Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

Would you like to hear 10 of THE BEST episodes so far?

How can certain whole life insurance polices grow on a GUARANTEED basis?

In this episode, we ask:

- What about Silly Putty?

- What about accidental inventions?

- What about the wheel?

- What about the axle?

- What about the power of leverage?

- What about access?

- What about cash value?

- What about a contract?

- What about Bank on Yourself® type whole life insurance contracts?

- What about Episode 195 and Episode 196?

- How can whole life insurance grow guaranteed?

- How long might you live?

- What affects guaranteed growth?

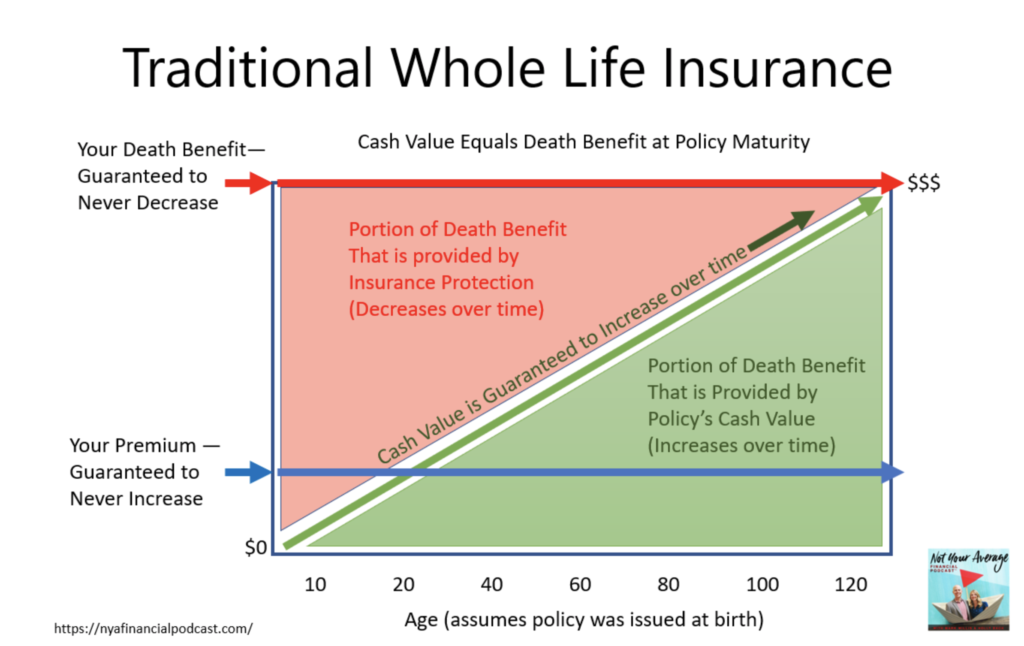

- What about traditional whole life insurance?

- What about the guaranteed death benefits at mortality?

- What about financial certainty?

- What about greater flexibility?

- What is powerful and often overlooked?

- What about the average ways of looking at finances?

- What about “mythical financial vehicles”?

