Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

- Does X mark the spot?

- Who is Dave Bonnemort?

- How did Dave get his start?

- How many policies does Dave and his family own?

- What is the E.S.I. framework?

- What about earning?

- What about saving?

- What about interest?

- What about banking?

- Who is good at at least two of the three?

- What about investing in yourself and your health?

- What about education?

- How might we bring value to others?

- What have you done to help keep up with inflation?

- What is the difference between saving and investing?

- Is a 401(k) saving or investing?

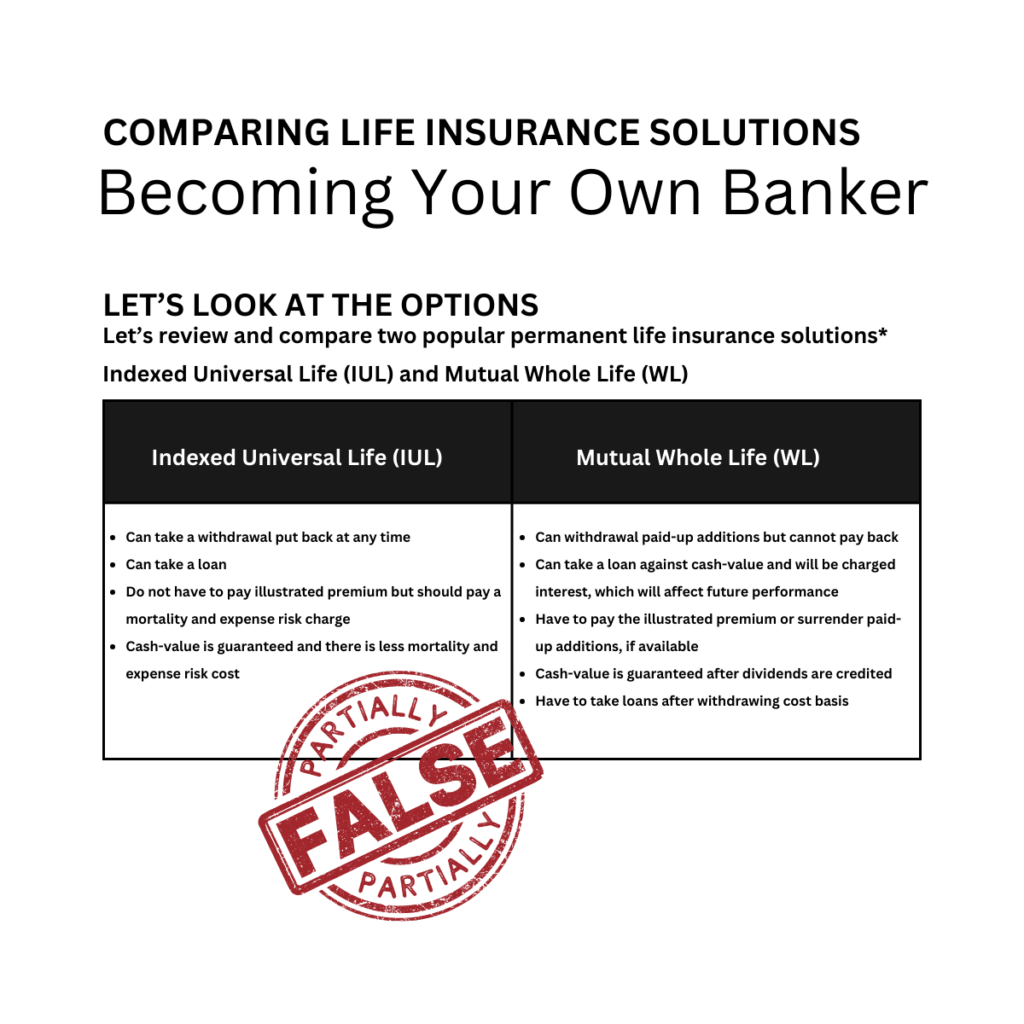

- What about the book Becoming Your Own Banker by Nelson Nash?

- What about keeping your debts low?

- What did Charlie Munger say?

- What about Willie Sutton’s law?

- What about the changing rules?

- Have you looked at the history of taxes?

- Where are the big payouts?

- What about risk?

- What about the likelihood of loss vs. the likelihood of winning?

- What about volatility?

- What about saving and building capital?

- What about being broke as a joke?

- How did Dave 10x some of his money?

- Who knows better (what to do with your money)?

- What about banking, rate and volume?

- What are the two businesses?

- How about patience and hard work?

- What about the mindset?

- What are the ugly, painful, grinding years?

- What about the capitalization phase?

- How is this like starting a tree farm?

- What about the loan phase?

- How much money do you bring in every month?

- What dollar amount do you bring in as loans?

- What if you were paying yourself back (for loans) and recapturing that interest instead?

- Would you like to hear Part 2 with Dave next week?

- What are the takeaways?

- What about the need to have accessible, liquid capital?

Dave Bonnemort is a current client and active practitioner of the Becoming Your Own Banker concept, as well as a husband to an amazing wife and father to three incredible kids.

Dave Bonnemort is a current client and active practitioner of the Becoming Your Own Banker concept, as well as a husband to an amazing wife and father to three incredible kids.

He makes his living as a small business owner, is a student of Austrian economics, and a personal finance junkie.

Amanda Neely, CFP® is a Certified Financial Professional® and Bank on Yourself® Professional, who uses her years of experience in business growth to develop personalized financial strategies for individuals, couples, and entrepreneurs. She works with people to find their unique path to financial freedom. Reach out to Amanda at

Amanda Neely, CFP® is a Certified Financial Professional® and Bank on Yourself® Professional, who uses her years of experience in business growth to develop personalized financial strategies for individuals, couples, and entrepreneurs. She works with people to find their unique path to financial freedom. Reach out to Amanda at

Doug Peacock spent 38 years as a high school teacher and football coach. He tried to retire the traditional/conventional path, and things didn’t work out like he was led to believe. He learned that other teachers and coaches were having the same conversation. Doug literally watched his 403(b) become a 203(b) twice in the last decade of his teaching career. He knew there had to be a better way, so he started learning how wealth really works.

Doug Peacock spent 38 years as a high school teacher and football coach. He tried to retire the traditional/conventional path, and things didn’t work out like he was led to believe. He learned that other teachers and coaches were having the same conversation. Doug literally watched his 403(b) become a 203(b) twice in the last decade of his teaching career. He knew there had to be a better way, so he started learning how wealth really works.

Grant Thompson works with families and their businesses nationwide. The Thompson & Thurman Agency works with families who share in their vision and want to become financially set for life without taking unnecessary risks. With so much misinformation in our financial world today, families really need guidance and direction to find the true path to financial freedom. Grant, Chris and their team of trusted advisers nationwide have are leading the way to meet that challenge. Grant is married to his wife Kathy and they have 2 sons Blair and Blane along with his wife Brittany. Grant enjoys spending his spare time with his family at reining and cow horse competitions plus trying to squeeze in a shooting competition every now and then with his sons.

Grant Thompson works with families and their businesses nationwide. The Thompson & Thurman Agency works with families who share in their vision and want to become financially set for life without taking unnecessary risks. With so much misinformation in our financial world today, families really need guidance and direction to find the true path to financial freedom. Grant, Chris and their team of trusted advisers nationwide have are leading the way to meet that challenge. Grant is married to his wife Kathy and they have 2 sons Blair and Blane along with his wife Brittany. Grant enjoys spending his spare time with his family at reining and cow horse competitions plus trying to squeeze in a shooting competition every now and then with his sons.