Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

- Is life like a road trip?

- Who is Steven Lyons?

- How did Steven and his wife meet?

- What did Steven learn from his dad’s entrepreneurship?

- What was the fork in the road?

- What is Steven’s work?

- What about pattern recognition?

- What’s Steven’s learning journey with money?

- What happened next?

- What’s the difference between being covered vs. being secure?

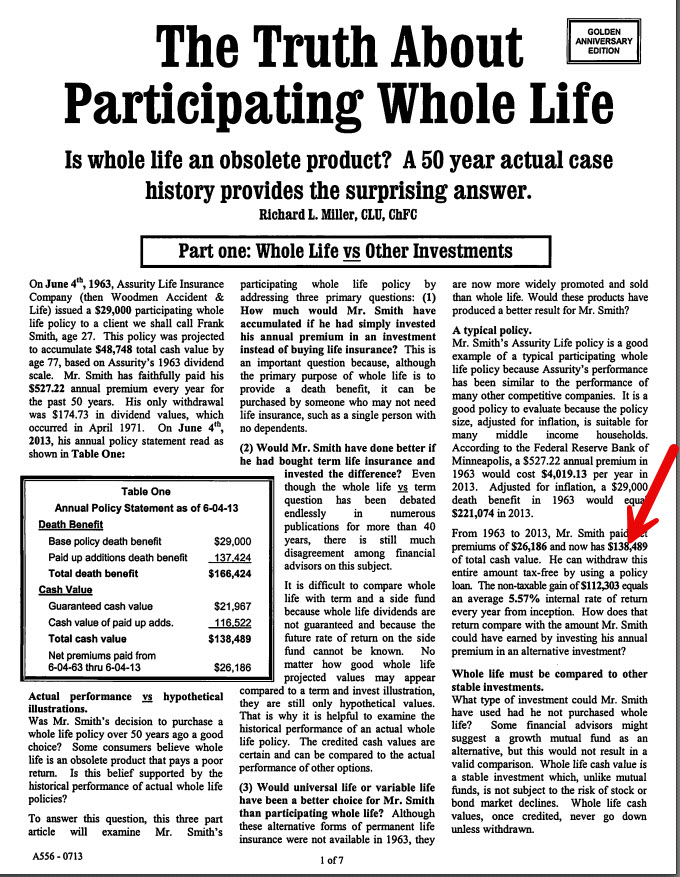

- What didn’t make much sense?

- What about being discouraged from taking loans on a life insurance policy?

