.

Tim Foor has been in the mortgage business since 2012 after several years in the education and coaching fields. Tim takes a holistic approach to mortgage lending with a focus on strategic equity management. Tim also works with the sales team to ensure efficiency in the loan process. He is a 2007 graduate of Walsh University with deep ties to his hometown of Defiance, OH. He currently resides in Akron, Ohio with his wife, Monica, and daughters, Alison and Cameron.

Angie Grimm is the Lead College Funding Professional at College Solutions LLC in Amarillo TX. She is a financial professional specializing in solving the late-stage college planning problem for families.

Angie Grimm is the Lead College Funding Professional at College Solutions LLC in Amarillo TX. She is a financial professional specializing in solving the late-stage college planning problem for families. Jay Helms, Founder of the W2 Capitalist, escaped the rat race after 6 years of side hustling in real estate investing. Jay has a goal to help one million people create multiple streams of income, achieve financial freedom, or build legacy wealth through real estate investing. Jay met his wife Cassie when they were contestants on a reality TV show and when their family of 5 are not traveling the country in their RV, Jay and Cassie reside in Gulf Breeze, FL, with their three kids, Rowland, Stella, and Ellen Anne. Knowing that closing on the first deal is the biggest hurdle and roadblock for new investors, he wrote a book,

Jay Helms, Founder of the W2 Capitalist, escaped the rat race after 6 years of side hustling in real estate investing. Jay has a goal to help one million people create multiple streams of income, achieve financial freedom, or build legacy wealth through real estate investing. Jay met his wife Cassie when they were contestants on a reality TV show and when their family of 5 are not traveling the country in their RV, Jay and Cassie reside in Gulf Breeze, FL, with their three kids, Rowland, Stella, and Ellen Anne. Knowing that closing on the first deal is the biggest hurdle and roadblock for new investors, he wrote a book,

Thomas is a father of two girls and married to his wife Amanda. They live in Chicago and are proud Cubs fans! Thomas is a great friend of over 10 years. We have gone on long runs together and have worked on big projects in various arenas of service, church, and more. I’ve got to see Thomas working at his best, being a great listener and a servant leader. He works as an IT analyst in a law firm In downtown Chicago.

Thomas is a father of two girls and married to his wife Amanda. They live in Chicago and are proud Cubs fans! Thomas is a great friend of over 10 years. We have gone on long runs together and have worked on big projects in various arenas of service, church, and more. I’ve got to see Thomas working at his best, being a great listener and a servant leader. He works as an IT analyst in a law firm In downtown Chicago. Mark Briggs is a management consultant who helps Fortune 500 companies modernize their operations, culture, and leadership by facilitating cutting-edge transformations. He is a professor of leadership and change management at the University of North Carolina, Chapel Hill, and is the author of four books. As a speaker, trainer, and consultant in digital transformation and innovation. Mark has worked with groups across the United States, Europe, China, and the Middle East.

Mark Briggs is a management consultant who helps Fortune 500 companies modernize their operations, culture, and leadership by facilitating cutting-edge transformations. He is a professor of leadership and change management at the University of North Carolina, Chapel Hill, and is the author of four books. As a speaker, trainer, and consultant in digital transformation and innovation. Mark has worked with groups across the United States, Europe, China, and the Middle East. Christian Ward is a seeker, writer, podcaster who happens to do real estate to make a living.

Christian Ward is a seeker, writer, podcaster who happens to do real estate to make a living.

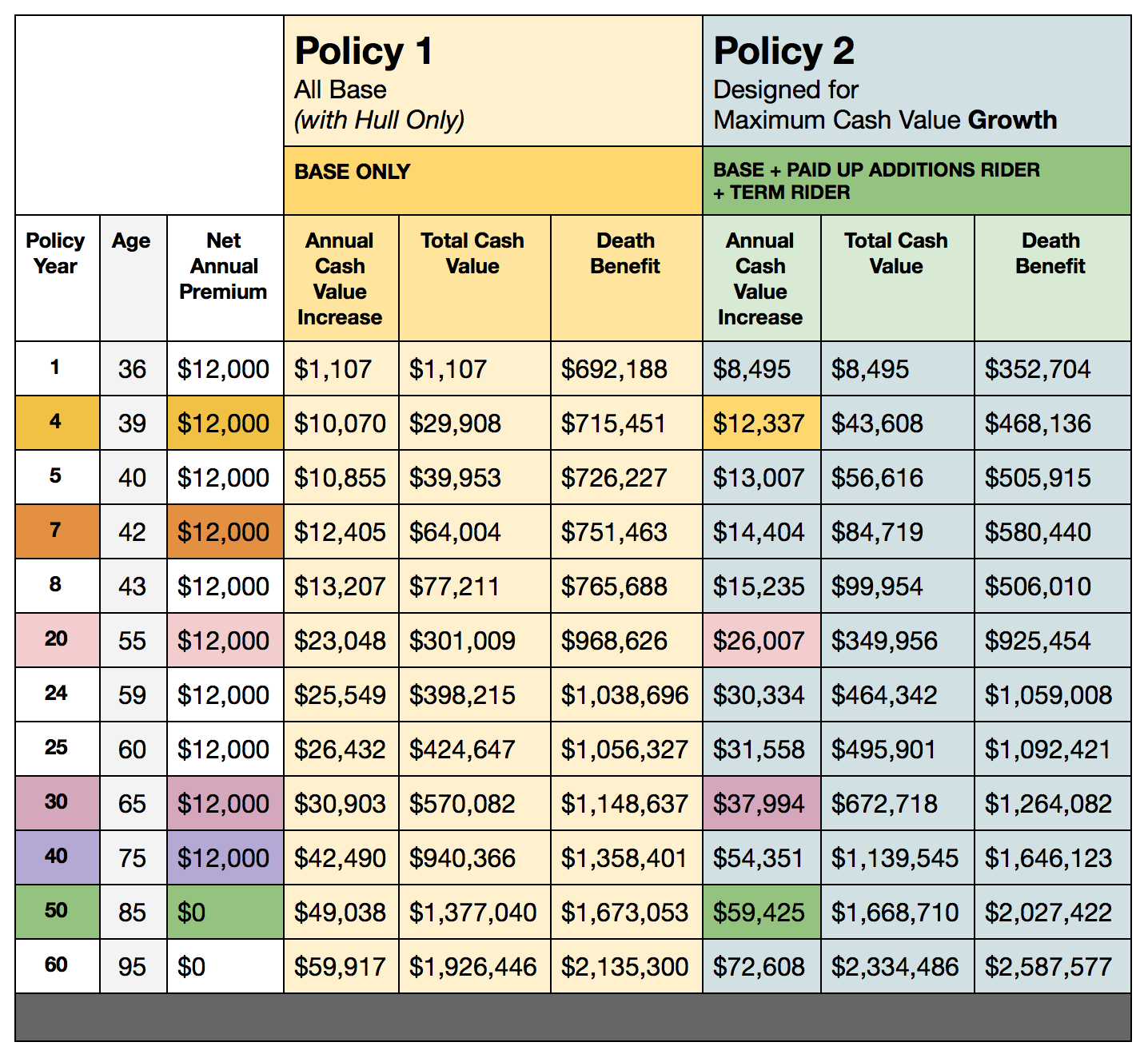

The numbers presented here are for example purposes only.

The numbers presented here are for example purposes only.