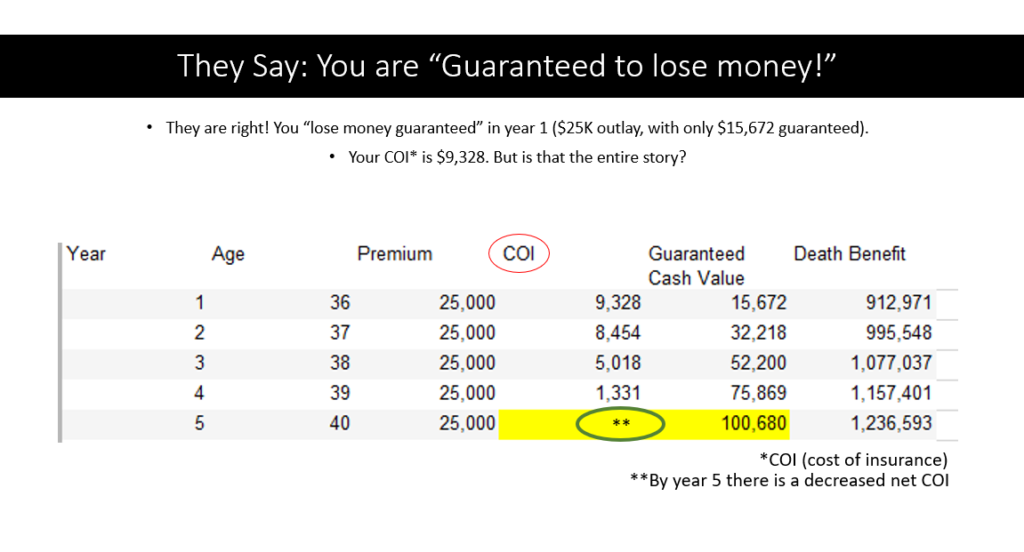

- Are you guaranteed to lose money if you buy whole life insurance?

- What happens in year 1 of a permanent whole life insurance policy?

- What about some context?

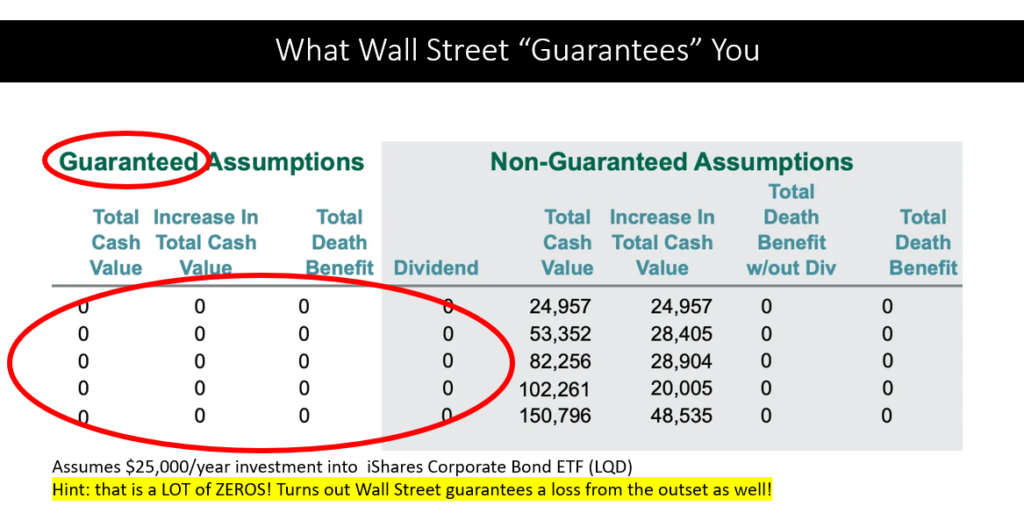

- What about whole life insurance compared to ETFs or bond fund?

- Is there a guaranteed ledger in the stock market? (NO!)

- What about the guaranteed LOSS for the stock market investor?

- What about the objections?

- What about the dividends?

- What about timing?

- Does timing matter?

- What about fluctuating markets?

- What about risk?

- What about success in retirement?

- What three things does whole life insurance provide?

- What about guaranteed income that cannot be outlived?

- What about access to mortality credits?

- How are mortality credits like the axle?

- How might insurance companies make a profit?

- What are mortality tables?

- What about hedging risk?

- What about Paid Up Additions riders or PUAs?

- Would you like to hear Episode 142?

- What about leverage?

- What about pennies that buy dollars?

- What about volatility?

- What about little or no volatility?

- How might you dramatically reduce your risk?

- What about the barbell?

- When is the greatest time to have cash value whole life insurance and annuities in your portfolio?

- What about getting greater yield?

- What about examples?

- What about CDs?

- What about annuities?

- What about death benefits?

- What about super low interest rate environments?

- What about privacy?

- What about going through probate (or not)?

- What about beneficiaries?

- What about creditor and predator protection?

- What about the power of the axle?

- Would you like to listen to Sarry’s podcast as well?