Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

- When did you start something really big?

- What are the options?

- What is the myth?

- What are the strategies?

- How is whole life insurance like a mortgage?

- What about bills?

- How is whole life insurance like real estate?

- What about savings?

- How can this benefit you in good times?

- What happens if… ?

- What if you hit hard times?

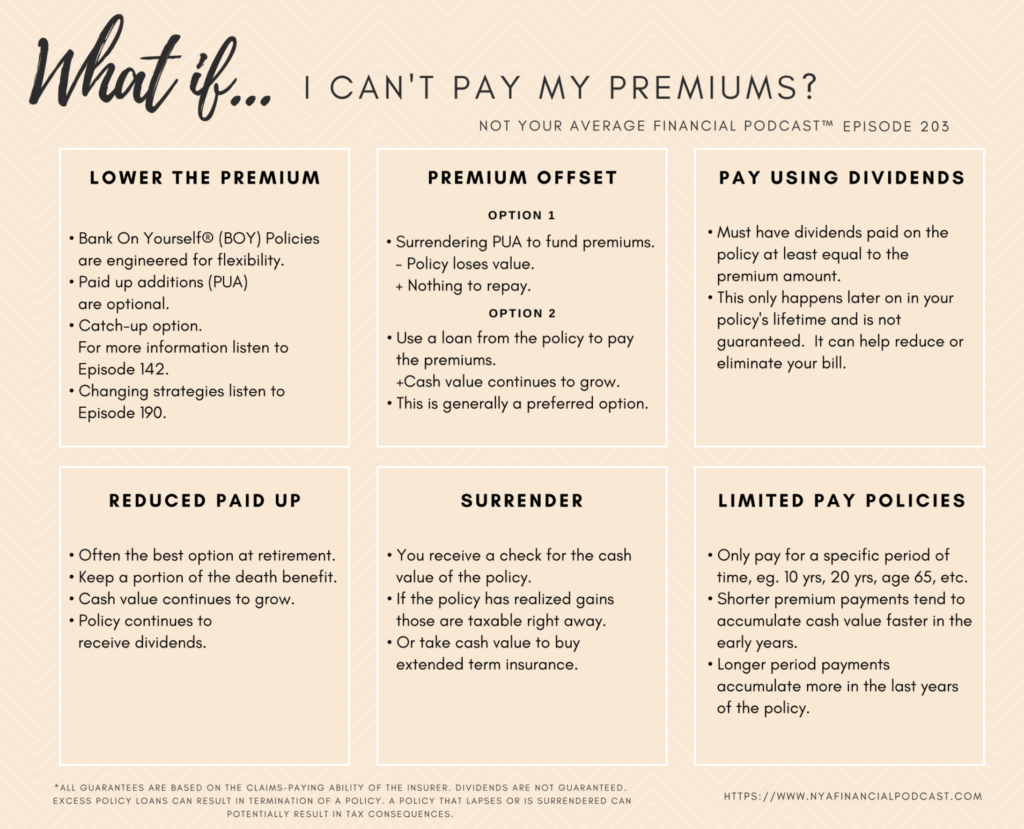

- Are you able to lower your premium payment?

- How is that possible?

- What about the paid up additions?

- Are paid up additions considered optional?

- What about “catching up”?

- What about annual premium?

- What if the business falls on hard times?

- What are the minimums?

- What are the smaller monthly possibilities?

- What about a premium offset?

- What about surrounding Paid-Up Additions (PUAs) to pay premium?

- What about the death benefit dropping?

- How does one pay the premium with a policy loan?

- What is the key difference between loans and surrender?

- What about an automatic loan provision to pay premium?

- Would you like to work on your situation with us? Schedule

- What about dividends?

- What are the dividend options?

- What about the dividends paying premiums?

- What are the nuances?

- What about the reduced paid up option?

- What are the benefits? What are the risks?

- What happens to a reduced paid up (RPU) policy?

- What about the irreversibility of RPU?

- What about surrender and cashing out the policy?

- Why is this technically possible?

- What are the risks?

- Why would people choose RPU instead?

- What about a permanent policy?

- What about buying extended term insurance?

- What about an example?

- What about limited pay policies?

- What are the benefits?

- What are some examples?

- What about shorter premium payments?

- What about longer premium payments?

- What about the option to add money in the future?

- Are you ready for rainy days?