Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

- Would you like to watch selected clips from us on YouTube?

- What is happening with the banks and the FDIC?

- What about non-bank banks?

- How much uninsured assets are held in these non-bank banks?

- Have you read David Graeber’s book, Debt: The First 5000 Years?

- How much wealth has debt created?

- Who is positioned to profit?

- Who is gobbling up the little banks?

- What is the exact issue?

- What about fractional reserve banking?

- Are we encouraged to speculate?

- Who is ready to opt out of this madness?

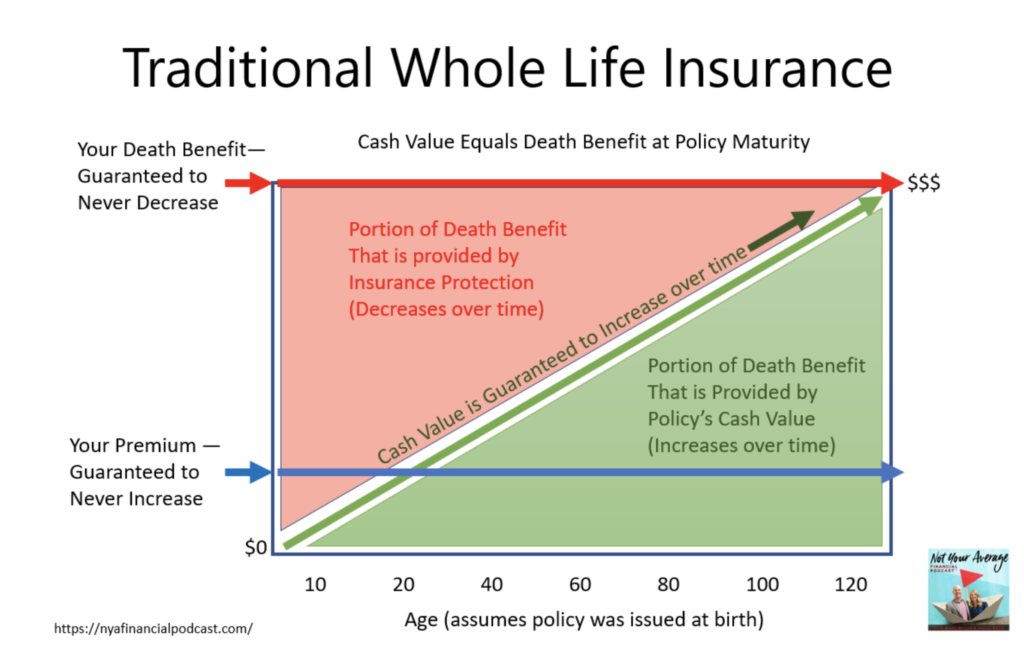

- What is the business of banking?

- What is the business of life insurance companies?

- How are the time horizons different?

- How are the reserves on hand different?

- What is the worst thing to happen to a banker?

- What is the best thing to happen to an insurer?

- Are you a year older?

- Will you take that deal?

- What are the insurers obligated to do?

- Where will you park your savings?

- What is contributing to the problem?

- What if fractional reserve banking evaporated?

- What would make the financial system more stable?

- What about private lending?

- What about dreaming of what the world could look like?

- What could reduce stress?

- What about the mortgage industry?

- What would lead to more responsible lending practices?

- Who needs an auto loan anyway?

- What other benefits could surface?

- Who is opting out?

