Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

- Is the policy correctly structured?

- How about a case study?

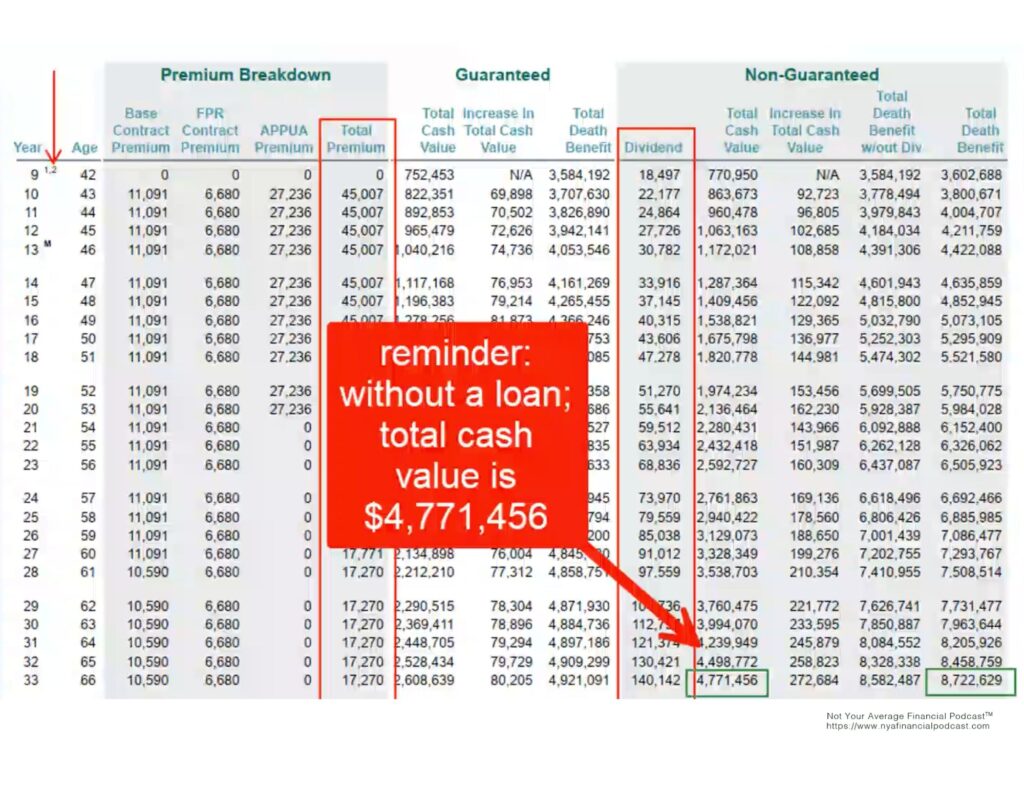

- Does the policy with the most cash value always win?

- What is the difference between a direct recognition and a non-direct recognition whole life insurance policy loan?

- What did the footnotes say?

- What are some possible outcomes?

