Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

- What is the truth about the last few years?

- Would you like to learn about underwriting?

- Who is Ryan Nemcek?

- What happened at Ryan’s wedding?

- How did Ryan become the Senior Underwriter at Security Mutual Life Insurance Company (SML)?

- What does underwriting entail?

- What’s is the weirdest case that has come across Ryan’s desk?

- What is a contestability period?

- When does an investigation occur?

- What happens within the first two years of a policy?

- What about suicide?

- What is adverse selection?

- What about risk?

- What has been happening since 1886?

- What about pricing?

- What about sustainability?

- What about having the funds to pay the claims, when they need to be paid?

- What happened over the last two years?

- What changed with COVID?

- What about risks?

- How has underwriting changed?

- What about life expectancy?

- What about advances in medicine?

- How does Ryan view the Bank on Yourself® strategy?

- How much death benefit does it buy?

- Can you afford it?

- How is life insurance a good tool?

- What is the limit on how many policies one could own?

- What about calculations based on multiples of age?

- What about calculations based on annual income?

- How long has Security Mutual been in business?

- What are the unique underwriting programs at SML?

- What is a risk class?

- What about years and years of mortality studies?

- What about heart disease?

- What about the long term growth of the policy?

- What is the “standard” rating?

- How might one improve their rating?

- What is the healthy living program?

- What about favorable factors?

- What is express underwriting?

- What are the limits to express underwriting?

- What happened with a lot of companies at the beginning of the pandemic?

- What is unique about SML?

- What is possible?

- What is the oldest age you can apply?

- What is the youngest age you can apply?

- Would you like to visit sml.ny.com?

Ryan Nemcek is the Senior Underwriter at Security Mutual Life Insurance Company of New York in Binghamton, NY. He has held this position since 2014.

Ryan Nemcek is the Senior Underwriter at Security Mutual Life Insurance Company of New York in Binghamton, NY. He has held this position since 2014.

Brandon Neely is a serial entrepreneur, Profit First and Bank On Yourself Professional, and the co-host of Wealth Wisdom Financial Podcast with his wife and business partner Amanda. He and Amanda founded and managed Overflow Coffee Bar, L3C from 2008 through 2018. They learned a lot of what to do and NOT to do through that experience. They have since sold that business. Now, as financial allies, they share their experiential knowledge through podcasting and developing personalized financial strategies for individuals and profitability strategies for businesses. They continue to help clients implement the Profit First system as well as how to use a Bank On Yourself framework to grow their businesses and future. Connect with Brandon at Wealth Wisdom Financial via the

Brandon Neely is a serial entrepreneur, Profit First and Bank On Yourself Professional, and the co-host of Wealth Wisdom Financial Podcast with his wife and business partner Amanda. He and Amanda founded and managed Overflow Coffee Bar, L3C from 2008 through 2018. They learned a lot of what to do and NOT to do through that experience. They have since sold that business. Now, as financial allies, they share their experiential knowledge through podcasting and developing personalized financial strategies for individuals and profitability strategies for businesses. They continue to help clients implement the Profit First system as well as how to use a Bank On Yourself framework to grow their businesses and future. Connect with Brandon at Wealth Wisdom Financial via the

