Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

- Why haven’t you subscribed yet?

- What big purchases are coming up?

- Can you earn your way out of expenses?

- What happens in retirement?

- Can you earn your way out of expenses throughout all of the ages of life?

- What’s the difference between earning income at age 35 and age 86?

- What allows for uninterrupted compounding?

- How is this possible?

- Who offers non-direct recognition policy loans?

- How about an example?

- What is the amount of the cash value?

- What is the simple interest rate on the policy loan?

- What happens over four years?

- What happens to the policy?

- What is the gain?

- Did you earn more than you spent?

- What happens over a longer time horizon?

- What about dividends?

- Would you like to hear Episode 345?

- Would you like us to review your policy?

- What is unbelievably cool?

- What products stop growing your money when you spend it?

- Can you imagine this chart?

- What happens on the spend down?

- What continues to earn interest?

- What if you could continue to maintain the compounding growth on your money?

- What are the implications?

- What results shocked Mark?

- What if they never paid off the loan?

- How about another apples-to-apples example?

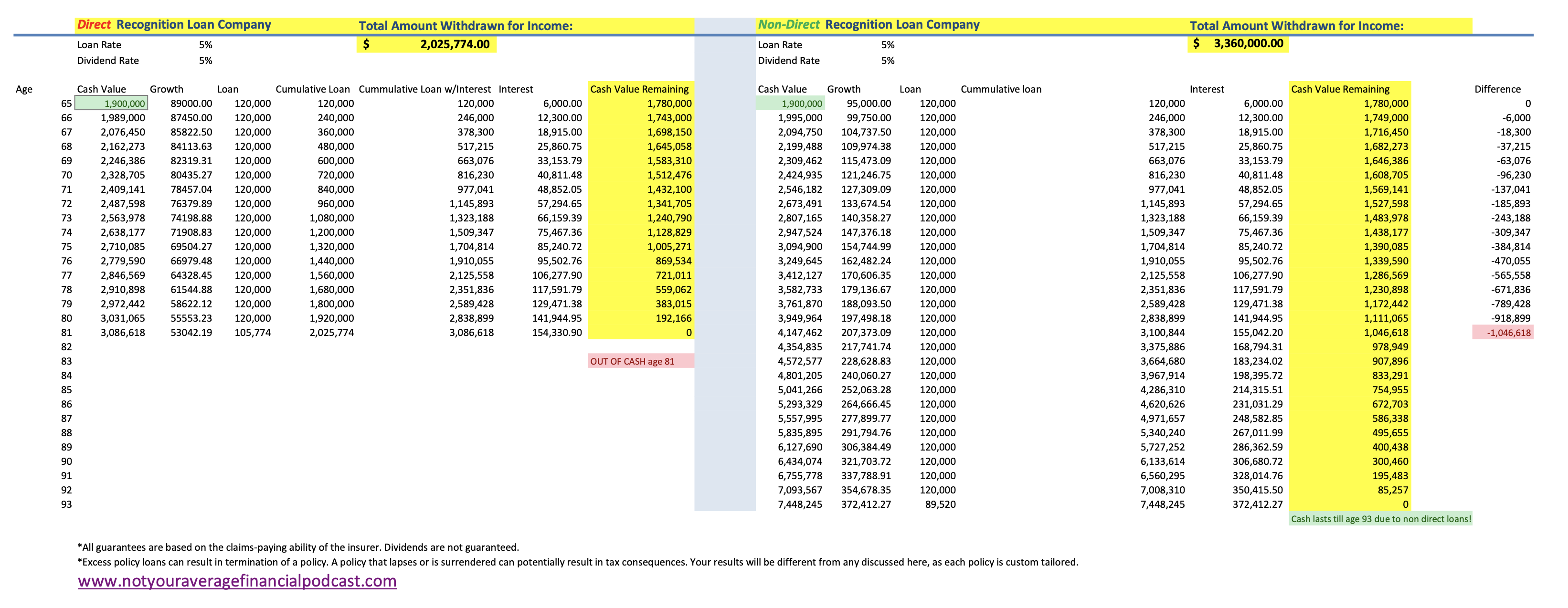

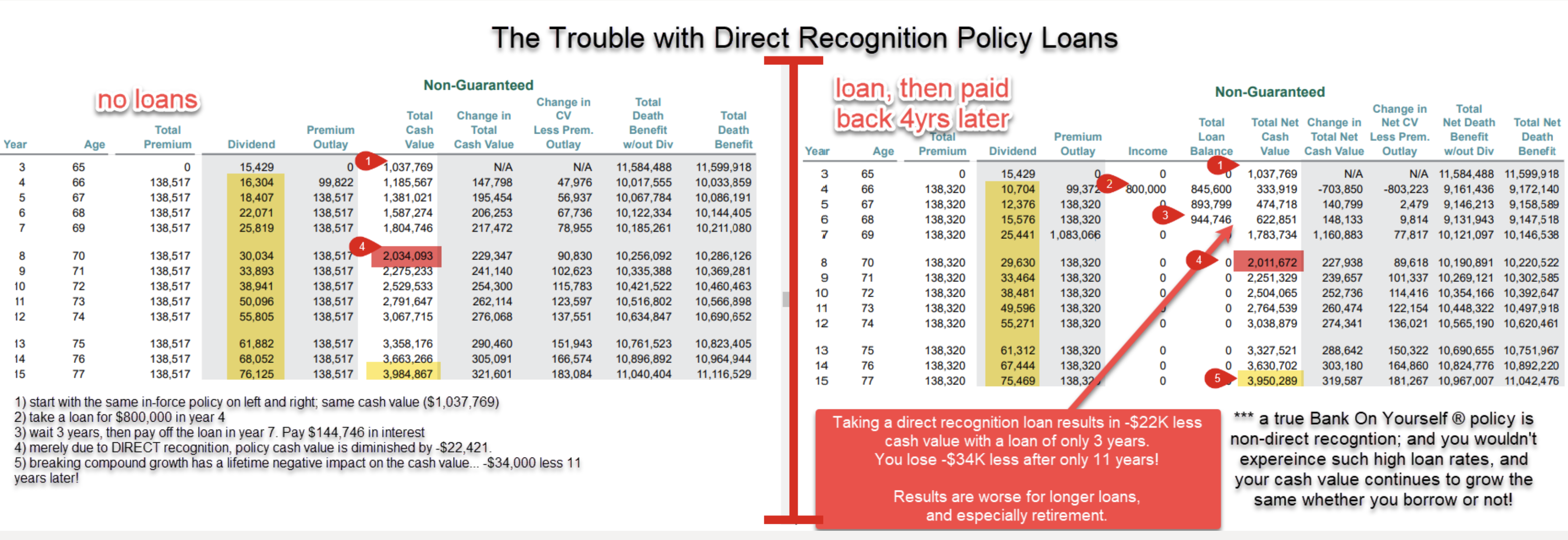

- What does a policy loan look like in a direct recognition policy?

- What about the interest?

- What about receiving a weird letter from the insurer at age 81?

- Where was the compounding?

- Where did the growth go?

- What does a policy loan look like in a non-direct recognition policy?

- What about the interest?

- What is the difference?

- What is the policy growth based upon?

- What about compounding and accumulation?

- What about loan interest?

- How much more?

- Is the policy designed the right way?

- Who is getting penalized?

