Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

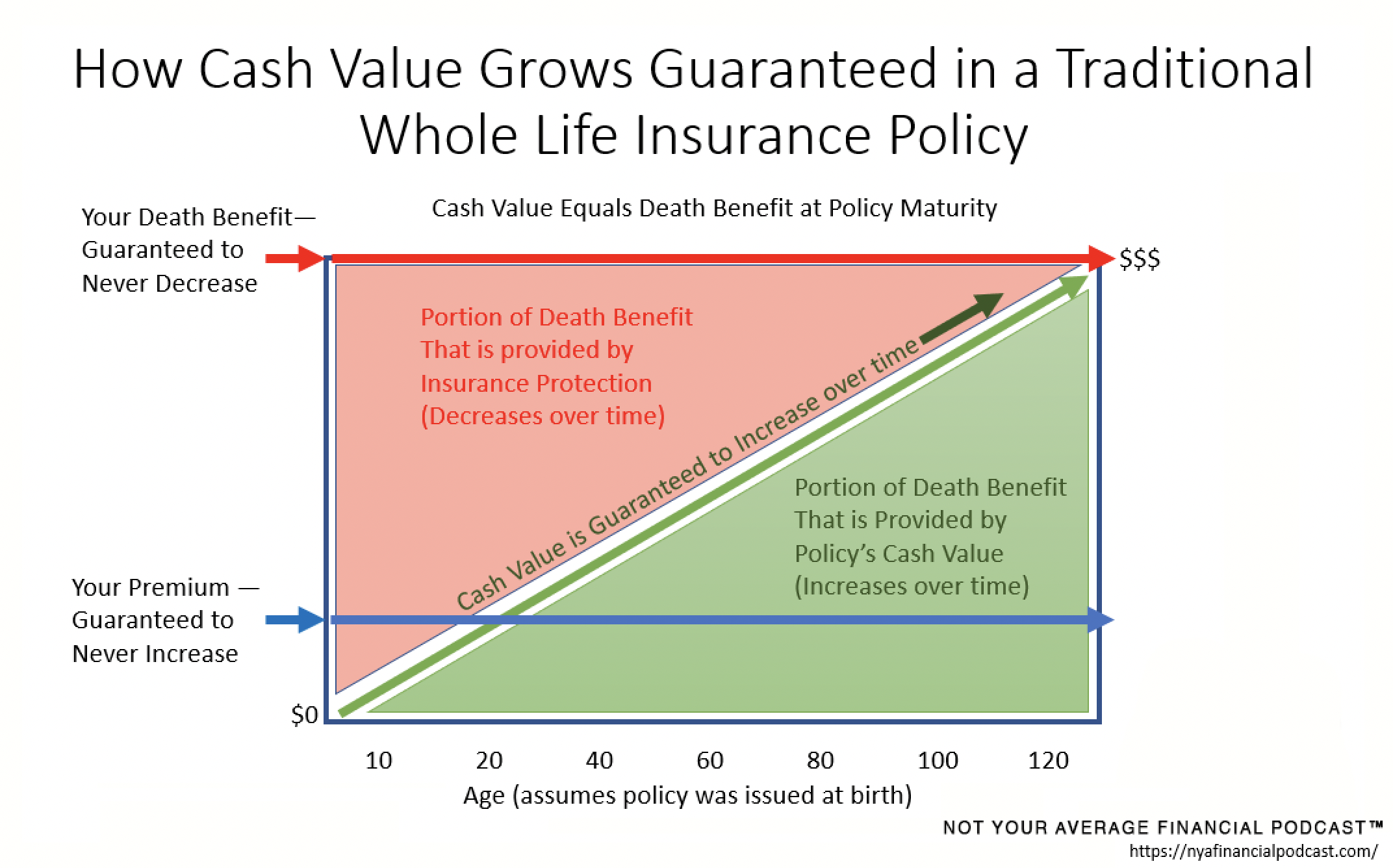

- When will your cash value equal your death benefit?

- What about an increase of cash?

- Do you intend to make it to 121 years old?

- What four ways can you accelerate your cash accumulation?

- What about interest rates?

- What about stock market performance?

- Is it boring?

What is the first way?

- What about a Limited Pay Whole Life policy?

- What about paying to a certain age?

- What about paying a limited number of premium payments?

- What about a single premium payment?

- What does this allow the policy to do?

- What about a 10-Pay or 20-Pay?

- What about paying premium to age 65 or age 100?

