Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

- What is a policy loan?

- Why do we love the Bank on Yourself® type whole life insurance policies?

- Is a non-direct recognition policy loan the best feature in the financial universe?

- What is a direct recognition policy loan?

- Is there really no difference between the two?

- Does it really matter?

- Why is transparency key?

- What is the history between non-direct recognition and direct recognition policy loans?

- How long have life insurance policies loans been around?

- Over 150 years ago, how did insurers treat these separate loans with distinct interest rates?

- What about collateral?

- What about the life insurance general fund?

- What about using your policy as collateral?

- What about dividends?

- How would the policy continue to earn interest?

- Where is the money for the loan coming from exactly?

- Why did some insurance companies move over to do direct recognition policy loans?

- Why did some insurance companies hold firm with non-direct recognition policy loans?

- What is a mutual life insurance company?

- What about profits?

- Who should logically have a higher dividend?

- Who is penalized?

- Do companies offering direct recognition policy loans offer slightly higher dividends?

- Who is going to have a better experience?

- What good is that cash value if you can’t collateralize it?

- What about the living benefits of life insurance?

- What is outrageous?

- What did Nelson Nash say?

- Who has real liquidity?

- What about direct recognition policy loans for a time horizon (for 10 years, etc.)?

- How about an example?

- What is a 1035 exchange (a like-kind exchange for life insurance)

- Would you like to learn more in Episode 252?

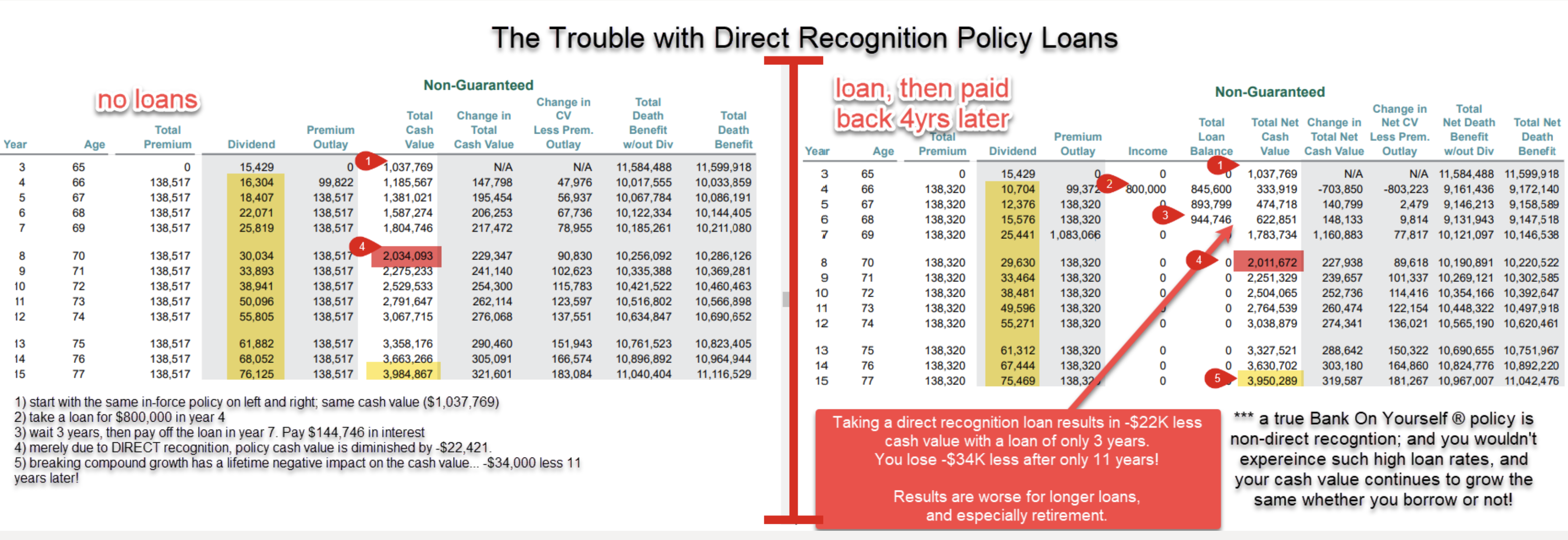

- What happens in a scenario where direct recognition policy loans were taken?

- What happens in a scenario where non-direct recognition policy loans (as in a Bank on Yourself type whole life insurance policy) were taken?

- What about the dollar diagram?

- What about the one dollar?

- What happens if you put this single dollar into a paid up additions rider (PUAR)?

- What about opportunity cost?

- What happens if you spend that dollar instead of saving it?

- What is the interest?

- What benefits you?

- What about dividends?

- How do the insurers earn money for dividends?

- How does that benefit policy holders?

- How much would you have?

- How many dollars…?

- Is there such a thing as paying too much premium?

- How about another example about a policy loan to purchase a car?

- What did the three cars cost you?

- How much did you net in the non-direct recognition policy loan’s policy?

- Knowing all of this, why would you buy a car any other way?

- Should you just get a bank loan?

- What totally defeats the purpose of Bank on Yourself®?

- Are you being penalized?

- Which scenario keeps me more in control of my own money?

- Which scenario yields control to the bank?

- What about Bank on Yourself® policy engineering?

- Would you like to meet with Mark?

- Would you join us next week?

The topics and images presented in this podcast are general information only and not for the purposes of providing legal, accounting or investment advice. On such matters, please consult a professional who knows your specific situation.