- How about a timely warning?

- Does your agent understand the working parts well?

- Is your policy built correctly?

- Is your policy breaking compound growth?

- What about the Gold Standard of the Bank on Yourself® Professional training?

- What would it look like?

- What about absolute certainty?

- Do you have to know everything about how your phone was engineered to enjoy it?

- How is a Bank on Yourself® type whole life insurance policy like a smart phone?

- When was the last time you reviewed your current policy?

- Would you like a second set of eyes?

- Would you like to learn more by listening through our Episodes in a List?

- What about time?

- Are you serious?

- Would you like a meeting with me or an associate?

Leonard Renier studies the economic trends and shifts and the impact of government programs and regulations on the social fabric of our country. His research has resulted in bringing a new awareness to the financial challenges the average American faces. Leonard is considered an expert in communicating these challenges and believes with more information; people will make better life decisions. As founder of the Wealth & Wisdom Institute, Leonard recognized the importance of Education, Discovery and Understanding. He has been involved in the financial services industry for over 30 years.

Leonard Renier studies the economic trends and shifts and the impact of government programs and regulations on the social fabric of our country. His research has resulted in bringing a new awareness to the financial challenges the average American faces. Leonard is considered an expert in communicating these challenges and believes with more information; people will make better life decisions. As founder of the Wealth & Wisdom Institute, Leonard recognized the importance of Education, Discovery and Understanding. He has been involved in the financial services industry for over 30 years.