Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

- What are people saying?

- Would you like to leave us a review on iTunes?

- Do you have ideas for future episodes?

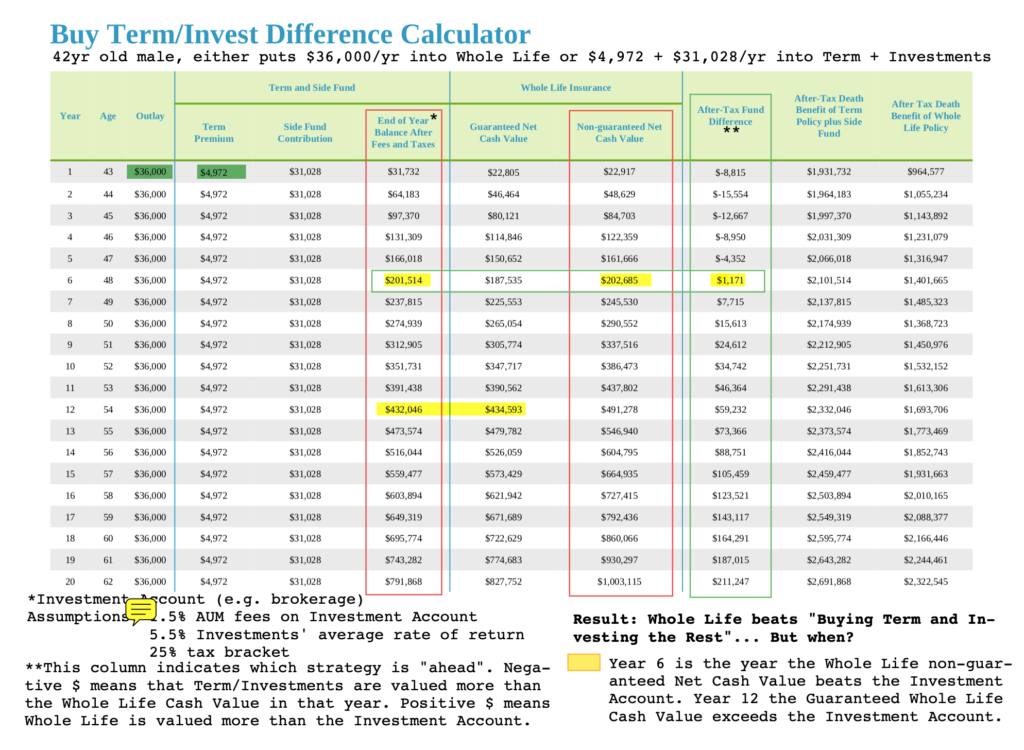

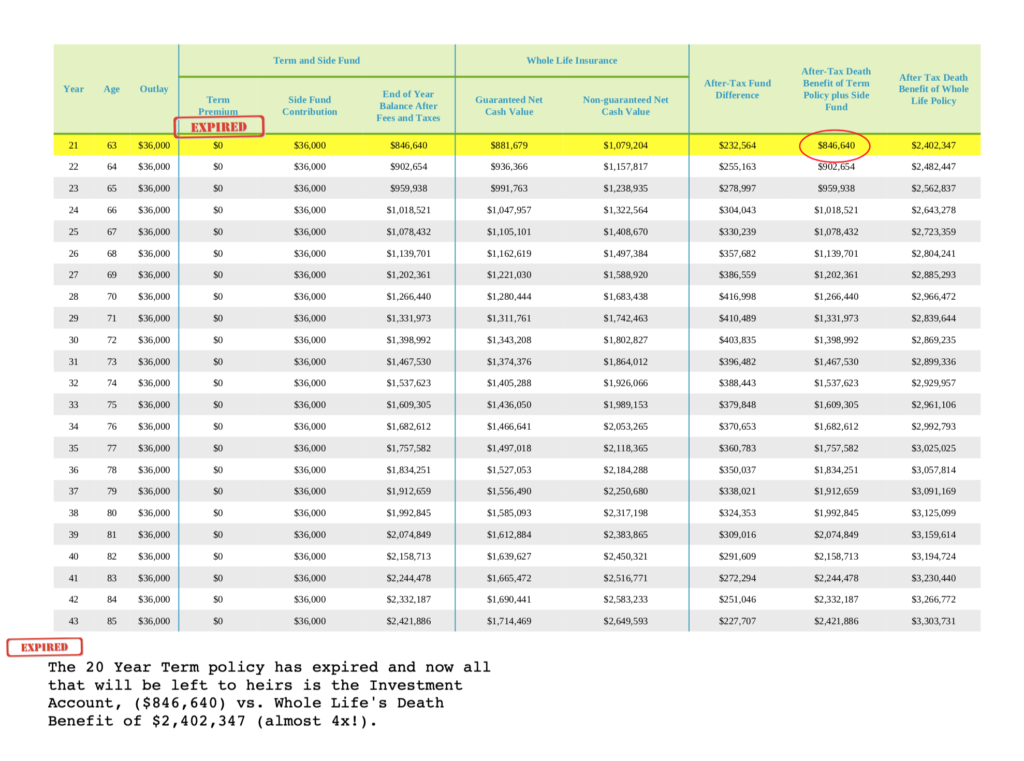

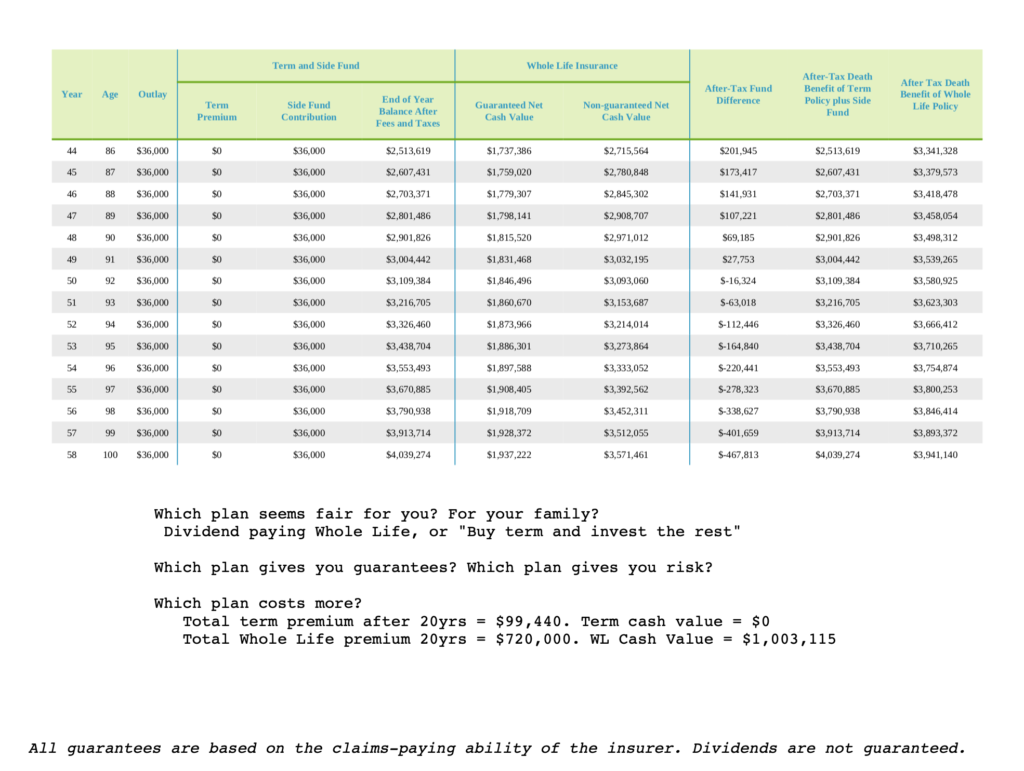

- Does whole life insurance insurance stink?

- Is “buy term and invest the difference” a better idea?

- Why are high commissions a problem?

- What are the alternatives?

- How much will an advisor make on mutual funds with a 1% fee?

- How much will an advisor make in commissions on a whole life insurance policy with the same lump amount over the same number of years?

- What is exciting about term insurance?

- See Episode 1 and Episode 51 to learn about real return

- Listen to both parts, Episode 52 and Episode 53 with Les Himel

- How do term insurance policies compare to permanent whole life insurance policies?

- Can you hold on to the commission in the long run?

- Which seems fair? Which seems risky?

- How much did the whole life truly cost?

- Who needs permanent insurance? Can’t you self insure?

- You only need insurance for your early years, right?

- Are you at risk for spoiling future generations?

- Can you live off 1 million in retirement?

- Do you need excitement?

- Do you love stable, predictable growth?

- Where does he get the idea that it’s rare to own whole life insurance?

- Why does Whole Life Insurance stink?

- Would you like to ask us some questions? Book a Meeting!

(Tip: right click and select “new tab” to make these spreadsheets larger on your desktop web browser)