Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

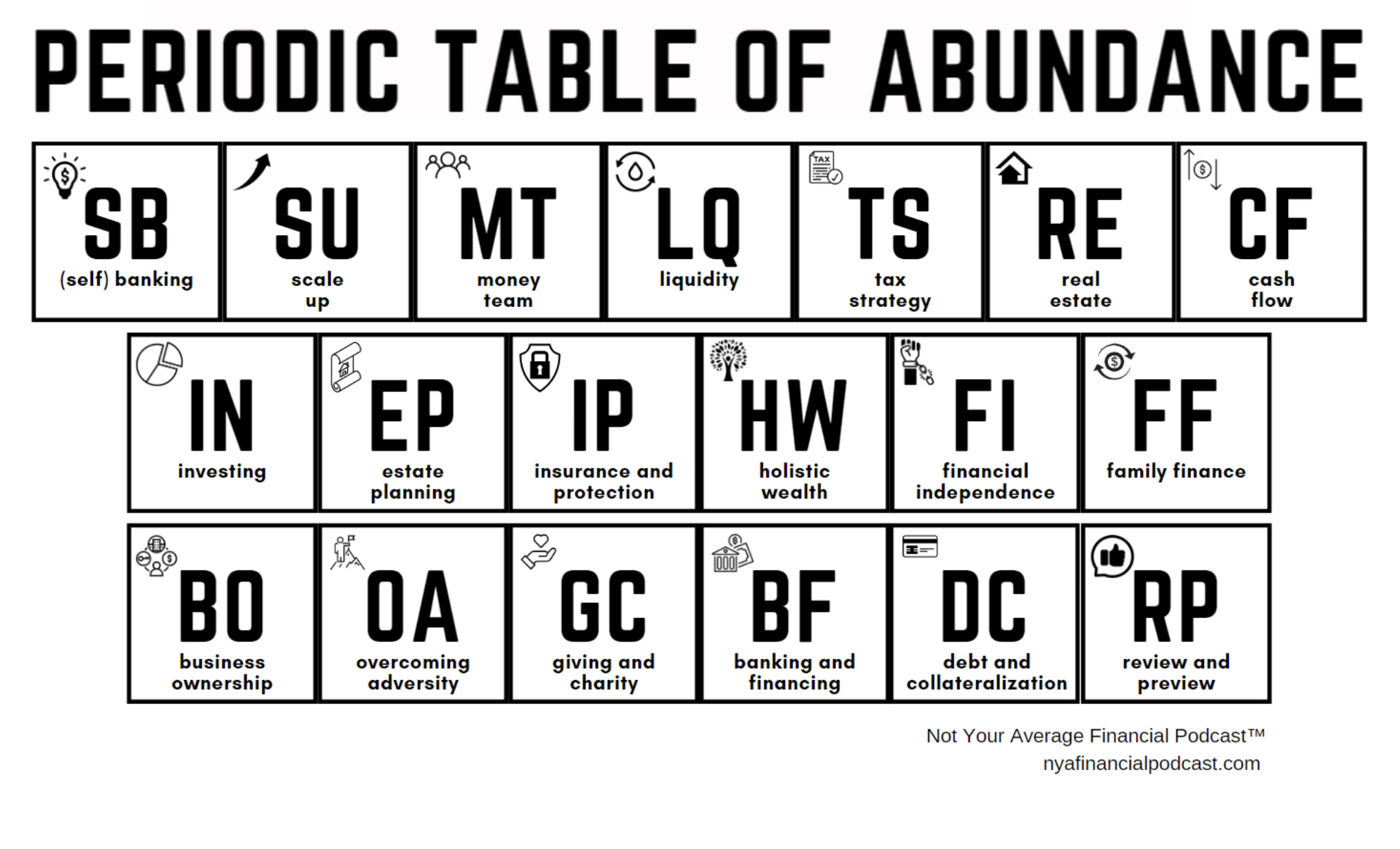

- Would you like to get the special report on the Periodic Table of Abundance? Would you like to Request a Meeting?