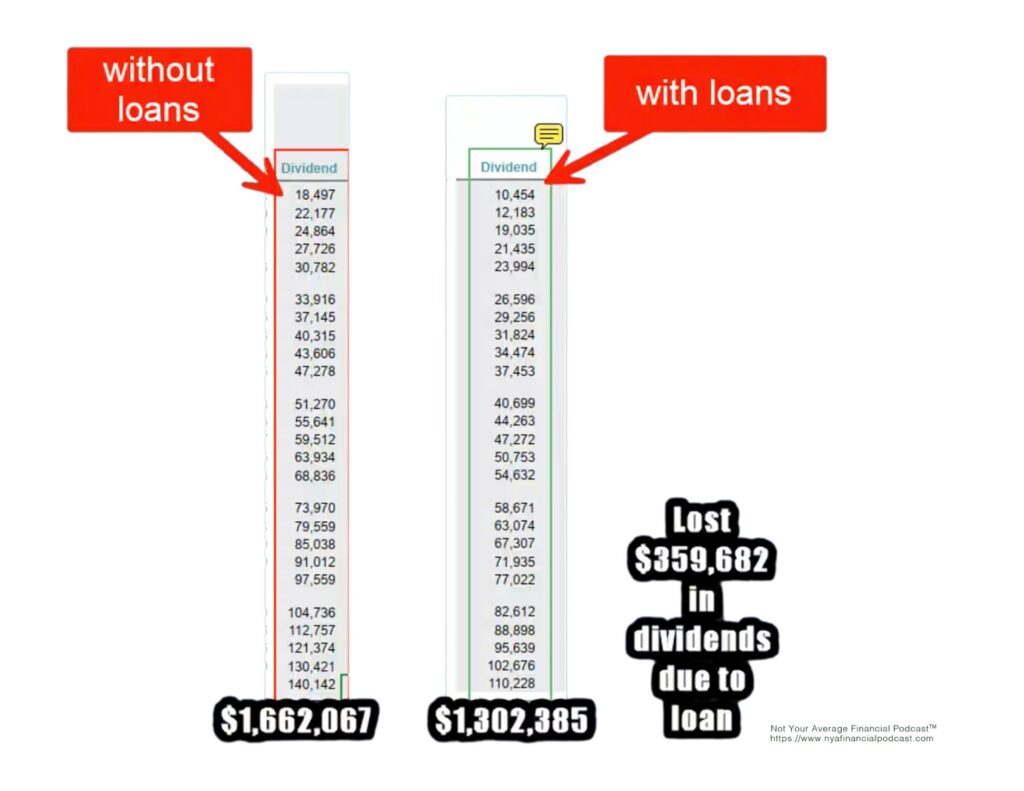

- What happened to the dividends with an outstanding direct recognition loan balance?

- What happens to the dividends with an outstanding non-direct recognition loan balance?

- What’s the difference?

