Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

- What is a necessary risk?

- What is an unnecessary risk?

- Do you need a side hustle?

- How do we manage risk?

- Where do we need to go from here?

- What is FINRA?

- What are the 21 categories of risk from FINRA?

- What are the two types of risk?

- What is an example of pure risk?

- What is an example of speculative risk?

- What is purchasing power risk?

- What is the consumption assumption?

- Do you spend more on your days off?

- How much do you expect the cost of consumer goods to increase over the next 20 or 30 years?

- How much have health insurance premiums risen since 1999?

- Will health care costs eat up your retirement income?

- What about systemic risk or market risk?

- Does staying in the market longer protect you?

- Would you like to review Episode 51: Does Buy and Hold Work?

- Would you like to review Episode 52: A New Perspective with Les Himel (Part 1)?

- Would you like to review Episode 53: A New Perspective with Les Himel (Part 2)?

- Are you exposed to political risk or tax risk?

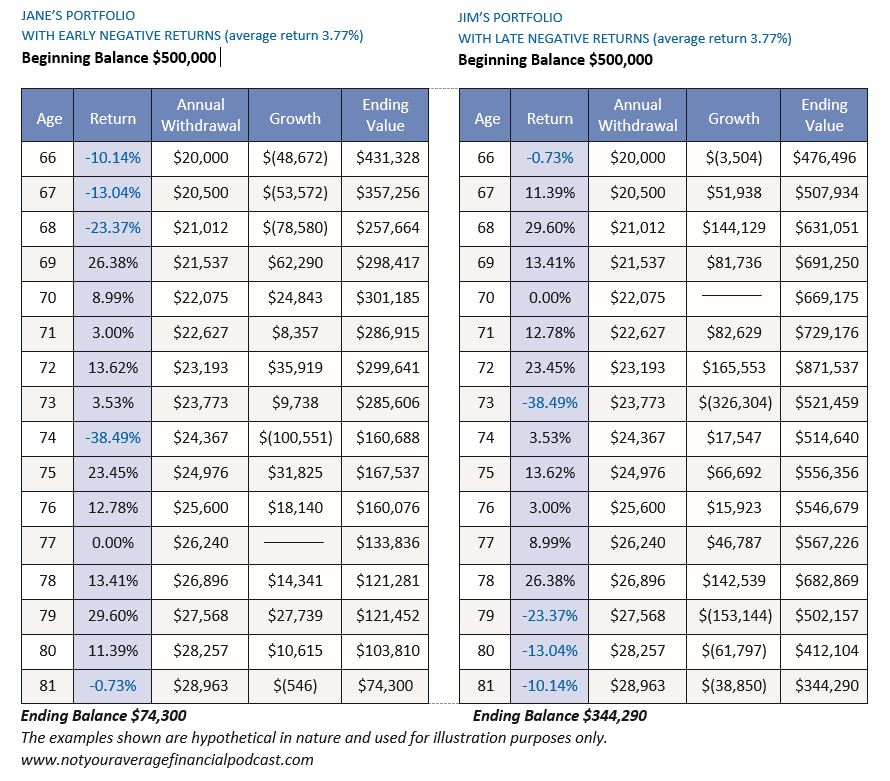

- What about the risk inherent with sequence of returns?

- What about the average rate of return?

- What about the IRA money being allocated to a nursing home?

- What about the risk of elder fraud in your senior years?

- What about the death of a spouse?

- What about the risk of dismissing long term care?

- How much does long term care typically cost?

- What are the unavoidable risks?

- Which of these risks is the most important?

- What about the risk of living too long?

- How do you protect against living too long?

- What is protected income?

- What if you could create a passive income stream, that even if you run out of money, you would never run out of money?