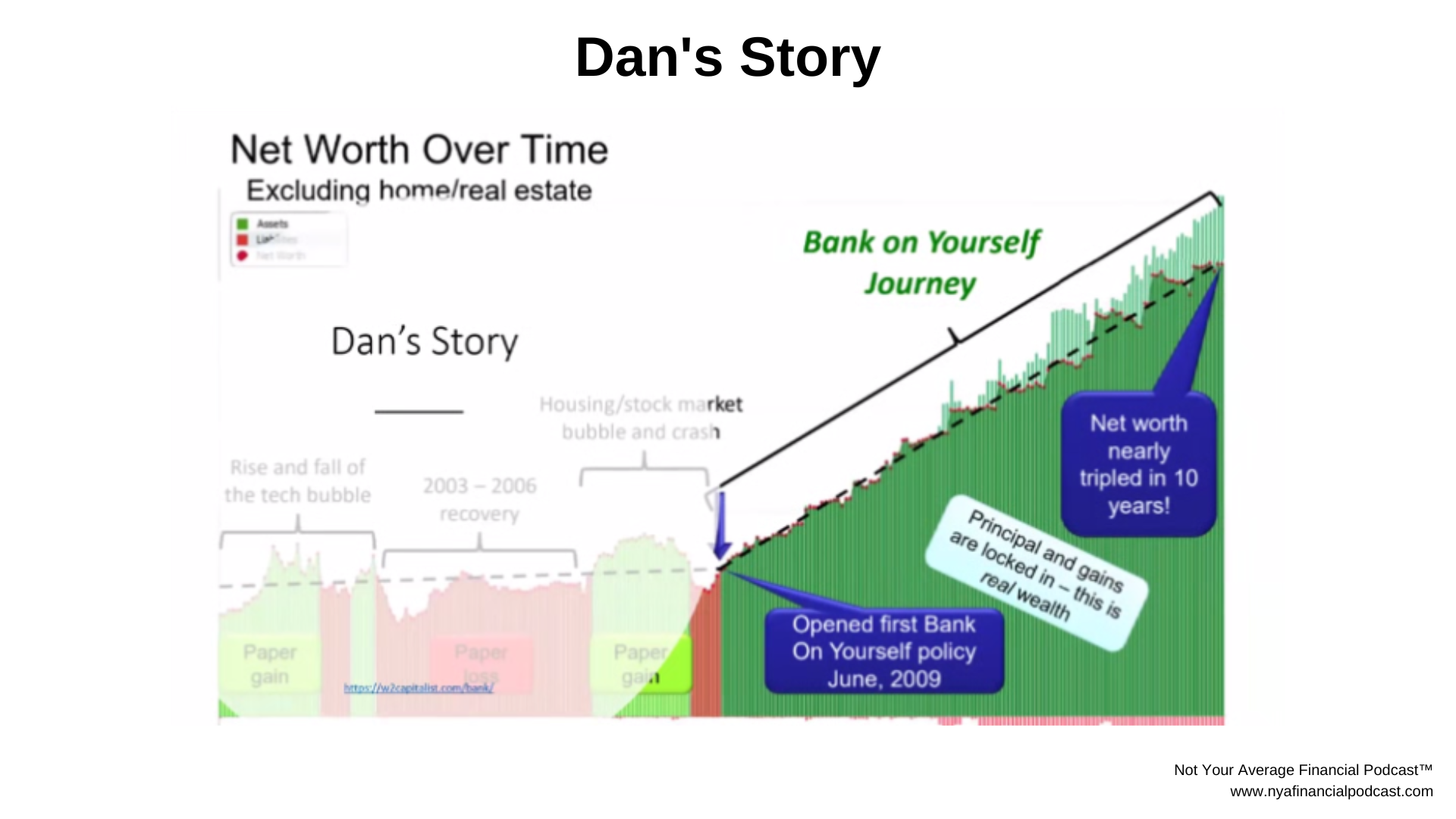

Dan Proskauer is Vice President of Engineering United Health Group’s Optum unit and has spent nearly 30 years as a professional in the Semiconductor and Health Care industries.

Dan Proskauer is Vice President of Engineering United Health Group’s Optum unit and has spent nearly 30 years as a professional in the Semiconductor and Health Care industries. Marc Beshears is the President of Top Wealth Agenda. He has helped his clients grow their wealth to achieve financial security and reach their personal and financial goals and dreams without the risk, worry, or volatility of stocks, real estate, and other investments.

Marc Beshears is the President of Top Wealth Agenda. He has helped his clients grow their wealth to achieve financial security and reach their personal and financial goals and dreams without the risk, worry, or volatility of stocks, real estate, and other investments. Amanda Neely is a financial professional who uses her years of experience in business growth to develop personalized financial strategies for individuals, couples, and entrepreneurs. She works with people to find their unique path to financial freedom.

Amanda Neely is a financial professional who uses her years of experience in business growth to develop personalized financial strategies for individuals, couples, and entrepreneurs. She works with people to find their unique path to financial freedom.