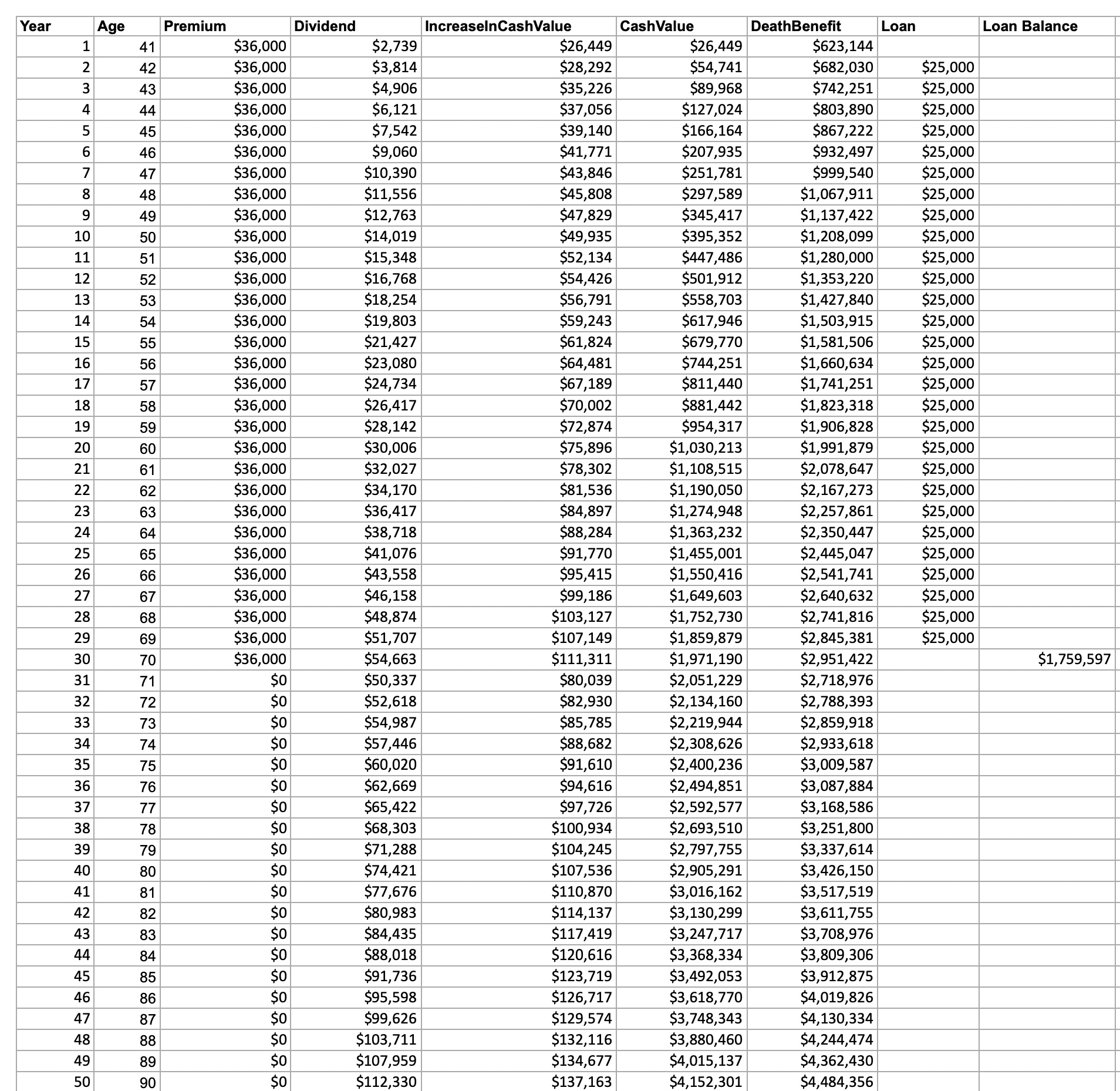

- What is possible?

- How are Bank on Yourself® type whole life insurance policies different?

- What was the disincentive on that plan?

- How could an annuity systematically pay for life insurance premium?

- Is this too good to be true?

- What about the vocabulary of insurance?

- What opportunities can Steven chase now, without losing his position?

- What are direct recognition loans?

- How do direct recognition loans affect compound growth?

- What has happened?

- How easy was it to take a policy loan?

- What is Steven doing with Authentic Texas Magazine?

- What are the three types of buildings you will find in many small West Texas towns?

- What about starting from an early age?

- What about teaching the kids?

- Where can you find Authentic Texas magazines?

- What are the takeaways?

- What about serendipity?

- What about learning from financial missteps?

- What about trusting in pattern recognition and trusting your gut?

Steven Lyons is the owner and creative director of Adaptable Space, a marketing design consultancy based in Nashville, Tennessee focusing on engineering business design solutions. Steven has twenty-eight years of agency and in-house creative experience building comprehensive brand communications working with Fortune 500 companies to non-profits. As the creative lead for Authentic Texas Magazine, he’s been an integral part of the redesign and continued development of the magazine since 2019, as well as the design director for the Official Texas Rangers Bicentennial Guide in 2023. Steven holds a bachelor’s degree in advertising and graphic design from Abilene Christian University.

Steven Lyons is the owner and creative director of Adaptable Space, a marketing design consultancy based in Nashville, Tennessee focusing on engineering business design solutions. Steven has twenty-eight years of agency and in-house creative experience building comprehensive brand communications working with Fortune 500 companies to non-profits. As the creative lead for Authentic Texas Magazine, he’s been an integral part of the redesign and continued development of the magazine since 2019, as well as the design director for the Official Texas Rangers Bicentennial Guide in 2023. Steven holds a bachelor’s degree in advertising and graphic design from Abilene Christian University.

Sarry Ibrahim, CFP®, EA, MBA, is located in Chicagoland and works with clients across the United States. As the founder of Financial Asset Protection, Sarry helps clients safely accumulate wealth without sacrificing liquidity.

Sarry Ibrahim, CFP®, EA, MBA, is located in Chicagoland and works with clients across the United States. As the founder of Financial Asset Protection, Sarry helps clients safely accumulate wealth without sacrificing liquidity.

Elan Moas, a seasoned financial advisor with over fifteen years in the industry, leverages his extensive experience and regulatory acumen to navigate the intricate world of universal life insurance. Holding multiple licenses including Series 6, 7, 63, 65, 2-15, and 2-20, Elan is a recognized advocate for ethical practices in financial advisory.

Elan Moas, a seasoned financial advisor with over fifteen years in the industry, leverages his extensive experience and regulatory acumen to navigate the intricate world of universal life insurance. Holding multiple licenses including Series 6, 7, 63, 65, 2-15, and 2-20, Elan is a recognized advocate for ethical practices in financial advisory.

Brian Claus

Brian Claus Nick Prefontaine is a 3x best selling author and was named a top motivational speaker of 2022 in Yahoo Finance. He’s a Speaker, Founder and CEO of Common Goal.

Nick Prefontaine is a 3x best selling author and was named a top motivational speaker of 2022 in Yahoo Finance. He’s a Speaker, Founder and CEO of Common Goal.

David C. Barnett has been working with small businesses for over 20 years. He’s helped them grow, he’s helped entrepreneurs buy and sell them, he’s helped people finance them. David is the author of 8 books about small business transactions and local investing. He’s the host of a YouTube channel with hundreds of videos about buying, selling, financing and managing SMEs and can be found anytime at his blog site

David C. Barnett has been working with small businesses for over 20 years. He’s helped them grow, he’s helped entrepreneurs buy and sell them, he’s helped people finance them. David is the author of 8 books about small business transactions and local investing. He’s the host of a YouTube channel with hundreds of videos about buying, selling, financing and managing SMEs and can be found anytime at his blog site