Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

- What did Mark learn from his parents?

- What was a great gift?

- What happened in high school?

- What did Mark receive after college?

- What happened with Dave Ramsey?

- How many jobs did we work?

- What did Mark’s mom do?

- What about health ratings?

- Would you like hear Episode 43?

- Would you like hear Episode 322?

- What did they discuss?

- What happened?

- How did Mark’s mom leverage her policy’s cash value?

- What about the Roth IRA?

- What happened next?

- What happens with a health rating?

- What about Mark’s dad?

- Would you like to hear Episode 302?

- What about the Upton Sinclair paradox?

- What was Dad’s philosophy for money?

- What did he believe about home values?

- What did Mark’s mom do through the cancer diagnosis?

- What are the limits on a Roth IRA?

- What happened in January 2017?

- What about estate planning?

- Are your documents in place now?

- Are your parent’s documents in place now?

- Do you have a will?

- Do you have a medical power of attorney?

- Do you have a financial power of attorney?

- What avoids probate?

- What does not avoid probate?

- Are life insurance proceeds private?

- Do you owe them or not?

- How might you avoid heartache?

- What goes directly to the beneficiaries?

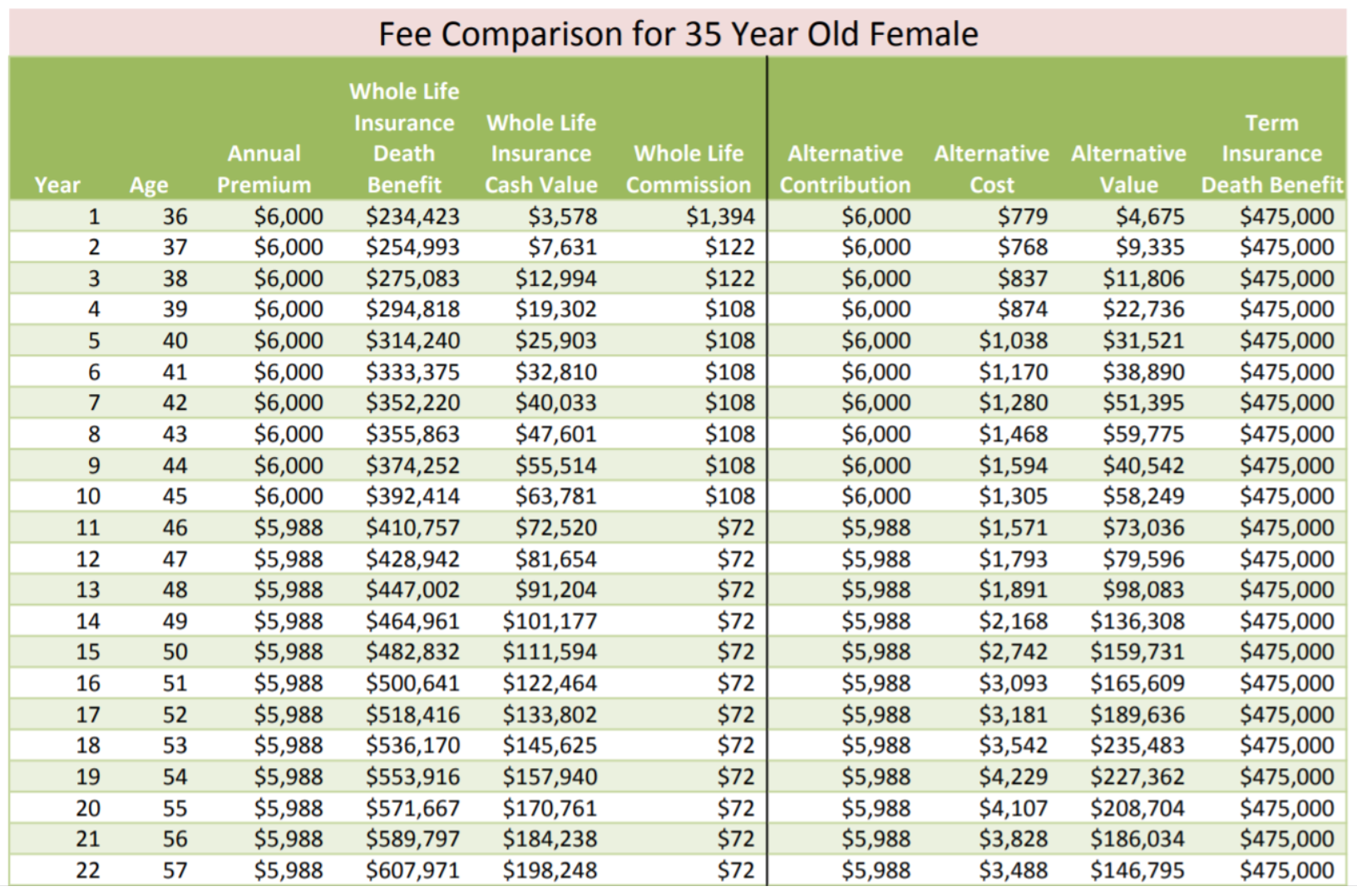

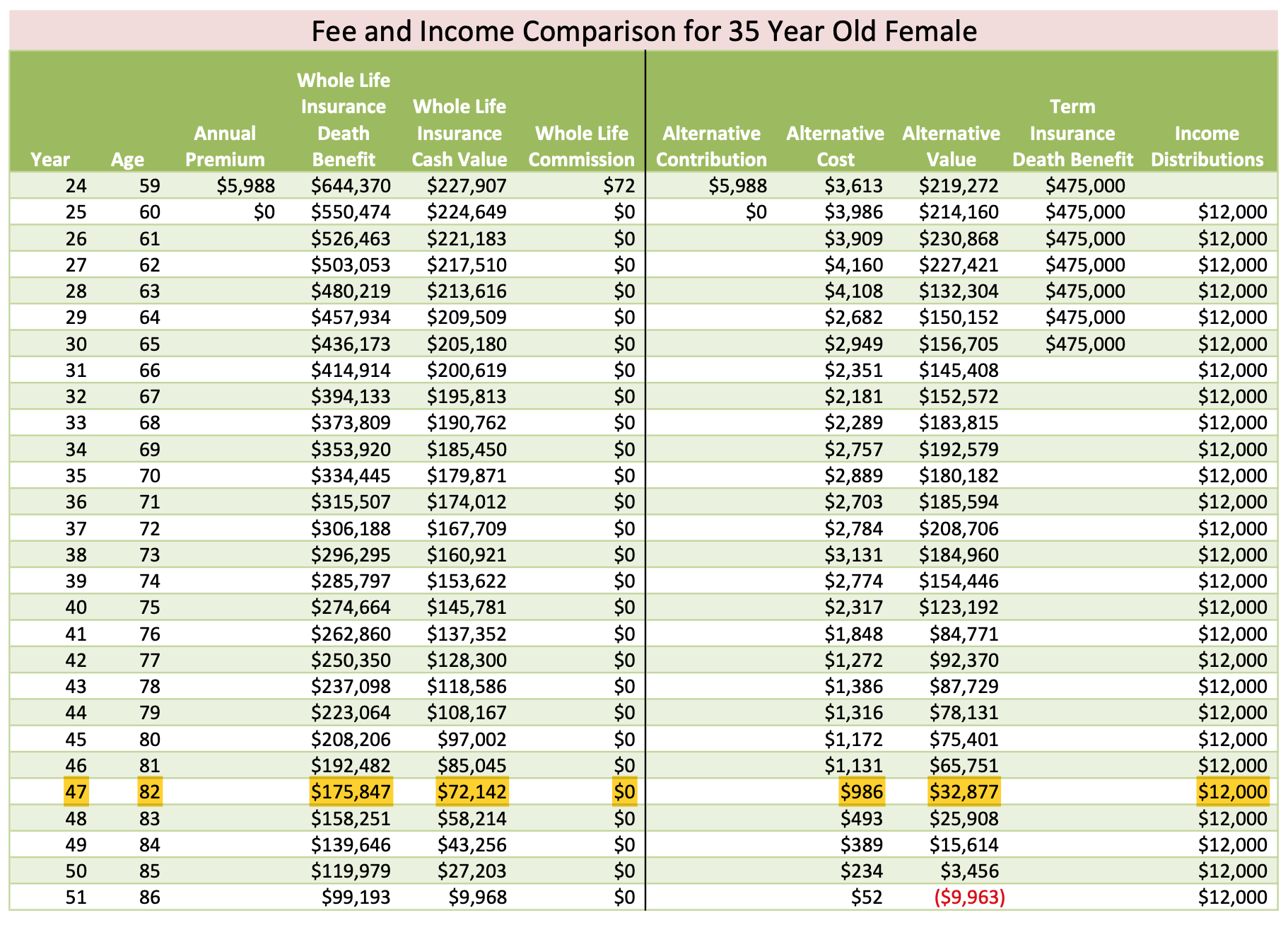

- How much did she pay in as premium?

- How much did the benefits pay?

- What was the return?

- What was the tax?

- What were the fees?

- Where did Mark and his brother put the money?

- What would Mark prefer?

- What makes Mark smile?

- What happened with Mark’s dad?

- What happened at the end?

- Do people actually invest the rest?

- What happens with term insurance?

- What was worthless to him?

- Is your will updated?

- What are the issues with term insurance?

- What about love?

- What has Mark learned through losing both parents at a young age?

- How about a tale of two parents?

- What are the big takeaways?

- What is messy?

- How might you leave the best last gift?

- What about letting policies expire?

- Where would you like to be buried?

- What songs would you like to be played at your funeral?

- Would you like to hear Episode 149?

- Does this story resonate?

- Do you have a similar story or experience?

- How might you leave the best last gift?

For over 28 years Scott Plamondon has been successfully helping people plan for retirement. He uses his accounting and investment background combined with a deep understanding of his client’s financial needs, to offer the best possible strategies.

For over 28 years Scott Plamondon has been successfully helping people plan for retirement. He uses his accounting and investment background combined with a deep understanding of his client’s financial needs, to offer the best possible strategies.