Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

- When was your moment?

- Who is Sean Morrissey?

- Have you heard the podcast Landlording for Life?

- Who is Sean leading?

- What about buy and hold real estate?

- What is leading with lifestyle?

- What does financial freedom mean for Sean?

- What happened when banks lowered the line of credit?

- What happened for four years?

- What did Sean learn?

- What does Sean do and what does liquidity do for Sean’s business?

- How did Sean get started?

- What is the value of liquidity?

- What are the challenges for landlords right now?

- What does the average guy or gal not realize about the need we have for access to capital?

- Is it easy to buy?

- What’s the weird position?

- Are you liquid enough?

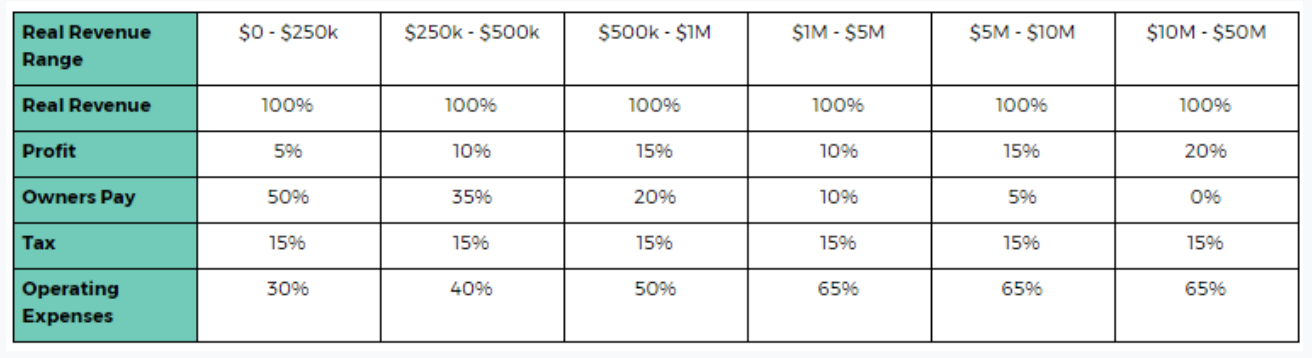

- What about roughly 3% of capital expenditures and reserves?

- What about roughly 5% for vacancy?

- What about roughly 3% for a liquidity factor?

- What about the “what if” game?

- What about Mark’s meeting with Sean?

- What surprised Sean?

- What did Sean find?

- Have you heard Episode 159 and Episode 160?

- What did Sean learn?

