Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

- How about peace, sanity and satisfaction?

- How do you pay your taxes?

- After you’ve cut down your obligation, what then?

- When did withholding start?

- What are all of the ways you can pay for something?

- What is opportunity cost? See Episode 13

- How much do you truly pay in taxes?

- Can you change how you pay for your taxes?

- What if you could save money?

- What if you could make a return?

- What are the IRS late penalties?

- What’s the difference between monthly and daily compounding?

- Have you heard the Debt, Saver and Wealth Accumulator episode?

- What happens when you take a loan from a 401(k)?

- How many times do you get taxed with a 401(k) loan?

- Can you take a loan from an IRA?

- What about HELOCs?

- Are home values guaranteed?

- Are you in the pocket of the bank?

- Can the bank take a HELOC away?

- Can the bank call a HELOC?

- What about tax savings with HELOCs?

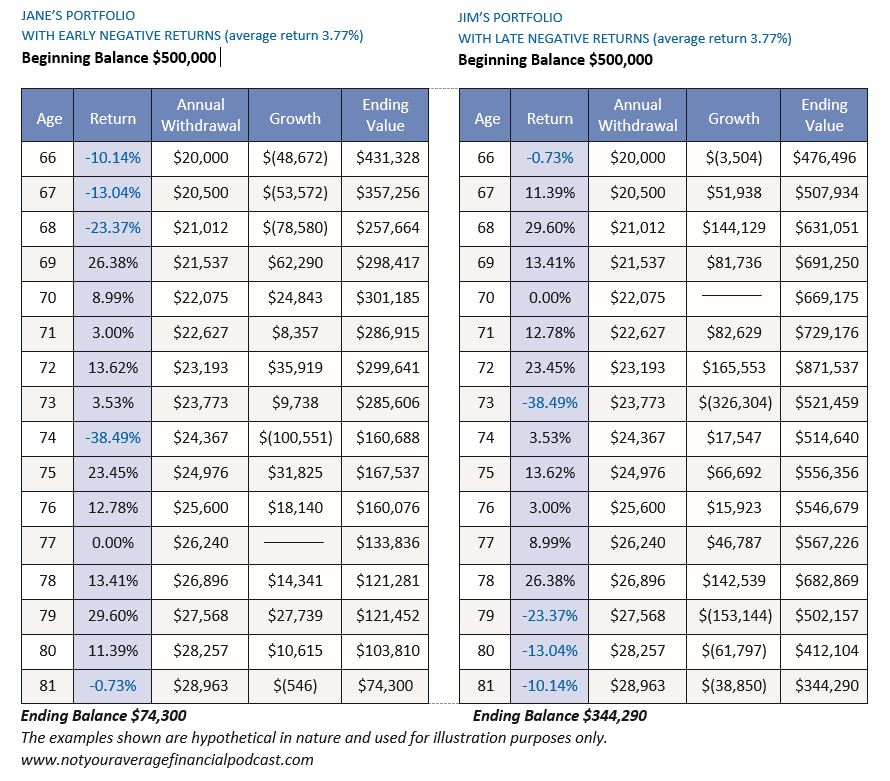

- When do you need money most?

- What has happened to tax benefits with HELOCs after the new tax law?

- What about collateralizing with a traditional bank loan?

- What about CDs?

