Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

- What is the “Rich People’s Roth?”

- Are there required minimum distributions (RMDs) on ROTH IRAs?

- What other elements make up a ROTH IRA?

- What accounts have contribution limits?

- What accounts can you contribute to tax free and take distributions tax free?

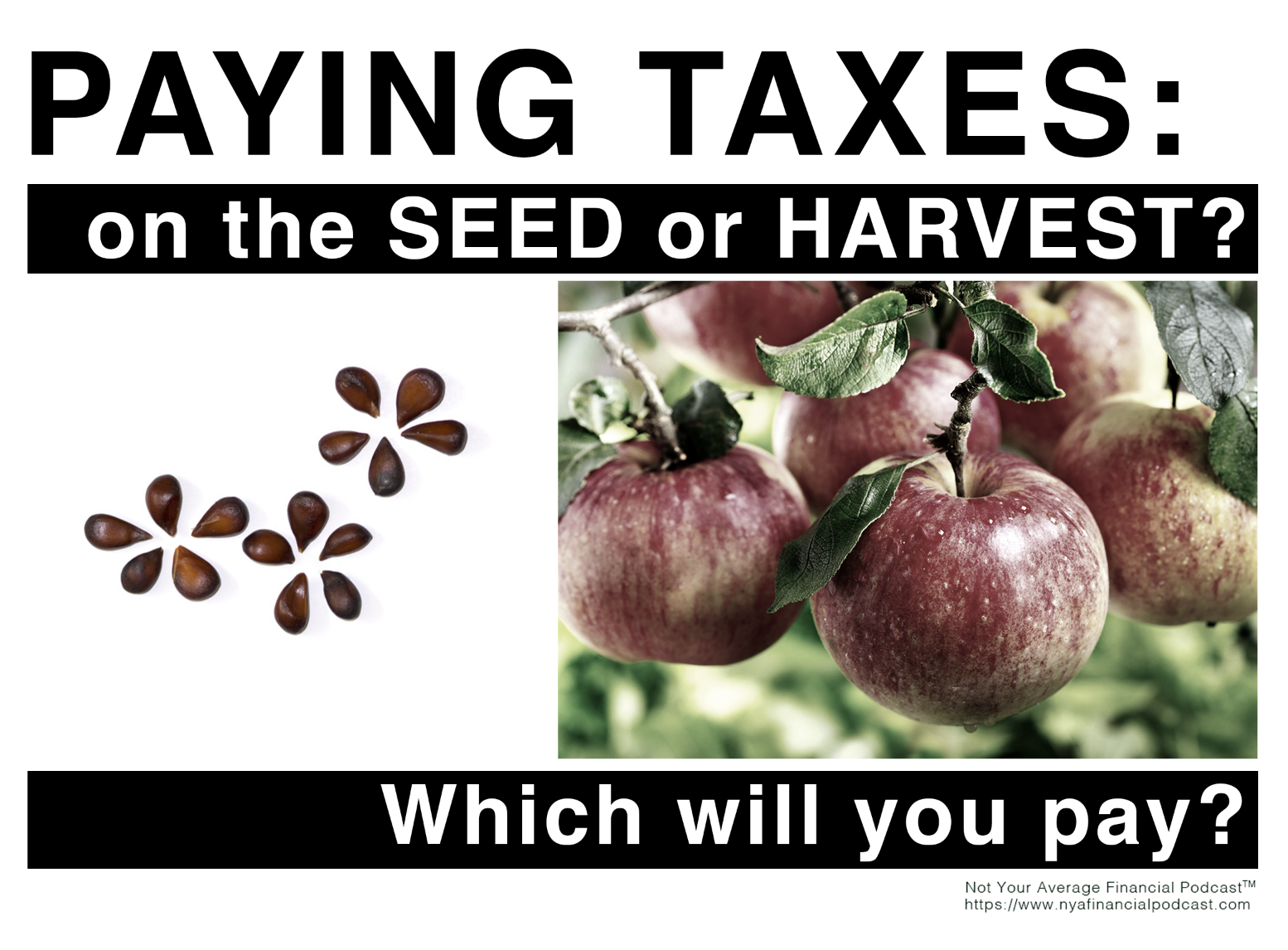

- What’s smaller? The seed or the harvest?

- Would you like to defer your taxes?

- Would you like to pay your taxes now?

- Are taxes going up?

- How can you get access to a death benefit while you’re still alive?

- How do Long Term Care policies work?

- Do you need Long Term Care?

- What is the average cost of a nursing home today?

- Do you know how much your taxes are going to be this year?

- Will you get a refund? What happens to the refund?

- Can you use a Bank On Yourself policy for taxes?

- What about Self Employed individuals?

- Would you rather prefer a dollar today or a dollar tomorrow?

- Do you have to prove to the IRS that that’s your money?

- How will your bigger paycheck affect your taxes?

- Have you gone to the IRS website to see what your estimated taxes will be?

- Are you giving the IRS a no interest loan?

- Are you proud when you receive a tax refund?