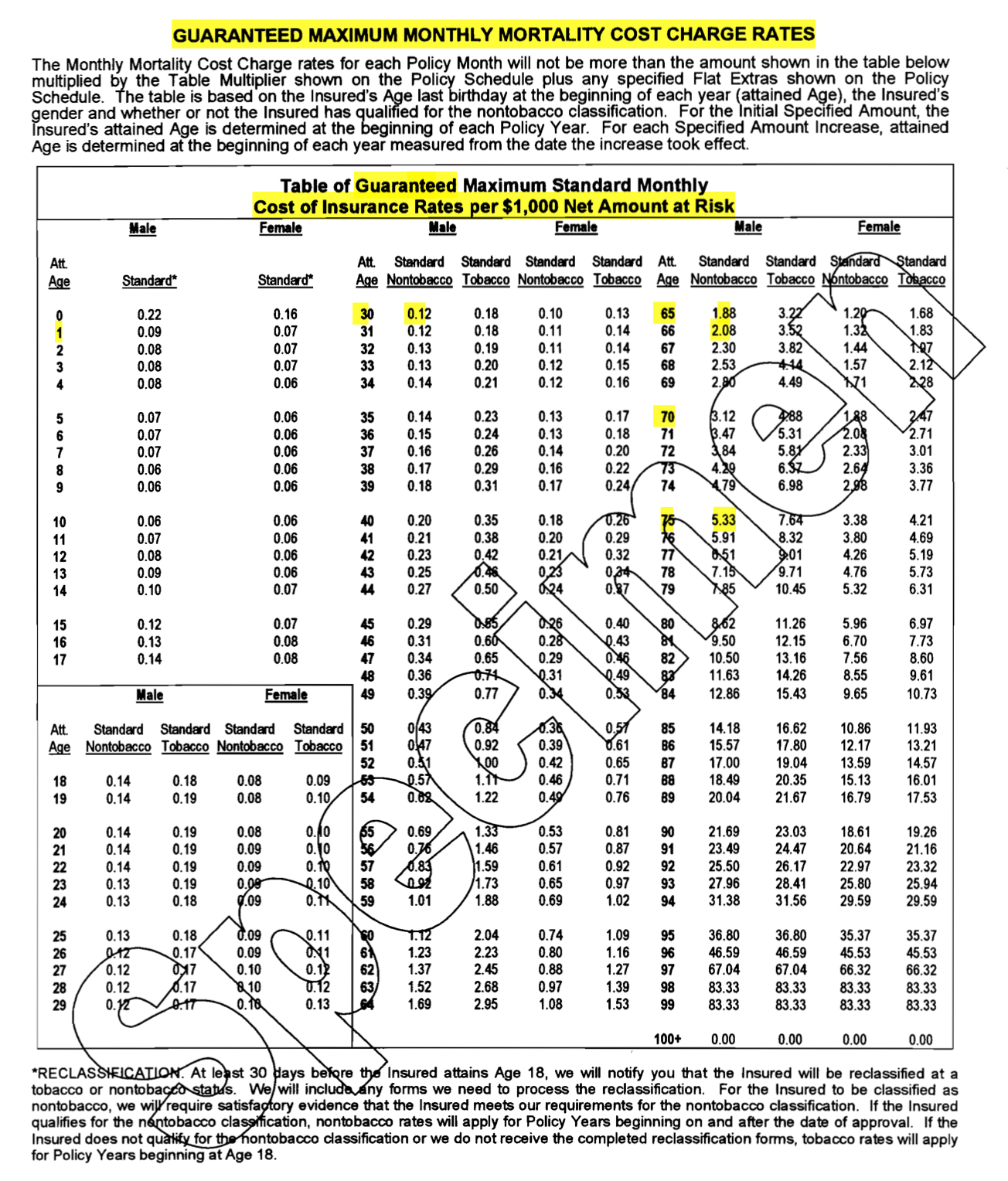

- What about universal life policies?

- Are all mutual insurance companies good for Bank on Yourself® type policies?

- Why does the contract matter on a life insurance policy?

- What is a direct recognition loan provision?

- What about non direct recognition company?

- What’s an eye opener?

- What are Sean’s hopes?

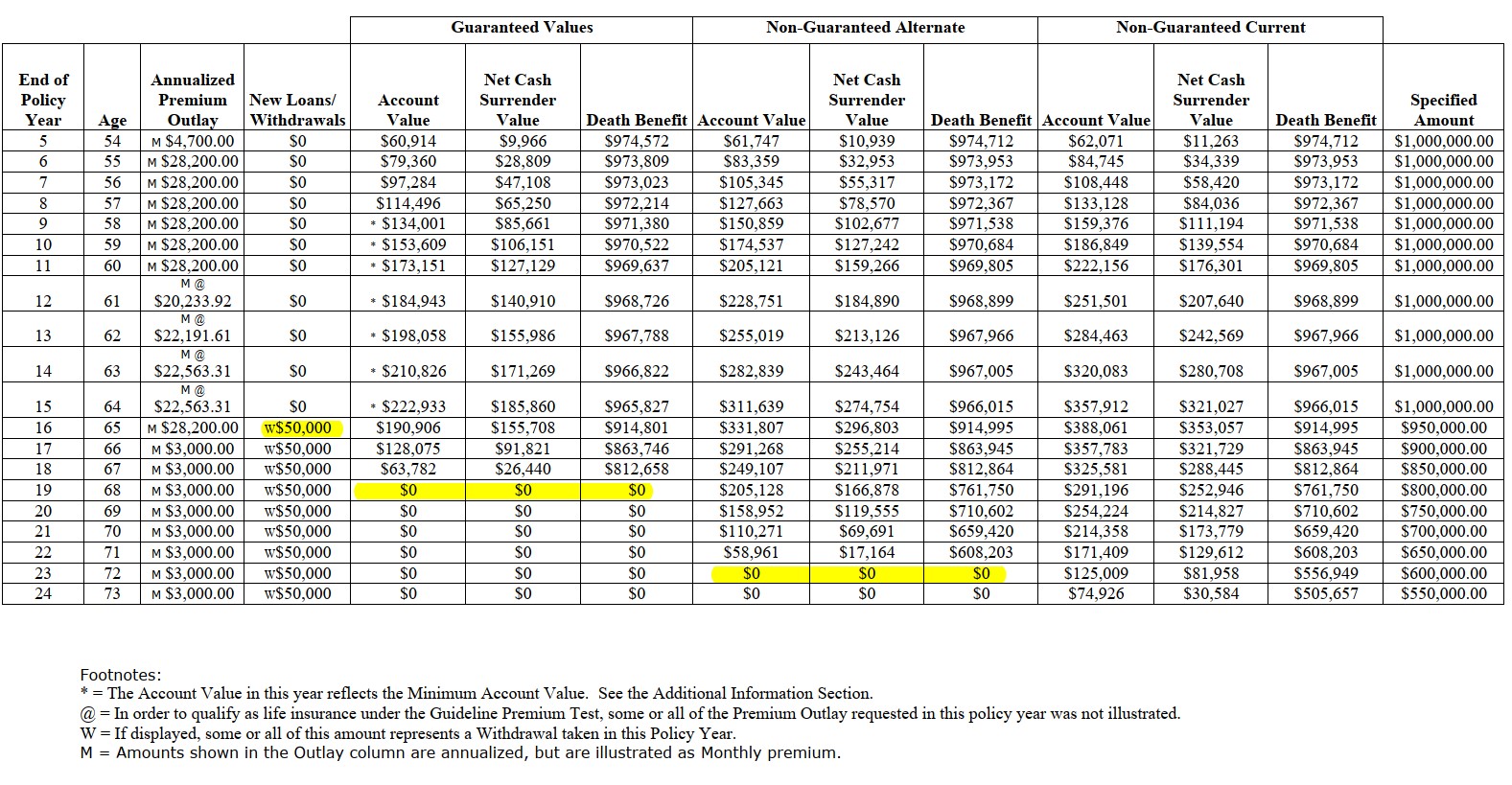

- How does Sean plan to use his policies in sync with real estate?