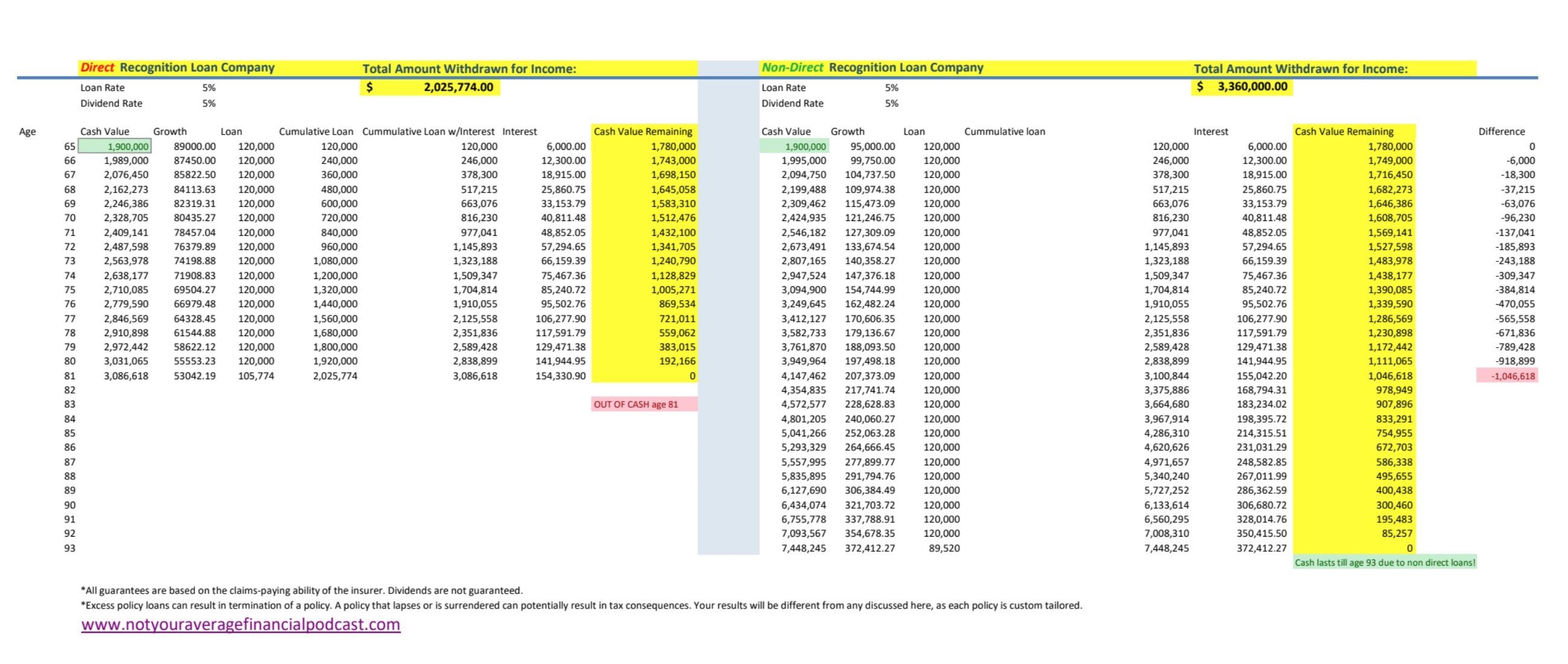

- How can you use a correctly designed whole life insurance policy to pay taxes?

- What about business owners?

- What about selling a business?

- Why do business owners benefit from a Bank on Yourself type, dividend paying whole life insurance policy when paying taxes?

- Would you like to make your own payback schedule?

- What happens if you don’t repay the loan?

- What about uninterrupted compound growth?

- Is the tax liability one of the biggest expenses of your year?

- What are some other benefits?

- How is this different from deductions?

- Do you have a good system for paying your taxes?

Remember! This episode provides generalized tax information and is NOT considered the same as the professional tax advice you will receive from your CPA. We are not CPAs, and we don’t play them on T.V.

Please consult your CPA or tax expert for professional tax advice and insight into your specific situation.

A Lehigh University graduate, William Rainaldi is a Regional Vice President for Security Mutual Life Insurance Company of Binghamton, NY. He is a leading U.S. authority on Social Security and its impact on retirement planning. He has an extensive background in life insurance, business & investment concepts and computer technology.

A Lehigh University graduate, William Rainaldi is a Regional Vice President for Security Mutual Life Insurance Company of Binghamton, NY. He is a leading U.S. authority on Social Security and its impact on retirement planning. He has an extensive background in life insurance, business & investment concepts and computer technology.