Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

- Who is Tim Austin?

- When did Tim start learning about money?

- When did Tim become a financial advisor?

- What did Tim learn from his dad?

- What did Tim learn from his grandmother?

- What did Tim have to tell his grandmother?

- What is the 10/10/10 rule?

- What are orphan clients?

- What did the orphan clients teach Tim about life insurance?

- How did the orphan clients save money?

- What are your liquid assets?

- Are you living within your means?

- What is financial independence?

- How much are Americans saving today?

- What is the difference between an asset and a liability?

- What if someone can’t save 30% of their income?

- What is the average debt ratio today?

- What kind of debt?

- What about an inventory?

- Can you accept where you’re at?

- Can you start making small, incremental improvements?

- Where are all of the dollars going?

- How many dollars are going to taxes?

- How many dollars are going to debt?

- Are you sacrificing your rate of return?

- What will Tim share in next week’s Part 2 episode?

- What are Mark and Holly’s takeaways?

Tim Austin is President and Founder of SET for Advisors, a leading training organization for financial advisors who want to help their clients grow wealth predictably and without taking unnecessary risk.

Tim Austin is President and Founder of SET for Advisors, a leading training organization for financial advisors who want to help their clients grow wealth predictably and without taking unnecessary risk.

He is also the co-founder and director of the Bank On Yourself authorized advisor whole life insurance concept along with best-selling author Pamela Yellen who wrote the book Bank On Yourself: The Life-Changing Secret to Growing and Protecting Your Financial Future.

Bank On Yourself is a major best seller, hitting #1 on the USA Today and Amazon best-seller lists, and is also a New York Times, Wall Street Journal and Publishers Weekly #1 best seller.Tim makes his home in Clarkston, Michigan with his wife and three children. Tim likes to test the limits of his physical ability and mental toughness participating in Half Iron Man Triathlons and marathons.

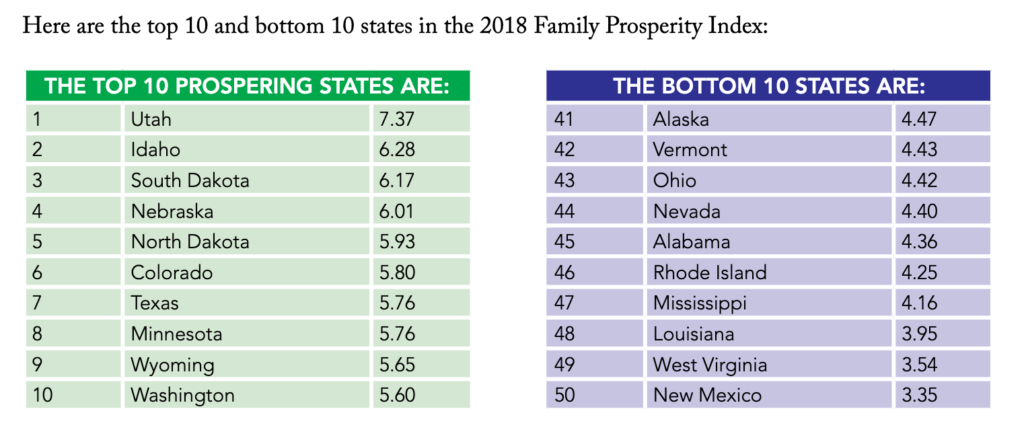

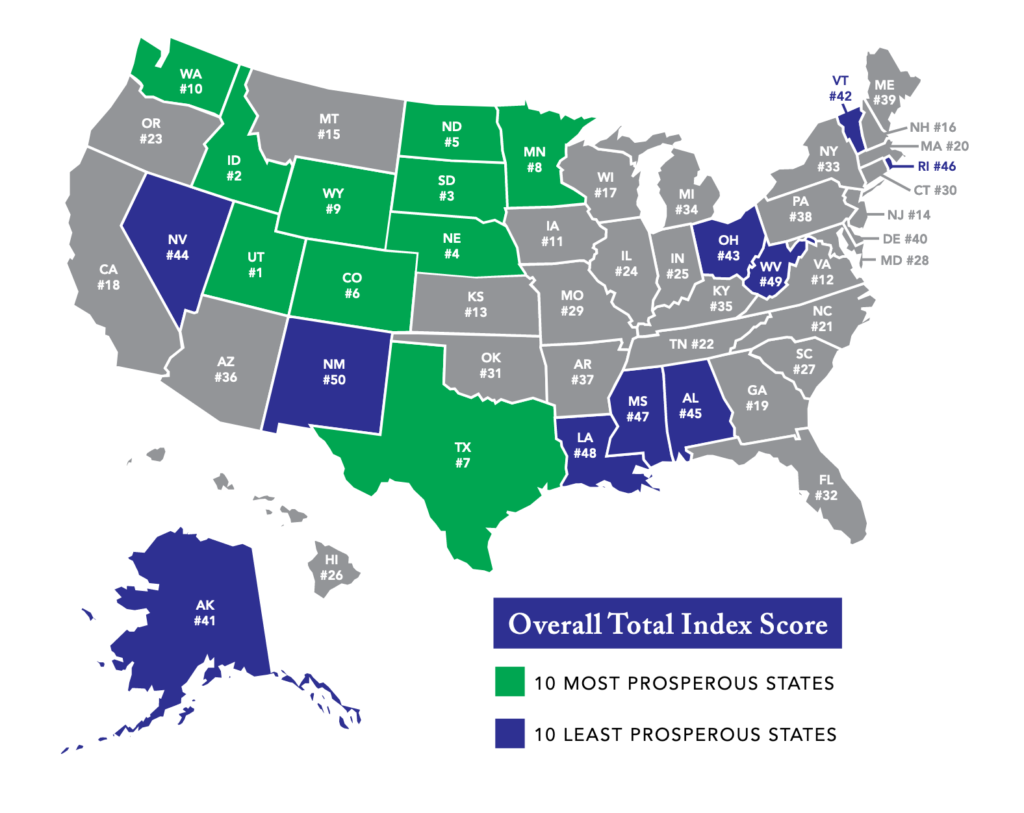

As a public choice economist trained in applied microeconomics and econometrics, Wendy Warcholik has spent her career applying economic tools to the problems of state government.

As a public choice economist trained in applied microeconomics and econometrics, Wendy Warcholik has spent her career applying economic tools to the problems of state government. J. Scott Moody has worked as a Public Policy Economist for over 18 years. He is the author, co-author and editor of 170 studies and books. He has testified before the House Ways and Means Committee of the U.S. Congress as well as various state legislatures. His work has appeared in Forbes, CNN Money, State Tax Notes, Portland Press Herald, New Hampshire’s Union Leader, Hartford Courant, The Oklahoman, and Albuquerque Journal.

J. Scott Moody has worked as a Public Policy Economist for over 18 years. He is the author, co-author and editor of 170 studies and books. He has testified before the House Ways and Means Committee of the U.S. Congress as well as various state legislatures. His work has appeared in Forbes, CNN Money, State Tax Notes, Portland Press Herald, New Hampshire’s Union Leader, Hartford Courant, The Oklahoman, and Albuquerque Journal.

Ryan Fleming is a college planning specialist in the Columbus, Ohio area, practicing for over 11

Ryan Fleming is a college planning specialist in the Columbus, Ohio area, practicing for over 11