- What does Sean see, looking back?

- How does Sean think big enough now?

- Where do you want to be in 10 to 20 years?

- When do we want our money most efficient?

- What’s the power of a whole life insurance policy (especially the older ones)?

- What about tax deductions and depreciation in real estate?

- What about long range thinking?

- What are the options down the road?

- What’s the problem of real estate without whole life?

- Would you like to work with Sean?

- What is happening with evictions in Illinois?

- What about liquidity?

- What about setting sights too small?

- How big can you think?

- What about opportunities?

- Want to work with us? We’re hiring. http://bit.ly/worklg

Sean Morrissey is a landlord and real estate broker, in the western suburbs of the Chicagoland area, who has built a $7M real estate portfolio and owns/manages Chicagoland Realty Group Partners LLC.

Sean Morrissey is a landlord and real estate broker, in the western suburbs of the Chicagoland area, who has built a $7M real estate portfolio and owns/manages Chicagoland Realty Group Partners LLC.

Having managed 200+ properties for landlords in the Chicagoland area, Sean has built property management systems to make “buy and hold” real estate sustainable and wealth-building.

Sean’s proudest achievement is being able to spend his days with his wife, two kids, dog and cat in what some may define a financial freedom lifestyle. Sean is the host of the real estate “buy and hold” real estate investor podcast called Landlording for Life.

Lane Kawoaka has been investing for over a decade and now controls 2,600+ units. As owner of CrowdfundAloha.com, SimplePassiveCashflow.com, and ReiAloha.com, Lane is responsible for finding investment opportunities, analysis, and marketing. Mr. Kawaoka obtained a BS in Industrial Engineer and MS in Civil Engineering and Construction Management from the University of Washington. In addition to an analytical engineering background, Lane has real world experience in working as a project manager for over $230 million dollars of capital construction projects in both the public and private sector. Working as a high paid professional in Corporate America and frustrated by the traditional wealth building dogma, Lane was compelled to inspire and mentor other working professionals via his Top-50 Investing podcast at SimplePassiveCashflow.com.

Lane Kawoaka has been investing for over a decade and now controls 2,600+ units. As owner of CrowdfundAloha.com, SimplePassiveCashflow.com, and ReiAloha.com, Lane is responsible for finding investment opportunities, analysis, and marketing. Mr. Kawaoka obtained a BS in Industrial Engineer and MS in Civil Engineering and Construction Management from the University of Washington. In addition to an analytical engineering background, Lane has real world experience in working as a project manager for over $230 million dollars of capital construction projects in both the public and private sector. Working as a high paid professional in Corporate America and frustrated by the traditional wealth building dogma, Lane was compelled to inspire and mentor other working professionals via his Top-50 Investing podcast at SimplePassiveCashflow.com.

As Chief Distribution Officer of Foresters Financial, Matt Berman is responsible for life insurance and annuity product development, pricing and sales across the United States and Canada.

As Chief Distribution Officer of Foresters Financial, Matt Berman is responsible for life insurance and annuity product development, pricing and sales across the United States and Canada. Matthew Shanlian received his bachelor’s degree in finance from Liberty University before working full time in the mortgage industry starting in 2007. Matt began as a Loan officer assistant and has worked his way up to Division President with Primary Residential Mortgage, INC. Matthew is a nationally recognized speaker, frequent podcast guest, and also serves on the board of directors for NIME, a non-profit , financial services education organization. These activities have helped him earn the achievement of being ranked by Mortgage Executive Magazine as a Top 1% Mortgage Originator in America. In his time away from the office, Matthew loves serving in his local church’s children’s ministry with his wife, Maria. Together they have 3 children, Miles, Millie, and Maverick.

Matthew Shanlian received his bachelor’s degree in finance from Liberty University before working full time in the mortgage industry starting in 2007. Matt began as a Loan officer assistant and has worked his way up to Division President with Primary Residential Mortgage, INC. Matthew is a nationally recognized speaker, frequent podcast guest, and also serves on the board of directors for NIME, a non-profit , financial services education organization. These activities have helped him earn the achievement of being ranked by Mortgage Executive Magazine as a Top 1% Mortgage Originator in America. In his time away from the office, Matthew loves serving in his local church’s children’s ministry with his wife, Maria. Together they have 3 children, Miles, Millie, and Maverick.