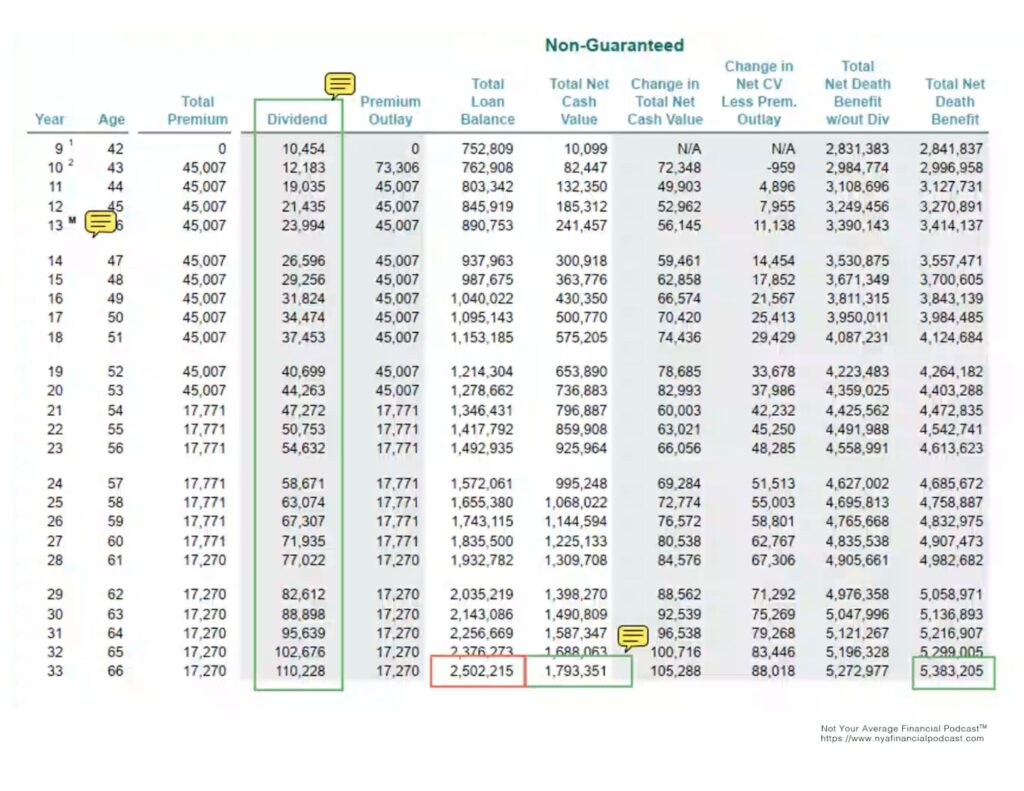

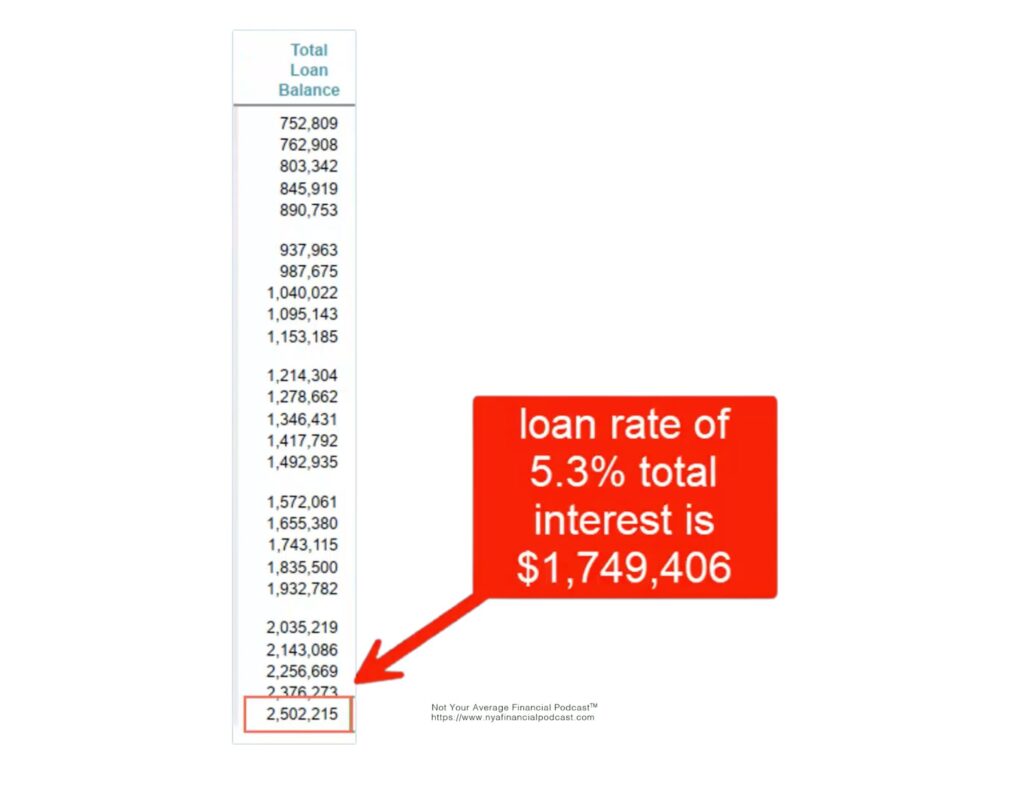

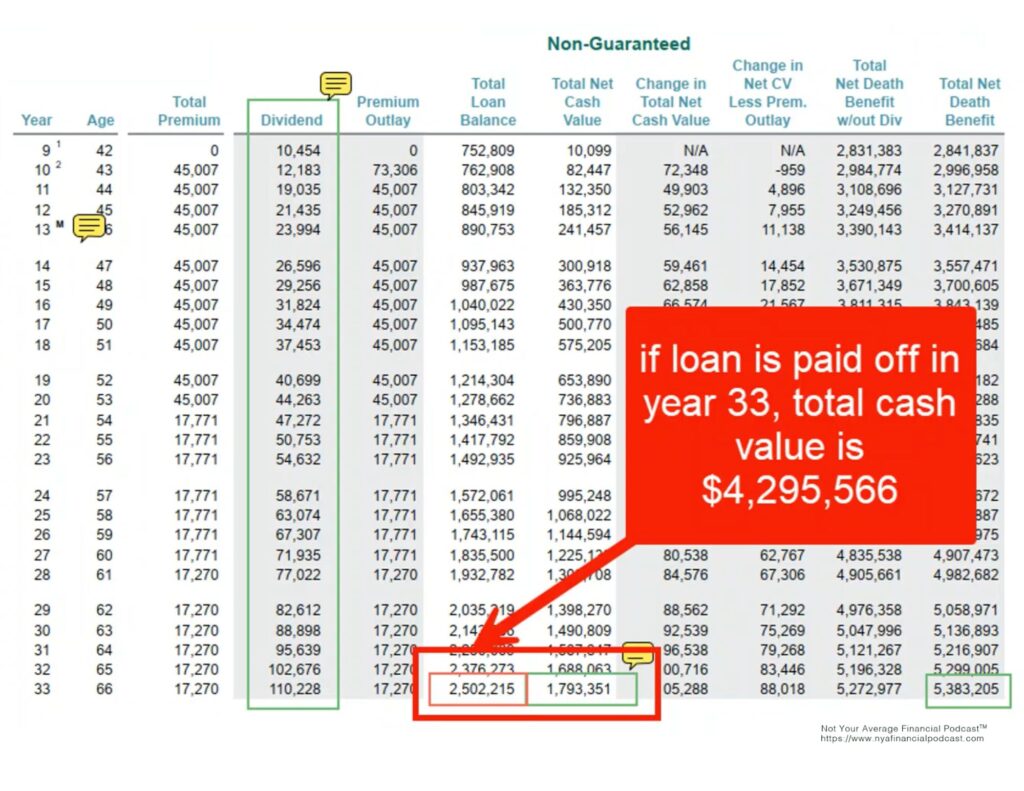

- How much loan interest?

- What’s the big takeaway here?

- Why would this policy become a modified endowment contract (MEC)?

- How about another example?

- What happened with the dividends?

- What about the policy loan interest?

- What are the takeaways?

- Why do Bank on Yourself® type whole life insurance policy loans use non-direct recognition policy loans?

Would you like to avoid direct recognition loans and loss of dividends?

Is my policy a Bank on Yourself® type whole life insurance policy?

Agent

- Is my agent captive or independent? (Can he/she work with multiple companies or just show me one company’s product line?)

- Is my agent trained to confidently and competently answer all of my questions? (Am I having to educate him/her?)

- What is the agent’s training and stability? How long will the advisor be around to help me?

- Is my agent among the ~200 Bank on Yourself® Professionals in good standing with the Bank on Yourself® organization?

Insurance Company

- Does the company offer whole life insurance? (Do I have Whole Life or a Universal Life, Variable Life, Indexed Universal Life or Term policy?)

- Is the insurance company mutually owned or stock owned?

- Is the insurer’s customer service department educated enough to help me with policy loans?

- Does this company have a high Comdex Rating and solid financial strength? Will they have the stability to be in business for the next 100 years at least?

Tax considerations

- Will this policy become a modified endowment contract (MEC)?

- Will both principal and gains be accessible tax-free under current law?

Riders

- Are paid-up additions (PUAs) offered through premiums or just through dividends?

- What is the Insurance Company’s PUA load cost? How does it compare to other whole life products?

- What are the PUA limits (and any other gotchas)? When and why must we reduce our PUAs, even if we don’t want to?

- Were any other riders available to help accelerate my cash value growth, like term riders?

- If I miss a premium payment, are there protections? What will happen to the policy?

