Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

- What is the greatest wealth building opportunity while paying taxes?

- Do you get a tax refund each year?

- Have you listened to Part 1, Episode 86?

- Is your cash accessible?

- Do you have the flexibility with a repayment schedule?

- What happens if you don’t pay a life insurance policy loan back?

- What about uninterrupted compound growth?

- What are the steps?

- Can you save for taxes and retirement at the same time?

- Can you pay taxes with a policy loan?

- Can you save for taxes throughout the year?

- For whom does this strategy work the best?

- Are tax refunds free money?

- Does the IRS pay you interest?

- What questions do you have?

Check out this private video webinar we did on Bank On Yourself and paying your taxes!

Click here to watch– https://youtu.be/000TgLqQpNQ

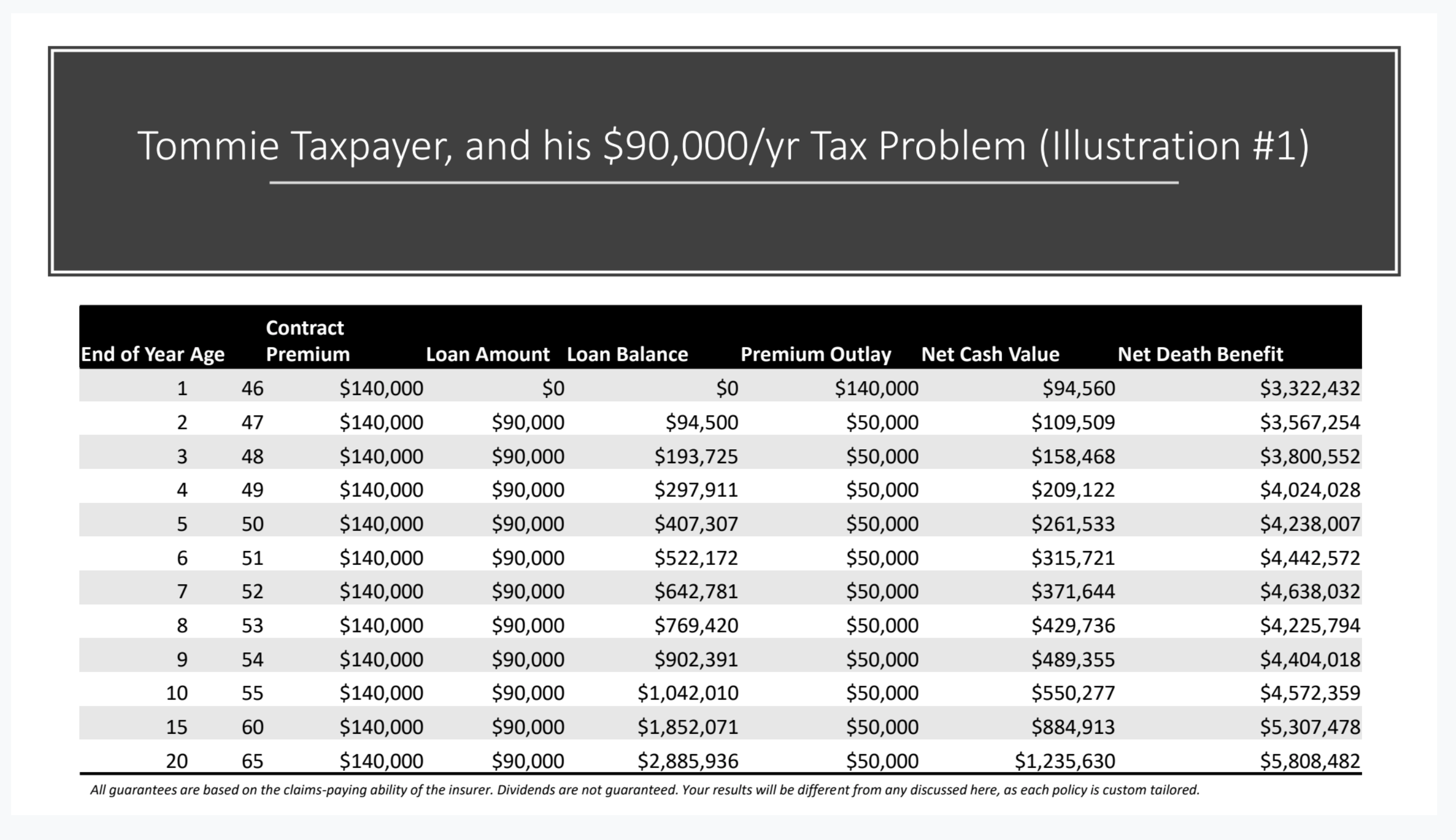

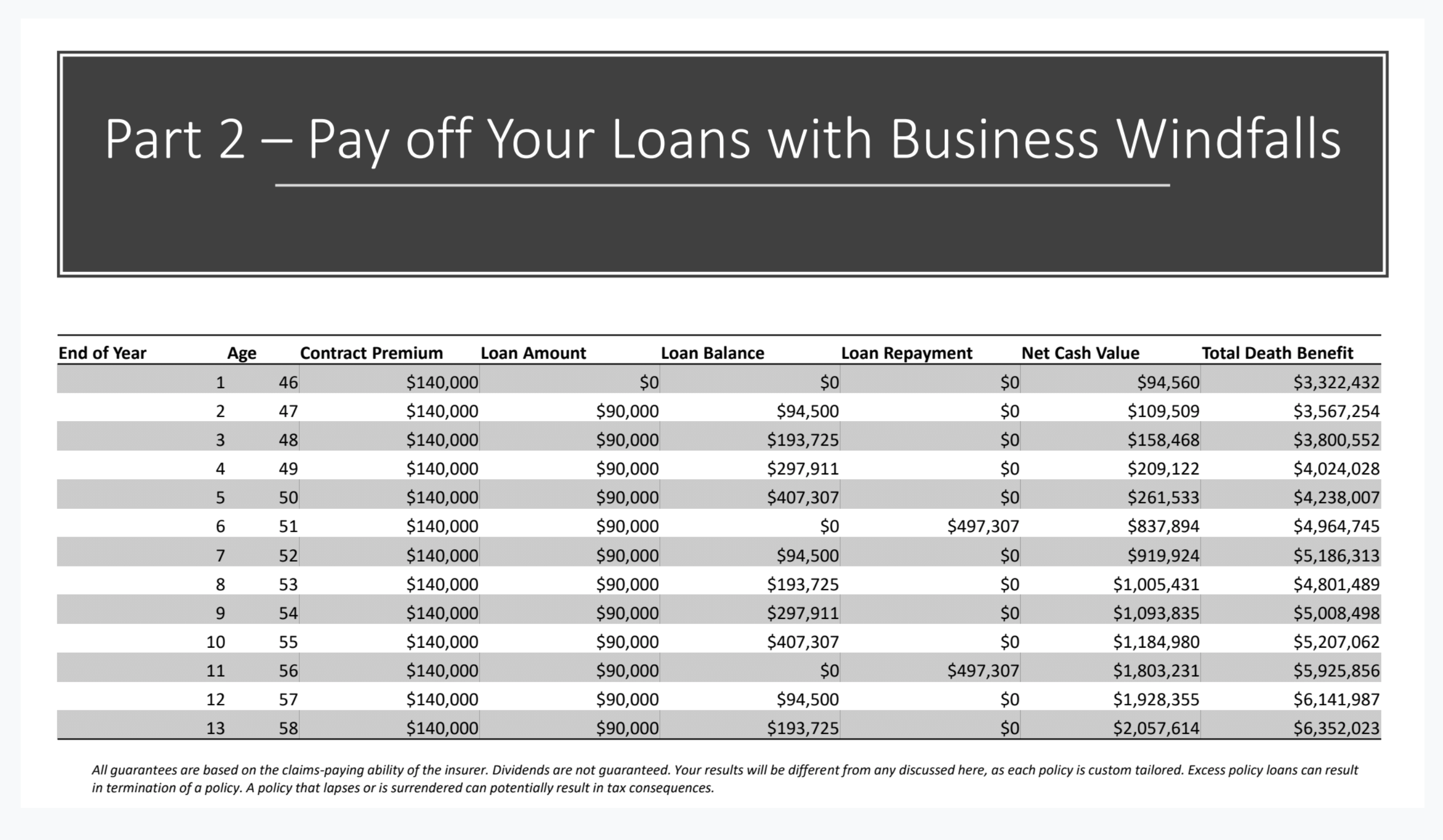

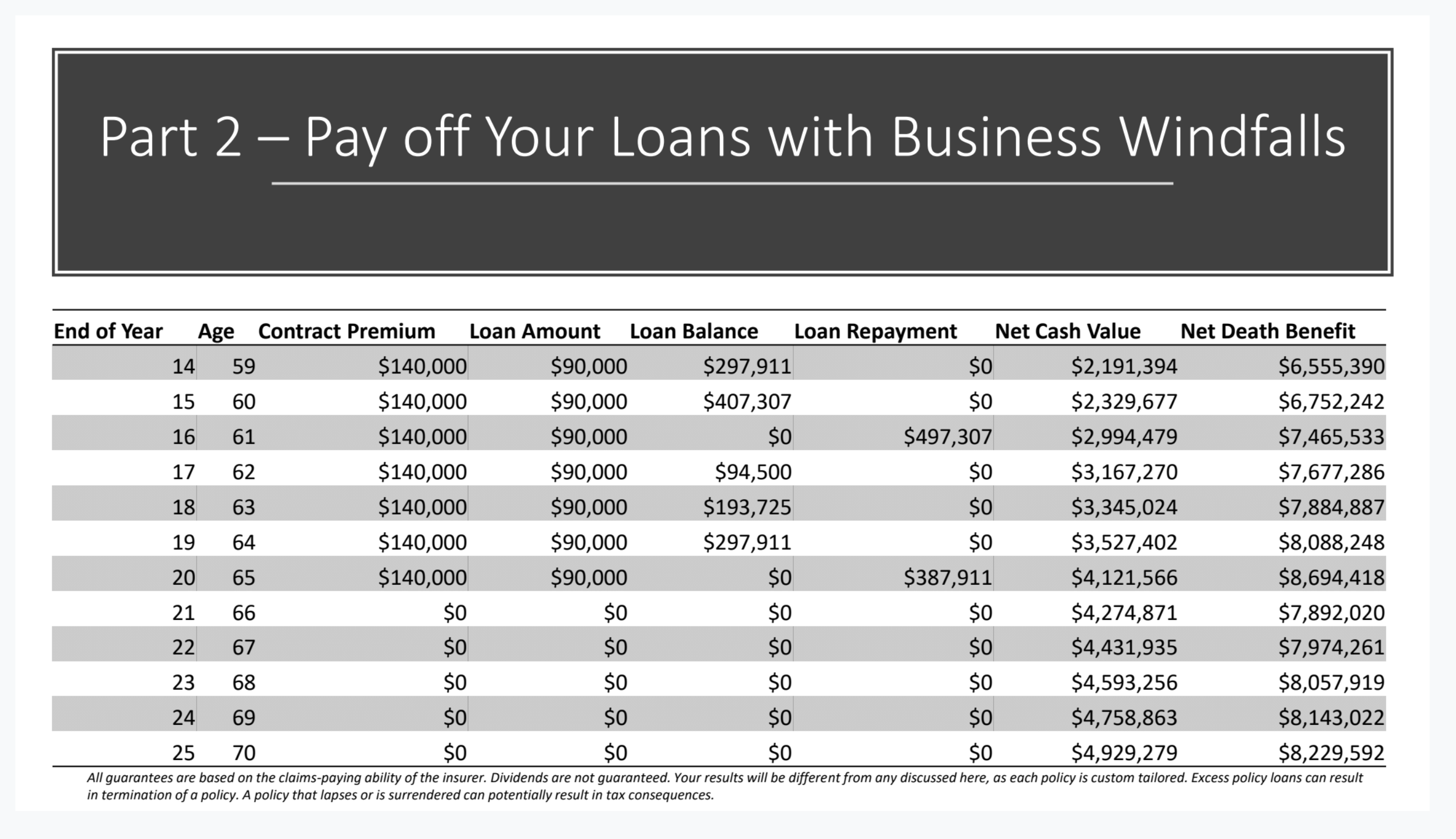

(or skip ahead to here to just see the numbers for “Tommie Taxpayer”) https://youtu.be/000TgLqQpNQ?t=4267