Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

- What is a life insurance policy loan?

- If I’m trying to be debt free, why go back into debt with an insurance company?

- Are life insurance loans just like a credit card or a mortgage?

- Isn’t a life insurance loan just like a personal loan?

- How does your cash value collateral continuing growing, even when you have a policy loan outstanding?

- How is this different from a HELOC?

- Is your house guaranteed to go up in value?

- What about contractual guarantees with a life insurance policy loan?

- What are the limits with a life insurance policy loan?

- Could the loans lapse the policy?

- What is the best kind of investment to a life insurance company?

- Can you be “underwater” in your life insurance policy loan?

- What are the requirements for this type of life insurance policy to work in a Bank on Yourself design?

- Is it whole life insurance?

- Is it a non-direct recognition loan?

- Is it flexible, so you keep it for your entire life?

- Are you repaying your loans?

- Are you working with a knowledgeable, authorized advisor?

- Do you have trauma from a previous bad experience?

- Why do so many advisors not know how to design these properly?

- Does your existing whole life insurance policy penalize you when you take policy loans?

- Does your advisor know what they’re doing? Do they frantically google in front of you?

- Why did the Titanic sink?

- Do you know an advisor who has a skillful knowledge of Life Insurance contracts?

- Of what red flags should you be aware?

- With non-direct recognition policy loan, how is the dividend credited on a whole life policy?

- If you don’t have a non-direct recognition policy loan, what happens?

- When you take a policy loan, where does the money come from?

- See The Bank On Yourself Revolution by Pamela Yellen, page 256

- What is the collateral for that loan?

- When do life insurance companies get a profit?

- How do you benefit from the interest you paid on the loan?

- If the insurance company’s yield is better than their worst case scenario, what happens to your dividends?

- Who’s allergic to paying interest?

- What are some financing strategies when buying a car?

- What interest does an insurance company charge on the loan?

- Who are the owners of the insurance company?

- Do you love that you are charged loan interest?

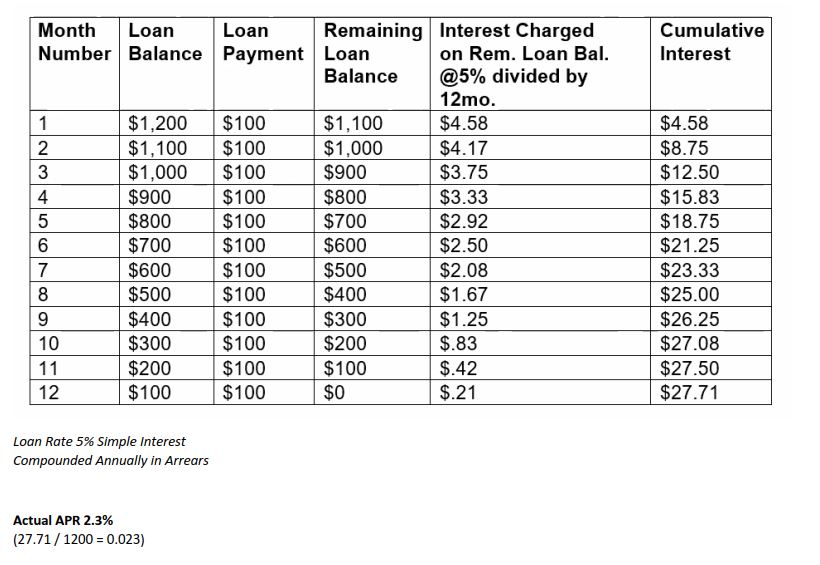

- What is simple interest, compounded annually in arrears?

- When is 5% not always 5%?

- Why would you willingly pay extra for something?

- What type of interest would you like on a savings account? Simple? Compound?

- How can you calculate the growth you receive?

- Is the method of banking on yourself better or worse than paying cash for things?

- Don’t you wish more people knew about this?

- How can you make a profit on buying a car?

- How can you use a life insurance policy with non-direct recognition policy loans for income in retirement?

- What’s the problem with the direct recognition policy loan design for income in retirement?

- What design features have a tremendous amount of impact on how long money will last in retirement?

- How do banks use money in more ways than one (at the same time)?

- What does the fine print in your contract say?

- “Ignore what banks tell you to do with money, and instead, watch what they do with their own money.” – John McCarthy

- How much money do banks keep in life insurance contracts?

- What’s a tier 1 asset?

- How can you change your family tree?