- Is there a Chronic Illness Rider or similar available? What are the fees for this rider?

- What are the limits on Chronic Illness, Long Term Care and Accelerated Death Benefit riders?

Dividends

- Does the insurer who issued my whole life insurance policy pay dividends?

- Does the whole life product I purchased receive dividends?

- Is the dividend based on company performance, with me participating as an owner, or is it merely “interest sensitive” based on industry performance?

- Has the insurance company paid dividends at least 100 years straight?

- Was there significant dividend variability over the last 12 years, suggesting risk to future cash value growth?

Loans

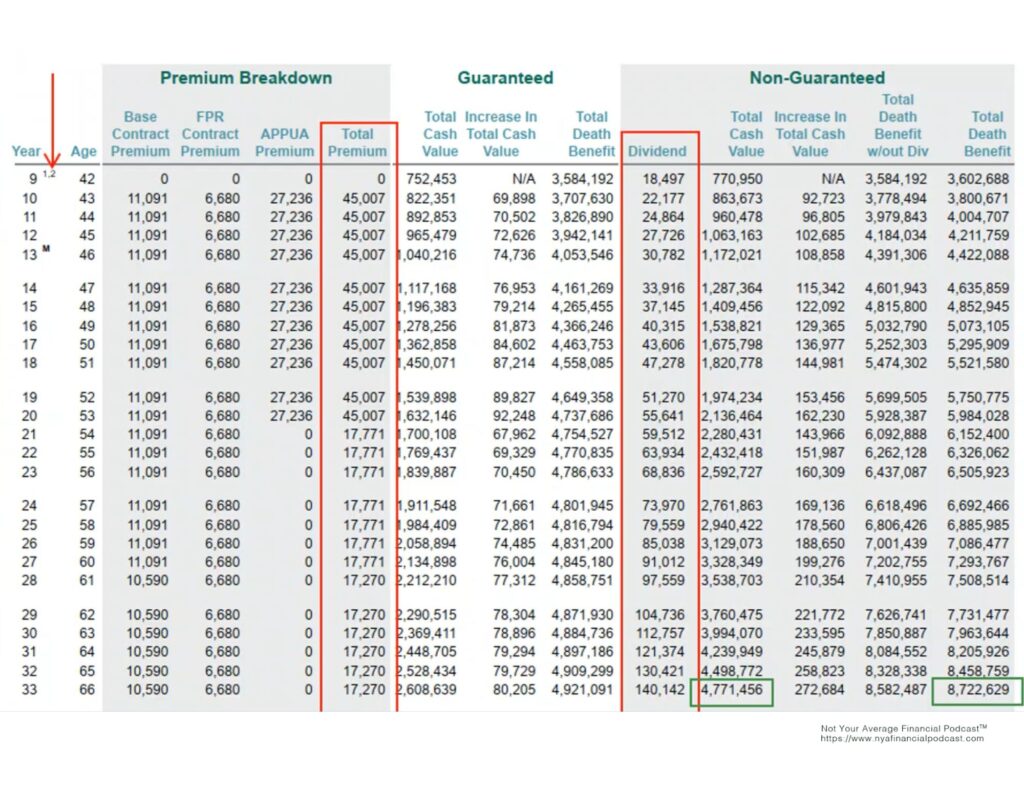

- If I take a loan, how will it affect the policy, short-term and long-term?

- Do I have non-direct recognition loans or direct recognition loans?

- When will I pay policy loan interest (at the end of year or immediately)?

- What limits are at work for policy loans? Is there a maximum amount per loan

- What will they allow me to borrow out at a time?

- What is my loan interest rate on this policy? Is it above or below the industry average?

- Is the loan simple interest or compound interest?

- At what time interval is the loan interest being accrued (annually, daily, etc.)?

Would you like a second set of eyes to review an existing policy, or would you like to discuss your specific situation? Reach out to meet with Mark or one of Mark’s associates.