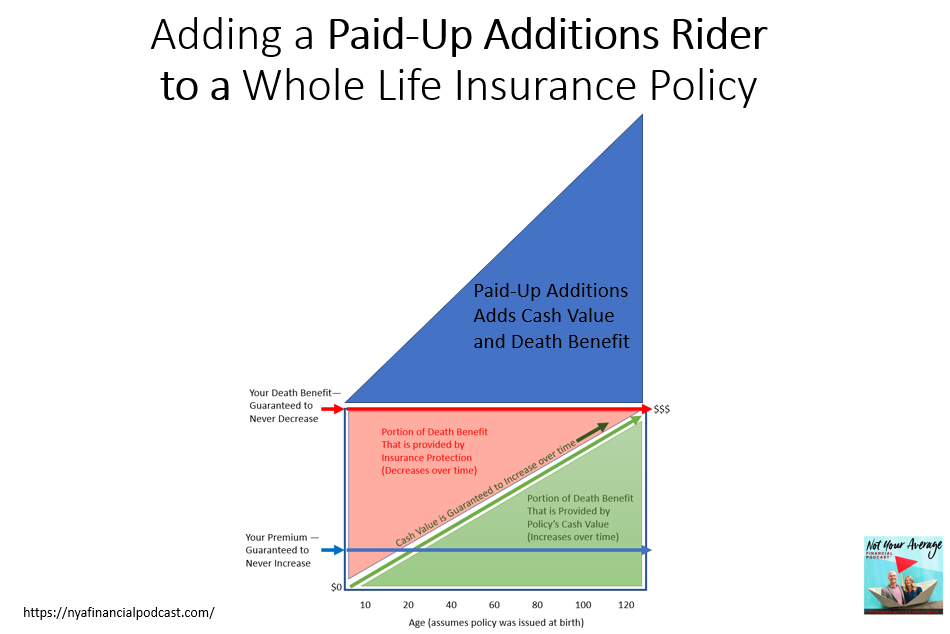

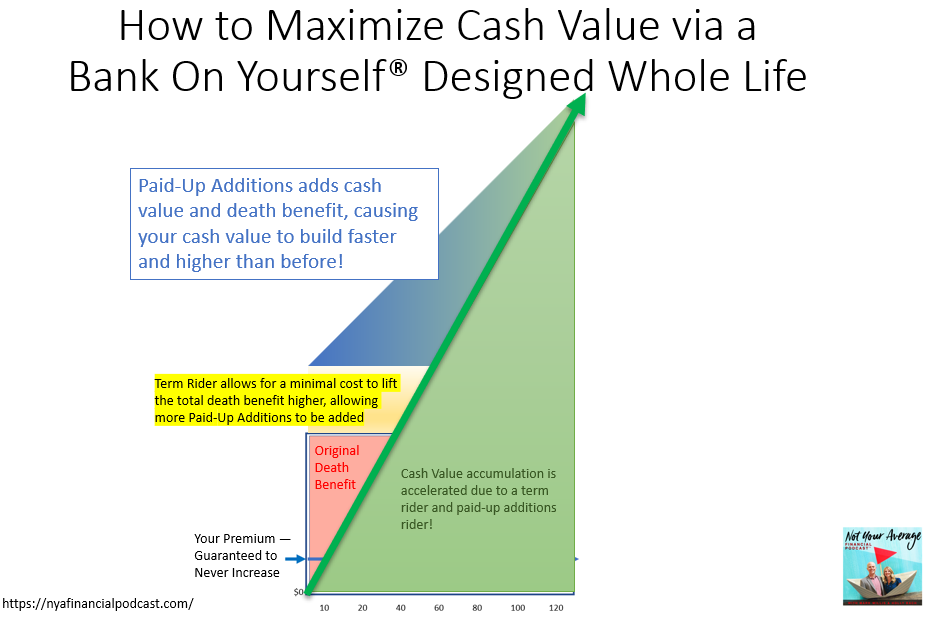

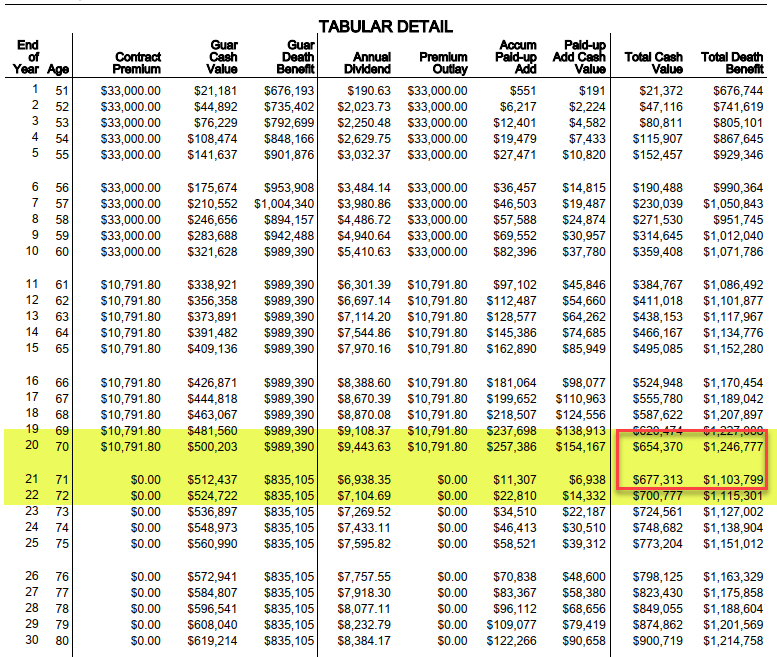

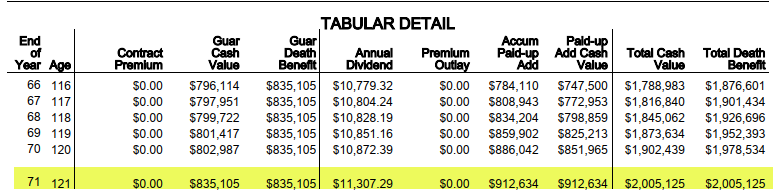

- How do Bank on Yourself® type whole life insurance policies reduce stress?

