Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

- Would you like to join us tomorrow, October 9, 2021, for the Not Your Average Financial Summit?

- What about the hyperinflation after WWI?

- Is finance “just math”?

- What about net worth?

- What is far worse than being in a negative net worth?

- What about interest payments to debt?

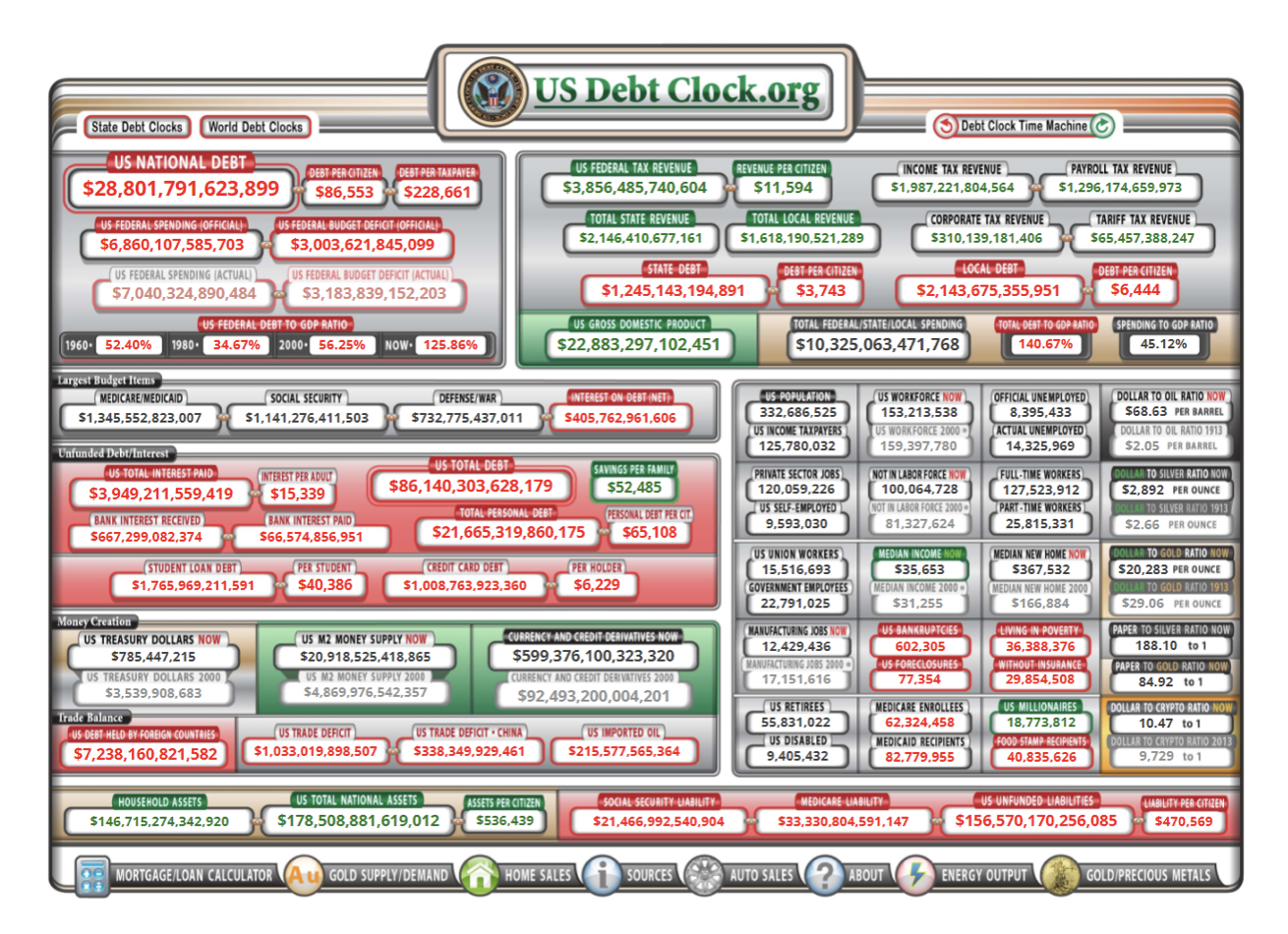

- Would you like to view the U.S. Debt Clock?

- What about the sizable national debt?

- What about the net present value calculation?

- What are the promises?

- What about the terminal value or liquidation value?

- What about global wealth?

- What about large liabilities?

- What happens systemically?

- What about debt to GDP ratio?

- What about math?

- How much has the money supply grown?

- How much has the population grown?

- Is inflation a stealth tax?

- What about compounding growth?

- What about leverage?

- What about the velocity of money?

- What about purchasing power?

- What are the banks trying to sell?

- What about savings accounts?

- Where can you get compound growth, leverage and velocity of money?

- What did DALBAR say?

- What about target date funds?

- What was the year over year growth over the last 20 years?

- Who has a 401(k)?

- What about the real return vs. the advertised return?

- Could real estate hedge inflation?

- What happens in a time of crisis?

- What are the options?

- What else is there?

- What are some not your average strategies?

- What about fixed indexed annuities?

- What about losing purchasing power?

- What about having an inflation rider?

- What about having a cost of living adjustment rider?

- What about the behavior of the market?

- What is laddering?

- Can your money keep up with or exceed inflation?

- How might we stabilize?

- What about an example?

- What about a dynamic response to inflation?

- Is there inflation insurance?

- What about Bank on Yourself® type whole life insurance policies?

- Is whole life insurance immune to hyper inflation?

- What happens when the rates go up?

- Would you like to hear Episode 113?

- What happens to bonds when inflation hits?

- What do insurance companies invest into?

- What are the rules?

- What happens to insurance products when inflation hits?

- Do you know anything else in the world can do what I just described?

- How much value would you like to build for your business?

- How might I respond in a positive way to whatever happens?

- This is the last day before our summit, would you like to RSVP for tomorrow, October 9, 2021?