Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

- Can you say ca-ching?

- What are the risks of a giant pile of cash?

- What are the four key challenges facing all savers today?

- What about the low interest rate environment?

- Have you been successful in saving for retirement?

- What is a required minimum distribution?

- How do we pay for long term care expenses?

- What is the average cost for nursing homes?

- Does Medicare cover nursing care?

- At what age does your financial plan end?

- How old will you live?

- What if you live past age 90? 100? 110?

- Am I too old?

- If you are age 60 to 85, how would your policy be affected?

- How long do you have to wait?

- Have you saved up your nest egg?

- What do you do with a lump sum when you don’t want to wait years for growth?

- What if you could do a one-time drop in?

- What if you could have a death benefit with your lump sum?

- What if your age could work to your advantage?

- What is a Bank on Yourself type Single Premium solution?

- What is a single premium?

- How do single premium plans work?

- What about health problems?

- What about naming someone else as insured?

- What if you own the policy?

- How does the value grow as soon as starting a new policy?

- How does the death benefit continue to grow?

- What about the cash value?

- What about long term care?

- How long does the coverage last?

- Can you use this benefit AT HOME or does it have to be in a skilled nursing facility?

- Is this more cost effective than a traditional long term care policy?

- What is the downside?

- What happened in 1986?

- What is the TAMRA act?

- What are the tax changes?

- What is the 7-pay test?

- What is the MEC (modified endowment contract)?

- What is FIFO?

- What about the gains that exceed the basis?

- What is considered taxable with MEC policies?

- Why are all single premium products MECs?

- What are the privileges of being age 60 or older?

- When do the gains kick in?

- Should we be afraid of MECs?

- In what circumstances do MEC policies make sense?

- In what circumstances do Single Premium policies make sense?

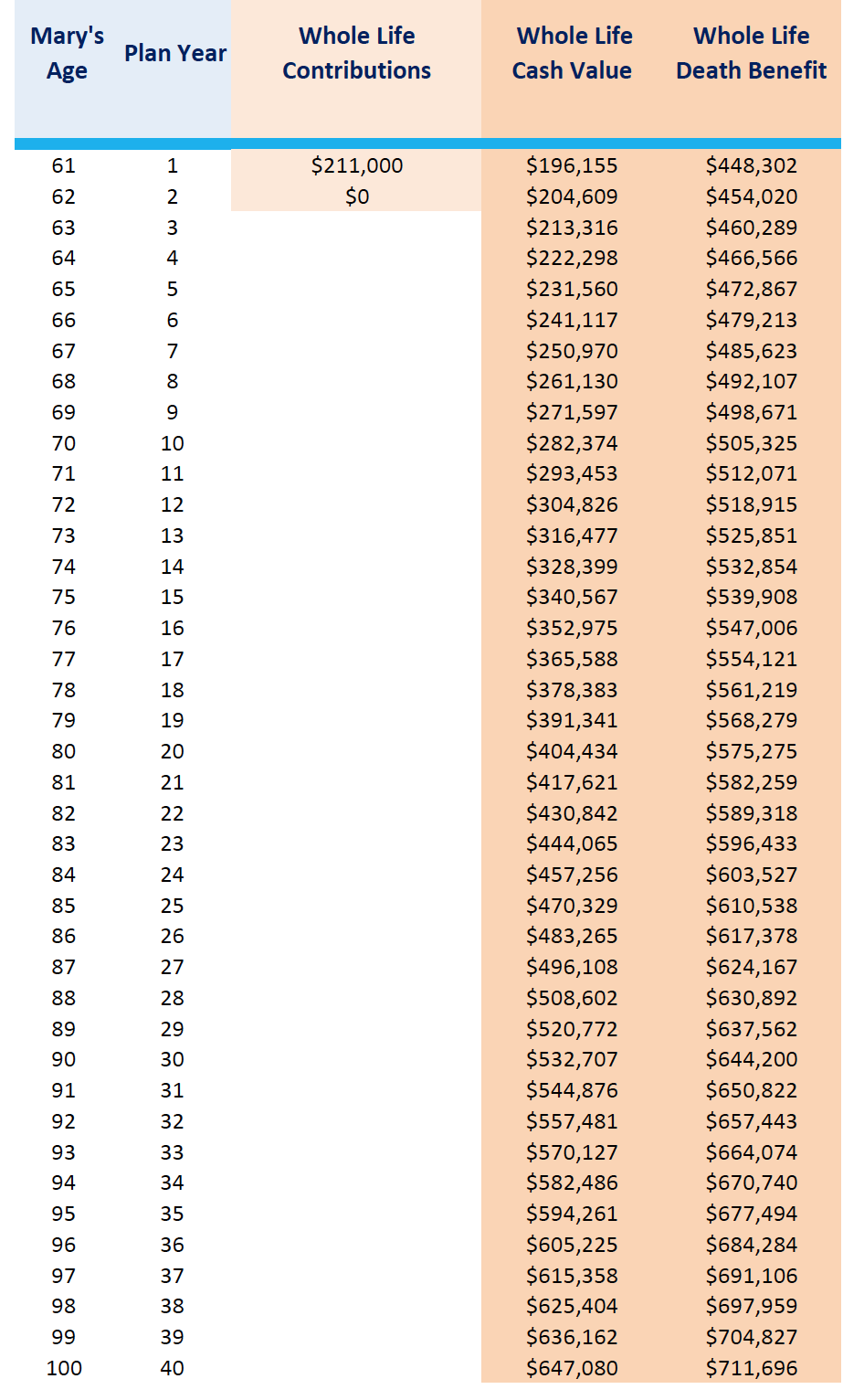

- Did you review the case study below?