- What about an example?

- What about overdraft fees?

- What about bridge loans?

- Do you have to wait?

- Can you choose to opt out?

- Would you like to meet with Mark to discuss your specific situation?

Brett Swarts is considered one of the most well-rounded Capital Gains Tax Deferral Experts and informative speakers in the U.S. He is the Founder of Capital Gains Tax Solutions, is an exclusive Deferred Sales Trust Trustee, host of the Capital Gains Tax Solutions podcast and an eXp Commercial Multifamily Broker in Sacramento, CA and Saint Augustine, FL.

Brett Swarts is considered one of the most well-rounded Capital Gains Tax Deferral Experts and informative speakers in the U.S. He is the Founder of Capital Gains Tax Solutions, is an exclusive Deferred Sales Trust Trustee, host of the Capital Gains Tax Solutions podcast and an eXp Commercial Multifamily Broker in Sacramento, CA and Saint Augustine, FL.

Both originally from South Dakota, Nick Poppe and his wife, Brooke, have been in Northwest Arkansas for the past 2 years with their 2 dogs. Brooke is an Occupational Therapist and Nick works fully remotely in the financial industry. After several years in banking and financial planning and knowing the ‘average’ financial strategies weren’t working, Nick discovered the Bank on Yourself® strategy and has implemented this Not Your Average financial strategy for the past 3 years and has experienced the peace of mind, ease, and guarantees that this strategy provides.

Both originally from South Dakota, Nick Poppe and his wife, Brooke, have been in Northwest Arkansas for the past 2 years with their 2 dogs. Brooke is an Occupational Therapist and Nick works fully remotely in the financial industry. After several years in banking and financial planning and knowing the ‘average’ financial strategies weren’t working, Nick discovered the Bank on Yourself® strategy and has implemented this Not Your Average financial strategy for the past 3 years and has experienced the peace of mind, ease, and guarantees that this strategy provides.

David A. Kozak is the founder and CEO of Elite Collegiate Planning and CEO of the College Planning Network. He has, in his own words, “the distinct honor” to work with families across the country to redefine what “investment” means to them. He believes—to quote Benjamin Franklin—“An investment in knowledge always pays the best dividends.” This drives his passion for educating families about how to send their children to college without jeopardizing their own financial goals and retirement.

David A. Kozak is the founder and CEO of Elite Collegiate Planning and CEO of the College Planning Network. He has, in his own words, “the distinct honor” to work with families across the country to redefine what “investment” means to them. He believes—to quote Benjamin Franklin—“An investment in knowledge always pays the best dividends.” This drives his passion for educating families about how to send their children to college without jeopardizing their own financial goals and retirement.  Joseph L. Kerins III, CCPS® is a Certified College Planning Specialist, Financial Planner, and Senior Planner at Paradigm Financial Group. Helping families pay for college without destroying their overall wealth and retirement is Joe’s focus. Many families don’t realize that it is not just a college problem, but a wealth and retirement problem. Joe works with these families to create unique plans with proper strategies to save and pay for college without sacrificing financial freedom and achieving all of their financial goals. Joe lives in Wayne, Pennsylvania with his wife, Mollie, and three children, Joey, Ellie and Eddie. Joe is a fourth-generation member of the South Philadelphia String Band, which participates annually in the Mummers Parade in Philadelphia.

Joseph L. Kerins III, CCPS® is a Certified College Planning Specialist, Financial Planner, and Senior Planner at Paradigm Financial Group. Helping families pay for college without destroying their overall wealth and retirement is Joe’s focus. Many families don’t realize that it is not just a college problem, but a wealth and retirement problem. Joe works with these families to create unique plans with proper strategies to save and pay for college without sacrificing financial freedom and achieving all of their financial goals. Joe lives in Wayne, Pennsylvania with his wife, Mollie, and three children, Joey, Ellie and Eddie. Joe is a fourth-generation member of the South Philadelphia String Band, which participates annually in the Mummers Parade in Philadelphia. Andrew Young is the Director of Recruiting for Bank On Yourself®. For over 25 years,

Andrew Young is the Director of Recruiting for Bank On Yourself®. For over 25 years,