Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

-

- What has Les Himel learned in his 28 years on Wall Street?

- What are the myths of standard conventional wisdom?

- What are the rules of thumb we should always be able to rely on?

- Can you get 10% or more per year in the market?

- How much lower will taxes go?

- What was the highest marginal tax rate in recent history?

- How does anyone pay over 90% in taxes?

- What happens when you go up in scale on your income?

- Will you be in a different tax bracket in the future?

- Are you looking at your finances in a 1 or 2 year time frame or in a 30, 40, 50 year time frame?

- What are the realities of the stock market?

- What is a cumulative rate of return?

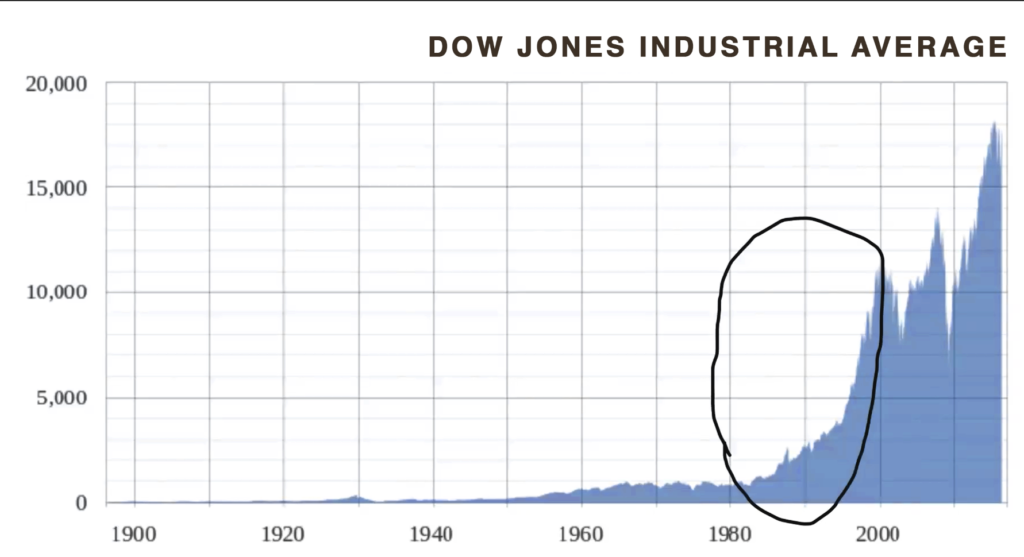

- How much was the cumulative rate of return on the DOW from 1900-1980?

- What about 1980-2000? Why does Les call this time the “roaring 20”?

- What happened on Black Monday?

- What was the average climb during the 1980-2000 period?

- What’s the story with the 401(k) in the 80s?

- What are arithmetic averages?

- What is a return?

- What is the difference between a return and a change?

- When do you truly receive a return?

- Does your investment advisor take fees and taxes into account when they present an update to you?

- How does volatility affect your future?

- What’s the difference between an average and real dollars?

- How can you calculate the change of how much you’ve really made or lost?

- If you take the Standard and Poor’s Index (the S&P) from December 31, 2000 until the changes of December 31, 2016, what happened with volatility, and what was the average rate of return?

- How do investment advisors anticipate the future earnings?

- Do stocks perform in a straight line?

- How can the cumulative rate of return help make sense of actual performance?

- How can you check your math?

- How does the math of the rate of return vs. the cumulative rate of return affect you?

- Are you willingly putting up with the volatility, the fees and taxes for a whopping 3.35% return?

- How does this affect pension funds and 401(k)s?

- What is the reality?

- What’s the difference between what we think we know and what we actually see?

- When you look at the math, what do you come up with?

- Do you have time to make it up?

- Is compounding flexible?

- Why does volatility destroy compounding?

- Do stocks and bonds narrow volatility?

Lester N. Himel discovered the use of specific types of Life Insurance to enhance and expand the performance of investment portfolios several years ago; this after spending 28 years in a variety of positions on Wall Street. Like most financial professionals, he considered stocks, bonds and similar instruments as the core of a reasonable investment approach. In those last several years, Les has found the better way.

Lester N. Himel discovered the use of specific types of Life Insurance to enhance and expand the performance of investment portfolios several years ago; this after spending 28 years in a variety of positions on Wall Street. Like most financial professionals, he considered stocks, bonds and similar instruments as the core of a reasonable investment approach. In those last several years, Les has found the better way.

Les comes to this field with a very broad financial background. He started as a compliance officer, worked in administration, was an institutional bond trader, developed an Emerging Markets business, and was also involved with “alternative investments”. Now, as one of only 200 Bank on Yourself authorized advisors, and with his ability to integrate far-reaching insights, he guides clients to financial success. Les prefers low risk and “guarantees”, and has an ability to simplify explanations of what, why and how. Les has achieved various FINRA registrations, and is a Chartered Financial Consultant (ChFC).

Lester resides in Westchester County, New York with his family and stays very busy working with clients across the country.