- Have you listened to the previous episodes in this series?

- Would you like to hear Episode 330: No.1 Scaling Up and Overcoming Adversity?

- Would you like to hear Episode 331: No.2 Money Team, Family Finance and Estate Planning?

- Would you like to hear Episode 332: No.3 Liquidity and Cash Flow?

- Would you like to hear Episode 333: No.4 Secrets of Leverage with Insurance and Banking?

- Would you like to hear Episode 334: No.5 Achieve Your Ultimate Potential with Investing and Real Estate

- Would you like to hear Episode 335: No.6 Building a Better World Through Business Ownership, Tax Strategy and Giving

- What is financial independence?

- Would you like to learn about financial independence?

- Would you like to learn about the power of financial collateralization?

- Do you have enough passive income to cover your expenses?

- Do you have to depend on your active income?

- Do you have streams of income to replace your day job?

- What are your expenses?

- What are the stages?

- Do you have an emergency?

- Why did we choose one year for an emergency?

- What about placing your emergency fund in a Bank On Yourself® type whole life insurance policy?

- What about passive income exceeding earned income?

- Would you like to run the financial independence calculator with Mark or a colleague?

- What would it take to cover a luxury item?

- What about changing the world through philanthropy?

- What about the journey?

- What about Odysseus?

- What about freedom?

- What did Nietzsche say?

- What about Frodo?

- What about Iron Man?

- What about Luke?

- What are most financial advisors up to?

- What do you want?

- What are the five mile posts?

- What is basecamp?

- What about reducing your expenses or increasing your income?

- Would you like to hear Episode 19?

- Would you like to hear Episode 63?

- What does Parkinson’s law of finance say?

- What about being honest with money?

- What about investing in yourself?

- What about your education?

- What about your health?

- Are you a better version of yourself?

- Do you have an idea of what you will be doing?

- How do you expect to be in a different place a year from now?

- What is the greatest challenge you’re facing right now?

- What have you tried in the past?

- What are you going to do next?

- …By when?

- What about liquidity?

- What will you do in an emergency?

- Do you budget?

- Do you save in liquid form?

- Who has a financially unstable pyramid?

- Who is putting all of their money at risk?

- Is your money liquid?

- Is your money available to you?

- Who does this benefit?

- Could you cover an emergency expense of $400?

- Do you need to sell your stuff?

- Why not build a stable financial structure?

- What did Tim Austin say about the 10/10/10 rule?

- Who is saving 30% of income each month?

- Now that I’m saving, where do I save it?

- Is your money stashed in the right place?

- What about CDs?

- What is taxable?

- What are you really earning after taxes?

- What about interest rates on (multi-year guaranteed annuities) MYGAs?

- What about Bank on Yourself® type whole life insurance policies?

- What about the power of collateralization?

- What about cash value?

- Would you like to hear Episode 32?

- What about investing in things you understand and control?

- What do you need to quit?

- Do you need a rental property?

- Do you need to borrow against your life insurance policy?

- What can you control?

- What are you into?

- Where can you put your money to work?

- How might you create multiple streams of passive income?

- How might you buy multiple streams of passive income?

- What could you do to add one more stream?

- Can you outspend any income?

- What about mentoring?

- Are you the guide?

- What do you have to share with the world?

- How are you writing your story?

- How many pages do you have left?

- Would you like to like to meet with Mark?

John Ensley is president of JEnsley Financial, a fiduciary, financial planning company and Registered Investment Advisor. John holds a Chartered Financial Consultant® designation from the American College of Financial Services and is one of an elite group of highly trained Bank On Yourself® Professionals.

John Ensley is president of JEnsley Financial, a fiduciary, financial planning company and Registered Investment Advisor. John holds a Chartered Financial Consultant® designation from the American College of Financial Services and is one of an elite group of highly trained Bank On Yourself® Professionals.