Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

- What do you say to someone when you know it’s the last time you will ever speak to them?

- How do you say something loving and honoring?

- What are the most important and pressing issues?

- Who is prepared? Who is not prepared?

- How does true wealth come through assets plus skills?

- What about the mindset and skillset that’s needed?

- What about education?

- What about buying a home?

- What about mentoring the next generation?

- What about leaving a family fund?

- How might one create a family fund or family reserve using Bank on Yourself® type dividend paying whole life insurance?

- What about creating a long-term, safe and sure wealth bucket?

- What about instantly creating a legacy and a savings strategy for years to come?

- What will help your whole family weather tough economic storms?

- What about long-term thinking?

- What about a more durable view of wealth?

- What about the family thinking as a family unit?

- What about creating financially responsible kids and adults?

- What skillsets will grow?

- What about creating a mission for your family that’s bigger than individual happiness?

- What do you prefer?

- How does one get started creating a family fund?

- Who do you need at the table?

- What is your greatest asset?

- Would you like to hear Episode 294?

- What about the big picture strategy?

- What is the best design?

- What is the unique solution for your specific needs?

- Would you like to meet with Mark to discuss a family fund?

- How soon does one see cash value?

- How might one use cash value from whole life insurance policy loans?

- What about an uninsurable life insurance policy owner?

- Who is buying policies on family members?

- Who is buying policies on their parents?

- Who is buying policies on their kids?

- Who is buying policies on business partners?

- What about a parent matching program?

- How might both generations contribute to a policy?

- How many creative ways can you think up?

- What about an example?

- What about single premium immediate annuities?

- Is it possible for annuities to pay insurance policy premium?

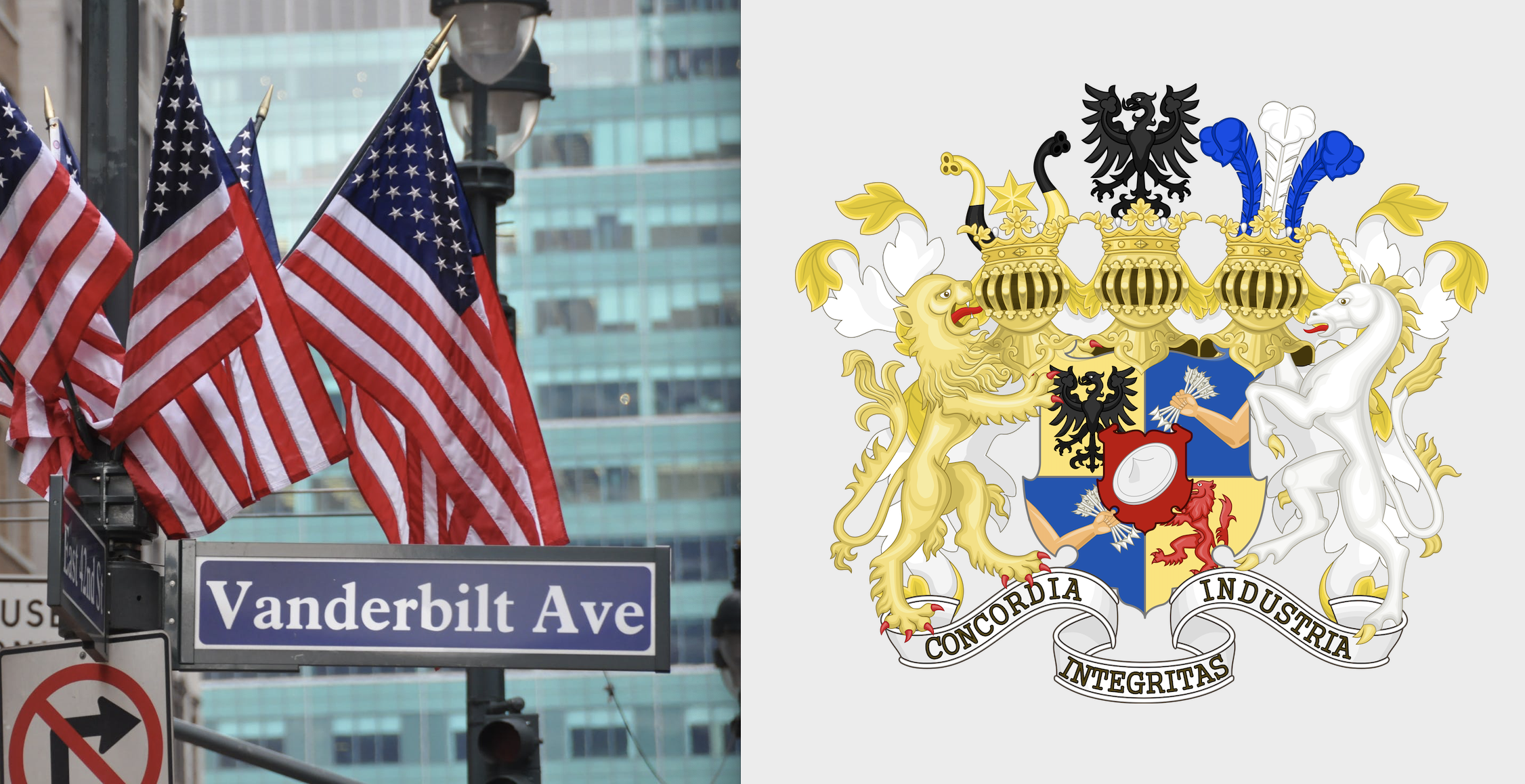

- What about the Vanderbilts?

- What about the Rothschilds?

- What about leaving assets?

- What about leaving assets and values?

- Who is a part of the ever unfolding story?

- Why does family wealth evaporate?

- Does success leave clues?

- Do you have control over your assets?

- Who has control over your assets?

- What about saving?

- What is the different between lending and giving?

- How might kids use family money wisely?

- What skills do kids need to remember?

- What about nurturing and training?

- What about long-term thinking?

- What about delayed gratification?

- What about displaying family values?

- What are the takeaways?