Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

- Is it possible to mess up a Bank on Yourself® type whole life insurance policy?

- Is it possible to mess up a microwave?

- Would you like to ask your own questions?

- Would you like to join us on the Not Your Average Financial Community?

- Who is Jim Conrad?

- What about a high level overview?

- What are Jim’s rules to live by if you’re banking on yourself?

- What gets better every year, guaranteed?

- Is there such thing as paying too much premium?

- What about paying as much premium as you can for as long as you can?

- What about the first seven years of a policy?

- Is paying premium a burden?

- What about stopping?

- Do you want to build wealth reliably?

- Should you always use your own capital?

- Why would I want to borrow from my own policy if I can get a better rate down the street?

- Do you need to finance a new vehicle?

- Do you need to invest in real estate?

- What about paid up additions premium?

- How will your dollars grow?

- Why would you want to save money in someone else’s bank?

- Can you enrich yourself and the bankers?

- What’s the biggest building in Charlotte?

- What happens when you pay interest?

- What about policy loans?

- Do policy loans take experience?

- How much does one need to pay back on the loan?

- Will an insurer take your car or house away?

- Whose in charge of their cash value?

- Who manages the cash value?

- What’s a reasonable time frame to pay back a policy loan?

- Do you want to pay premium first and then loan payments?

- Are interest rates really important?

- What’s the best return?

- What questions do you have?

- What about using other people’s money?

- What about using your own cash value to make purchases?

- What about arbitrage?

- What about credit cards and discipline?

- What are the risks?

- What about paying premium out of cashflow and savings?

- Why did Jim write these rules to be timeless?

- What about credit union loans?

- How does privatized banking work?

- How much can a bank lend out?

- How much does a bank have to keep on hand?

- Would you like to eliminate bankers from your life?

- How can the bank make so much interest?

- What about low or no interest loans?

- Do you need to borrow more capital than you have in your policies?

- What about closing that window?

- What about feathering the clutch?

- What about uninterrupted compound interest?

- What about retirement?

- What happens if your goals change?

- Are you creating income for life with whole life insurance?

- When do most people stop paying premium?

- What about premium offset?

- What about paying your loans back?

- How might you maximize your lifetime income?

- How might you pay back your policy loans before you retire?

- What is the best practice?

- What about using your own capital to buy points on a mortgage?

- Who keeps a mortgage for 30 years?

- What about refinancing?

- What about moving?

- Does it make sense?

- What about the book How Privatized Banking Really Works?

- How might you use your own capital?

- What about the volume of debt?

- How much skin in the game does the bank really have?

- What were the reserve requirements in 2008?

- How might you build up and use your own capital?

- Why favor paying premium over paying back loans quickly?

- What does one do when they run out of wiggle room in a policy?

- What about timing?

- How might one completely replace banks?

- How might one do the banking at the “me and you” level?

- What about checking accounts?

- Would you like to join our membership site?

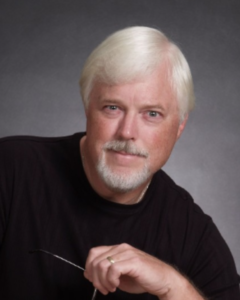

Jim Conrad, the President of Conrad Financial Services, resides with his wife, Deb, in Concord, North Carolina. Jim started working for his clients in financial services 20 years ago, after a 25-year career in management with a Fortune Top 10 company. He grew up in the Chicago suburbs, and he holds a B.S. in chemical engineering from Purdue University and an MBA from Lewis University.

Jim Conrad, the President of Conrad Financial Services, resides with his wife, Deb, in Concord, North Carolina. Jim started working for his clients in financial services 20 years ago, after a 25-year career in management with a Fortune Top 10 company. He grew up in the Chicago suburbs, and he holds a B.S. in chemical engineering from Purdue University and an MBA from Lewis University.

Jim has been a Bank On Yourself Authorized Advisor for the past 13 years. His passion is helping people achieve financial peace of mind by owning a strategy they can count on for life.