- What about the time value of money?

- What about the lack of flexibility?

- What can be a great source of liquidity?

- What is the second way?

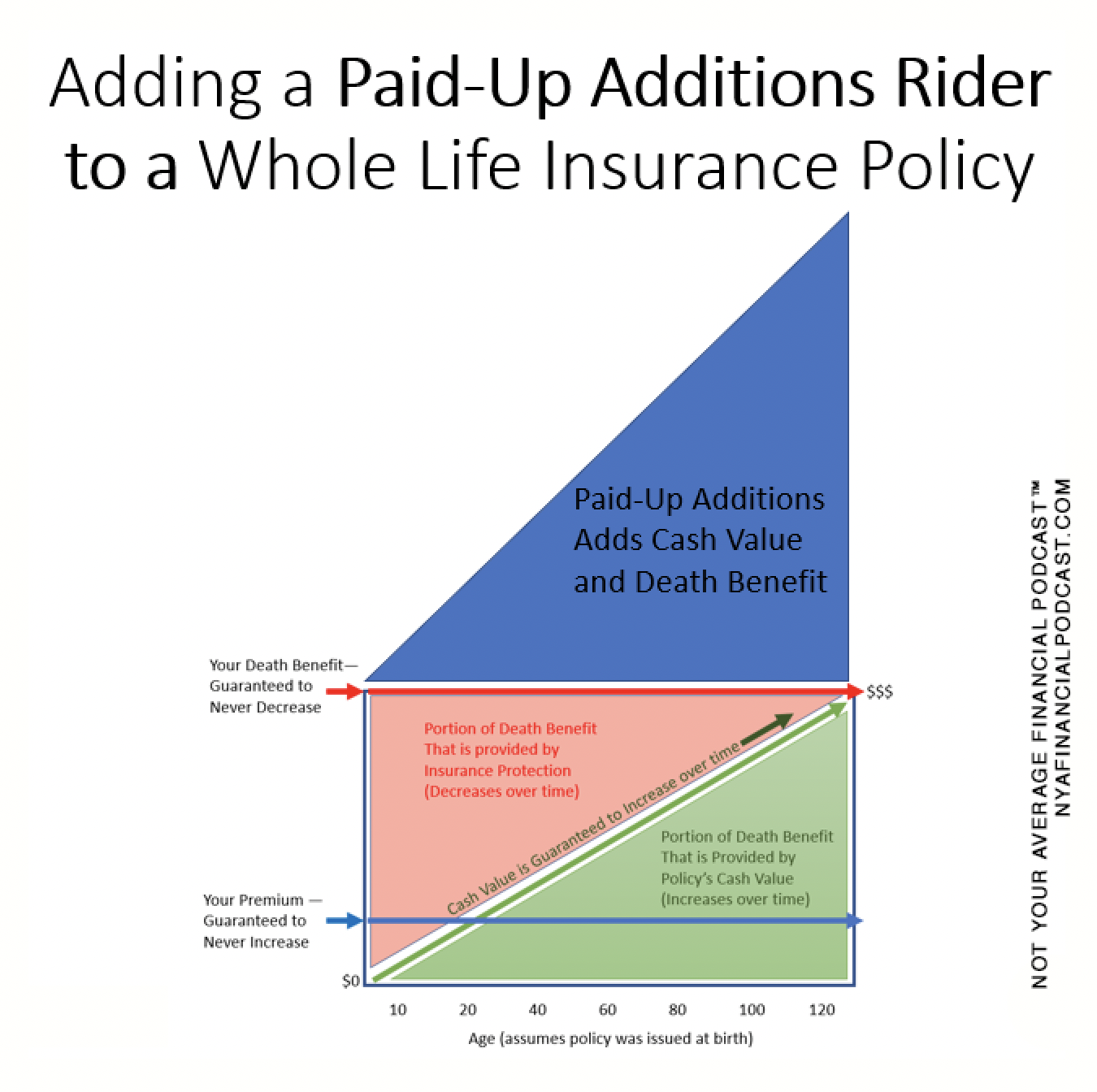

- What about a paid up additions rider or PUA rider?

- What about a flexible paid up additions rider?

- What about an old fashioned whole life insurance policy

- What happens when you add a PUA rider, even without extra premium dollars?

- Is underwriting necessary for PUAs?

- What do you call money when it goes into a bank account?

- What do you call money when it goes into a 401(k)?

- What do you call money when it goes into a whole life insurance policy?

