Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

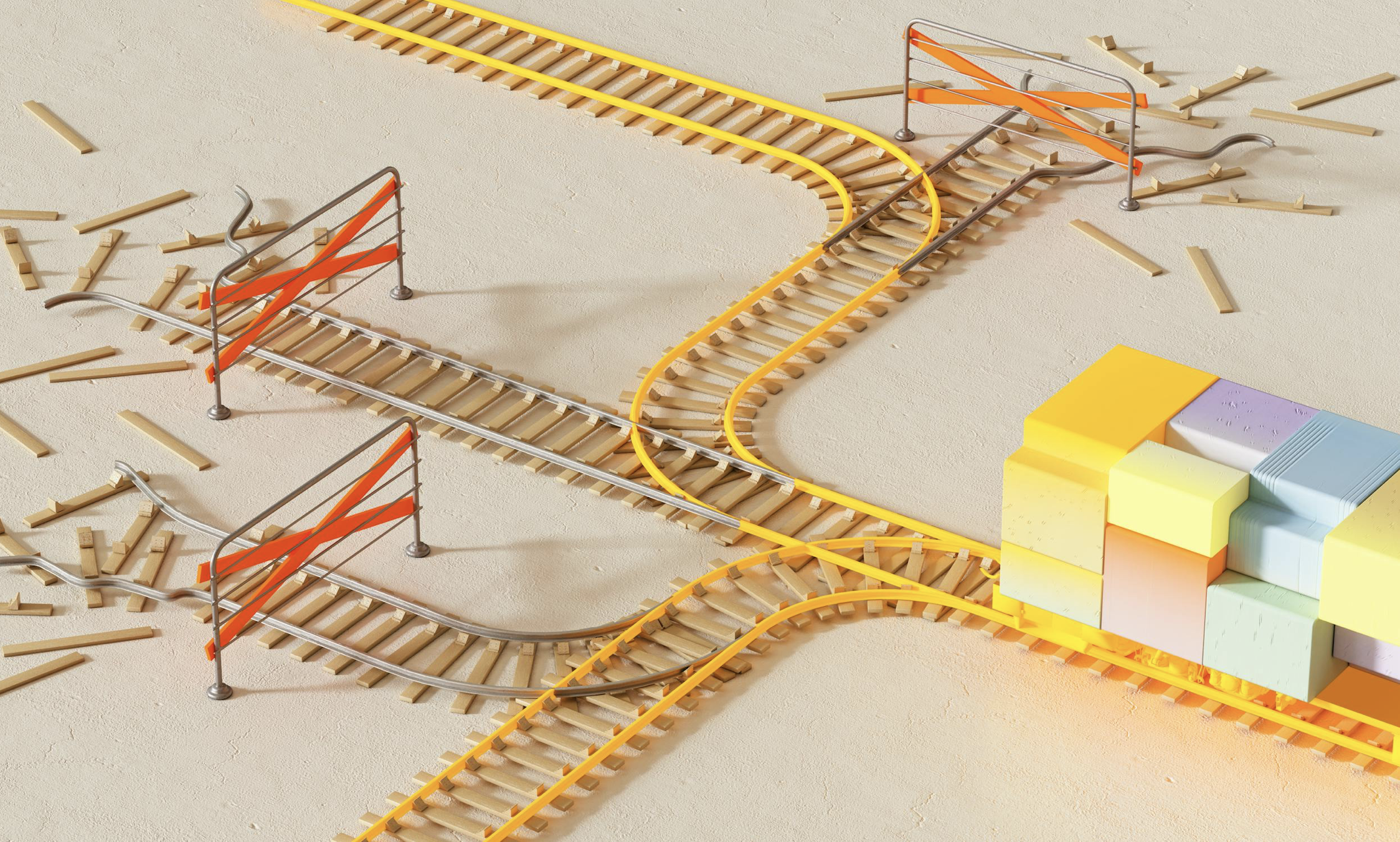

- What if running your business was like solving one giant puzzle?

- What is your vision of success?

- Have you been building the wrong picture all along?

- Who is Ciara Stockeland?

- Would you like to listen the Inventory Genius podcast?

- What happened?

- What was the craziest part of Ciara’s ride up?

- What does success look like?

- What started to implode?

- What advice would Ciara give her former self?

- Could we do it?

- Should we do it?

- What about top line revenue?

- What should you build your goals around?

- Do you know your numbers?

- How are your numbers like puzzle pieces?

- What does margin look like?

- What does profit look like?

- What does cash flow look like?

- What about learning?

- What is the main focus?

- What is gross margin?

- How are we leaving money on the table?

- How is a profit and loss like a rearview mirror?

- What one number will you fall in number with?

- What about achieving a goal?

- How is business like an endurance event?

- What about micro-adjustments?

- How is every business problem solvable?

- What is the bottom line?

- What debt are you servicing?

- What are your sales goals?

- What is the cost of business?

- Is the issue top down or bottom up?

- What do many business owners look at first?

- What happens when businesses fire their bankers?

- What practices are there to build?

- Does money solve the problem?

- Who are you surrounded by in your business?

- What does Ciara do?

- Do you have a product based business?

- How do you clear the overwhelm?

- Would you like to reach out to Ciara at Your C-Suite?

- Would you like to learn more about Ciara at ciarastockeland.com?

- Would you like to listen to Inventory Genius?

- What are the takeaways?

Ciara Stockeland is a speaker, author, 4x Ironman and Fractional CFO for inventory based businesses. Ciara has owned and operated a business since her early teens. As a serial entrepreneur, her business mindset and tenacity led her to opening her first store in 2006 which she then franchised. Her vast experience in both retail and wholesale industries led her to launch the first to market wholesale subscription box for boutique retailers, which she built and sold within 18 months. Most recently Ciara has launched the Inventory Genius, a consulting program for inventory-based business owners and has published the books Inventory Genius and Profit Genius, both of which give practical steps for creating more profitability in an inventory based business.

Ciara Stockeland is a speaker, author, 4x Ironman and Fractional CFO for inventory based businesses. Ciara has owned and operated a business since her early teens. As a serial entrepreneur, her business mindset and tenacity led her to opening her first store in 2006 which she then franchised. Her vast experience in both retail and wholesale industries led her to launch the first to market wholesale subscription box for boutique retailers, which she built and sold within 18 months. Most recently Ciara has launched the Inventory Genius, a consulting program for inventory-based business owners and has published the books Inventory Genius and Profit Genius, both of which give practical steps for creating more profitability in an inventory based business.

Len Sanford Jr. is the definition of a comeback story. Once a C student, a college dropout, and even homeless, Len rebuilt his life through God, grit, and growth. He built businesses from nothing, beat cancer, and transformed himself through self-education and relentless inner work. Today, he’s an asphalt foreman by day, a real-estate investor by trade, and author of From Overlooked to Unstoppable — a book born from lived experience, not theory. Len now helps high achievers break through invisible ceilings and unlock the performance they didn’t know they had. His mission: prove where you start has nothing to do with where you can rise.

Len Sanford Jr. is the definition of a comeback story. Once a C student, a college dropout, and even homeless, Len rebuilt his life through God, grit, and growth. He built businesses from nothing, beat cancer, and transformed himself through self-education and relentless inner work. Today, he’s an asphalt foreman by day, a real-estate investor by trade, and author of From Overlooked to Unstoppable — a book born from lived experience, not theory. Len now helps high achievers break through invisible ceilings and unlock the performance they didn’t know they had. His mission: prove where you start has nothing to do with where you can rise.