Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

- What are the possible streams of income in retirement?

- What can you build up now, so you can rely on them later?

- Would you like passive income? What is passive income?

- What about passive income from Social Security?

- What about defined benefit plans?

- What about personal savings / investments?

- What about annuity income and life insurance?

- How much is the average Social Security check?

- What is the maximum SS amount for this year?

- What are the best things about Social Security?

- What do you have set up with your employer?

- What are the restrictions on defined benefit plans?

- What are RMDs (Required Minimum Distributions)?

- When do you have to start taking RMDs?

- Which plans are considered qualified plans?

- What is the penalty for not taking RMDs?

- How does qualified plan savings affect Social Security?

- What happens at age 70.5? How much does the IRS charge each year in retirement?

- Who sets the interest rates?

- How do you allocate your assets to become income providing?

- What are dividends? How do they help generate income?

- What streams of income are taxable?

- What about CDs?

- What are some efficient ways to generate income?

- What about cryptocurrency?

- What about Whole Life Insurance and Annuities?

- What about Bank on Yourself?

- What income is guaranteed?

- What about interest rates and dividend rates?

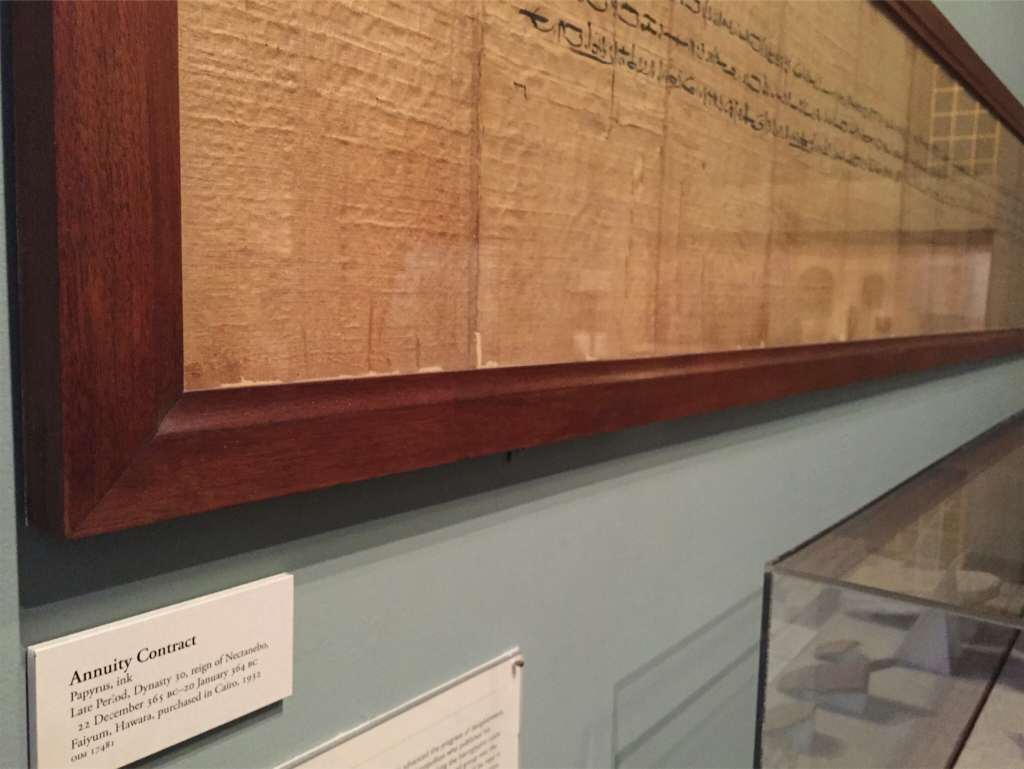

- What did Mark find at the Oriental Institute on the University of Chicago’s campus?

- What are some helpful annuities for guaranteed income in retirement?