- What does premium buy?

- What is the most efficient type of insurance you can buy?

- What about an example?

- What if you want to add additional premiums to increase your cash value?

- What are the limits to PUAs?

- How much can you stack onto your base premium?

- What about an example?

- What capacity will you decide upon?

- What happens when your buckets are full?

- How does the insurance company limit you?

- How does the IRS limit you?

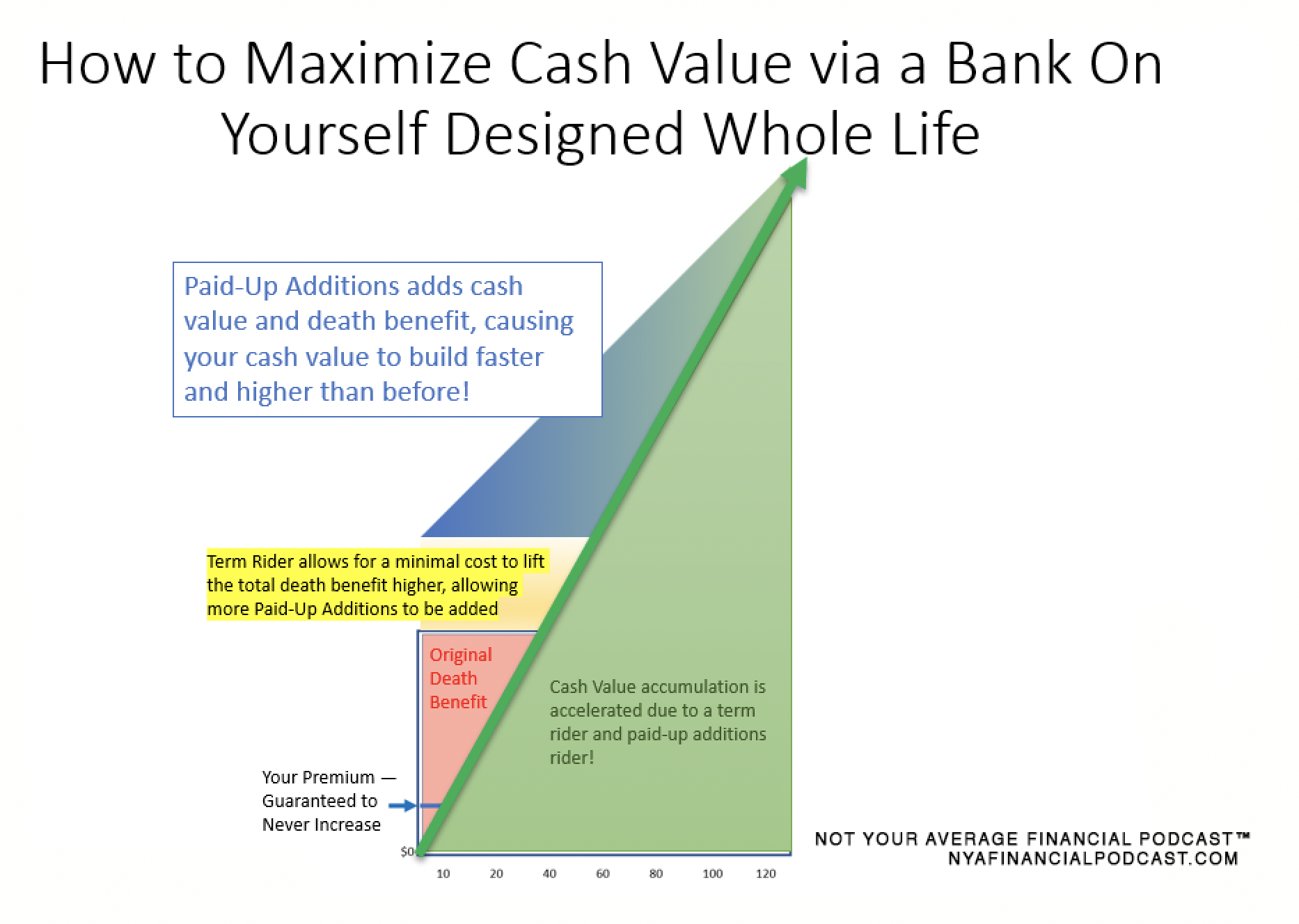

- What is the third way?

- What about blending whole life insurance with a term insurance rider?

- What is the combination?

- What is the fourth way?

