Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

- Are we in a retirement crisis in this country?

- How was that agent trained?

- What is the problem with indexed universal life insurance (IUL)?

- Have you read the book Becoming Your Own Banker by Nelson Nash?

- Would you like to hear Episode 312?

- Have you read Pamela Yellen’s book The Bank on Yourself Revolution?

- What did the estate planning attorney say?

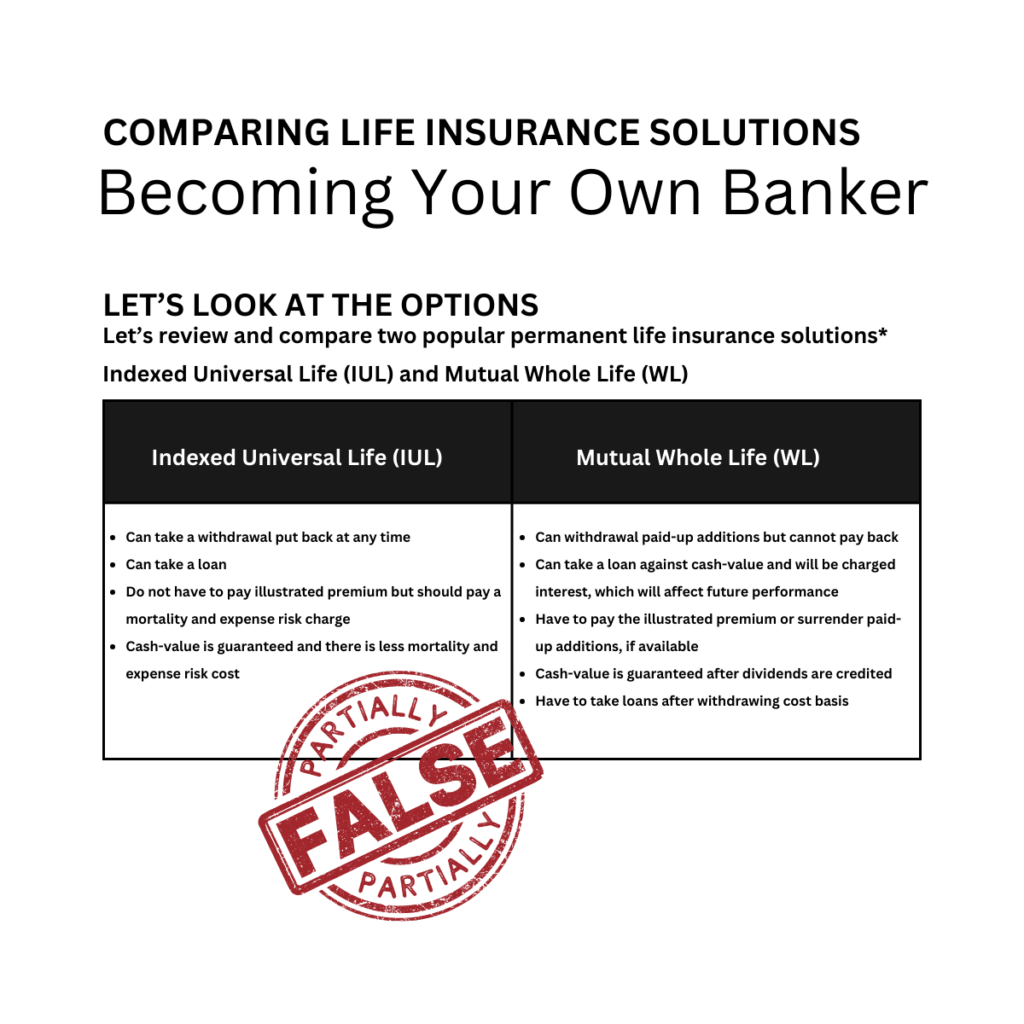

- What was on the Comparing Life Insurance Solutions document (see readable image of document below)?

- Have you been tricked?

- What’s in the fine print?

- What about withdrawals?

- Can you put money back into an IUL after a withdrawal?

- What is the main purpose of a life insurance company?

- What about the investment portfolio?

- What do insurers make on their overall portfolio?

- What types of investments are in the insurer’s portfolio?

- Who believes 7%?

- What is mathematically impossible?

- What rate of return is legally shown on the statements?

- Is there such a thing as an average rate of return?

- What will the insurers do with an IUL contract?

- Do you remember the Fast and the Furious, etc.?

- What happens if you take a loan from an IUL and the market crashes?

- What is the feature?

- What about the insurance expenses?

- Why is that IUL cash value shrinking?

- Why does the cost of insurance go up every single year in an IUL?

- What about tax-free loans with an IUL?

- What happened to the IUL writing agent?

- How much are you taking out each year to supplement your retirement?

- How many years are you getting 0 on your index?

- Do you have income to pay down the IUL policy loans?

- What adds to the pressure?

- What happens to 88% of IUL policies?

- How many IUL policies pay a death claim?

- What if your IUL policy lapses with gains inside of the contract?

- How long do you have to pay the taxes?

- What is the over loan protection rider for those age 75+?

- What about properly set up permanent dividend paying whole life insurance, from a mutual insurance company that offers non-direct recognition loans?

- What is true?

- What happens if you totally ignore the policy loan?

- When does a policy risk lapsing?

- What about flexibility?

- How about a thought exercise, a tale of two contracts?

- What happens when you’re in your in your eighties and can’t pay the higher premiums?

- What are the guarantees in IUL?

- What are the guarantees in whole life?

- What is annual renewable term insurance (ART)?

- What about costs?

- What are the differences?

- What are the limits of an IUL?

- What is a reduce paid up policy (RPU)?

- Can one RPU an IUL?

- What about the strength of dividends?

- What should this document say about whole life insurance?

- What is the cost basis?

- What about the rules for policy loans?

- Why the ommissions on the IUL side?

- What is a stalwart of several centuries of financial stability?

- What is the big experiment of modern times?

- What almost never pays a death benefit?

- What about the gains being taxable?

- What about the tax implications for beneficiaries of IUL policies?

- What is the 1035 exchange?

- Can one 1035 exchange from an IUL into a whole life policy?

- Who’s in your corner to help you navigate and interpret all of this jargon?

- Would you like to meet with Mark or one of Mark’s colleagues?