Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

- Would you like to join us on Saturday, October 9, 2021 for the Inaugural Not Your Average Financial Summit? Join the Not Your Average Community to learn more!

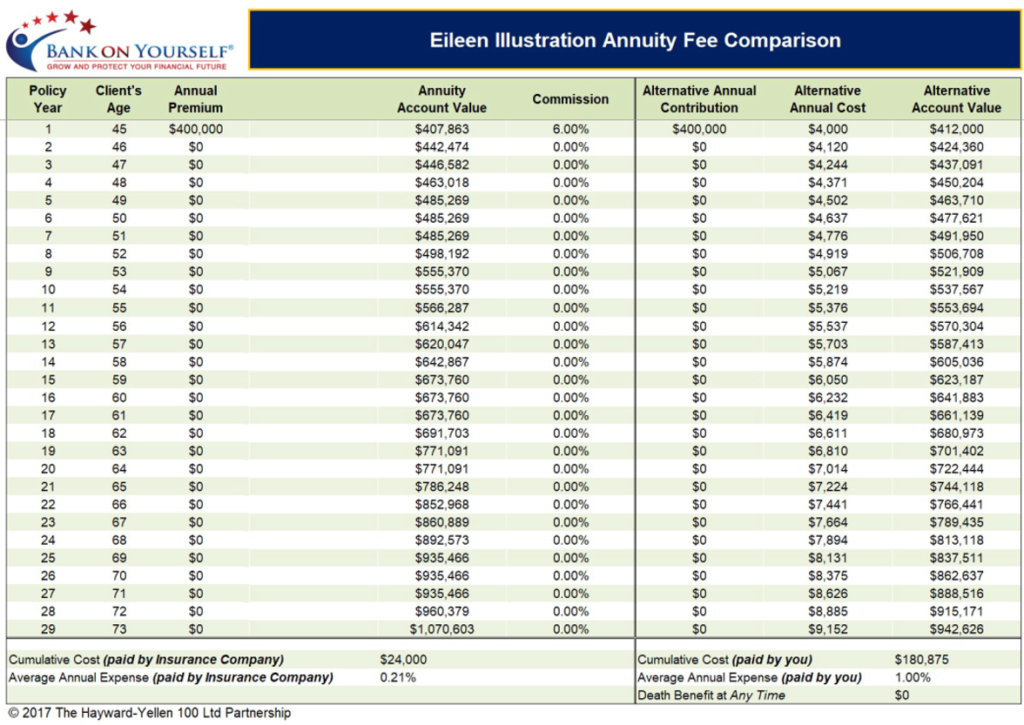

- What about the fees on annuities?

- What about Dave Ramsey, Ken Fisher and Suze Orman?

- What about transferring risk?

- What about buying a guarantee that you will never run out of money?

- How about an example?

- What about commissions?

- What would the investment advisor earn on assets under management (AUM)?

- What are the fees on AUM?

- Do these fees seem reasonable?

- What offers a predictable income?

- What about annuities and liquidity?

- What about deferred annuities?

- What about liquidity provisions?

- What about 10% withdrawal amounts?

- What about surrender charges?

- What about the cumulative amount provisions?

- Would you like another example?

- What is the 3% rule?

- How could you generate more income in retirement without extra work?

- What about interest rates?

- What about Wade Pfau’s paper in Forbes Magazine?

- What do annuities rely upon?

- What are mortality credits?

- What sort of guarantees come with annuities?

- What about the law of large numbers?

- What about pricing out mortality?

- What about youth?

- What about a familial tendency toward premature death?

- What about payments to family members?

- What about old-fashioned annuities?

- What about giving up control?

- What about gaining control over longevity risk?

- What about gaining control over a deflationary economy?

- What about gaining control over market risk?

- What about gaining control over sequence of returns risk?

- What happens if…?

- What about bonds?

- What are the three phases of wealth building?

- What about protecting money when the market goes up?

- What about distributing wealth?

- What about protecting wealth from creditors and predators?