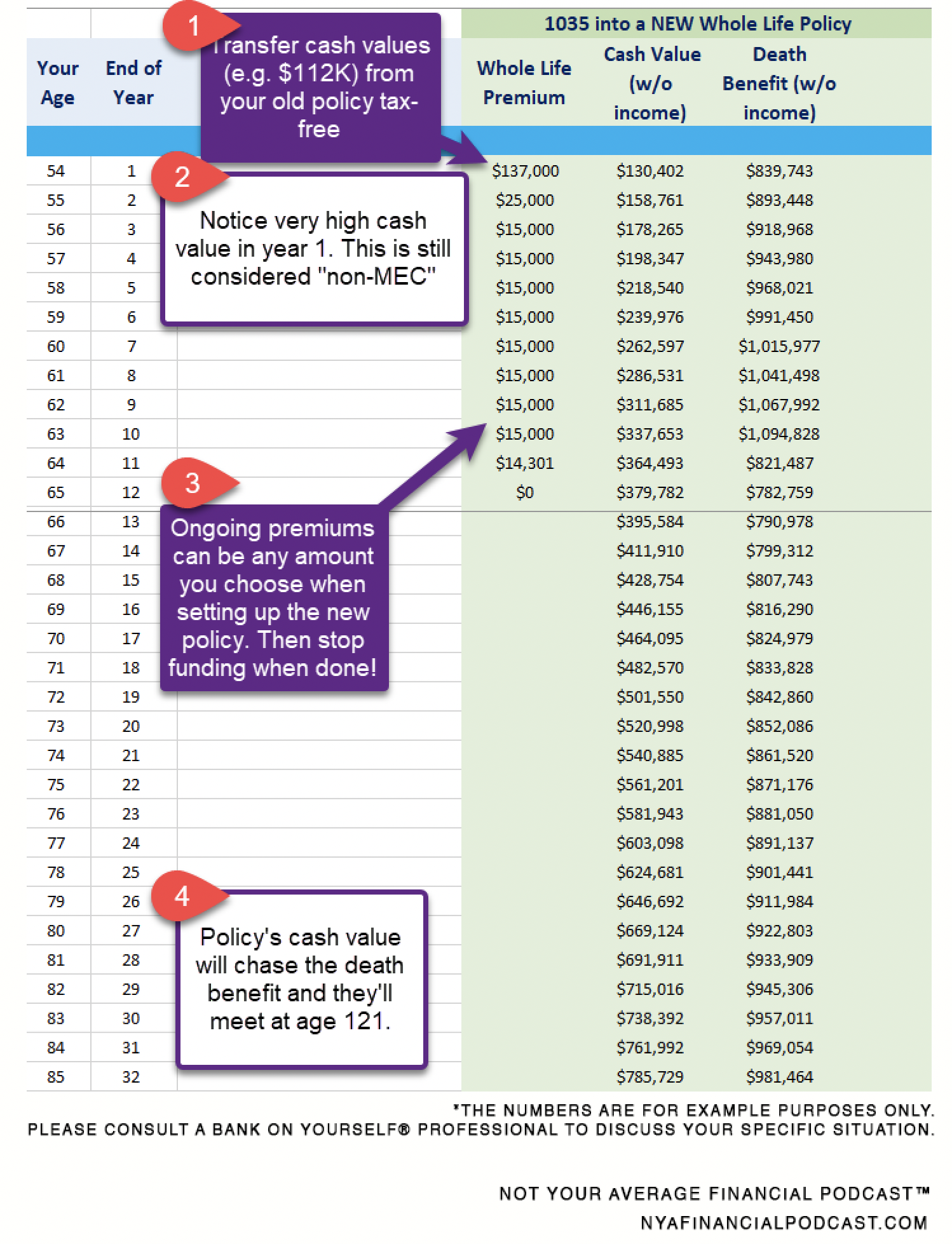

- What about an existing policy that isn’t efficient?

- What can you do about a whole life policy that is underperforming?

- What is a 1035 exchange?

- What can you do about a Variable Universal Life policy?

- What about a tax free transfer of values?

- What about an annuity?

- What about accelerated death benefit rider?

- What about an example?

- What about a bonus way to grow your cash?

- What about dividends?

- How might one purchase PUAs with dividends?

- Do PUAs become permanent insurance?

- Would you like to leave us a review?

- Would you like to share this show with someone you care about?

- Would you like a free book?

- Would you like a gift card?

- Would you like to schedule a 15-minute meeting with Mark?