Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

- Do you need a budget?

- How much is in the bank?

- What reaction do you have to budgeting?

- How do you keep your budget fluid?

- How do you use a budget?

- How can you be successful with a budget?

- What is a state of flow?

- Are you single and budgeting successfully?

- What are the first three steps of budgeting?

- Step 1: Enter your income. Add it all up.

- Step 2: Budget it all. Put a name on every dollar.

- Step 3: Follow it.

- Can you budget passively?

- Do budgeting apps count as budgeting?

- What is YNAB?

- How do you decide to use your time?

- What are your priorities?

- How do you actively participate in how your dollars will be spent?

- If you don’t employ your dollars, what will happen?

- Have you ever built a fictional, ideal budget?

- How much did Mark budget for groceries before marriage?

- Have you ever broken a budget?

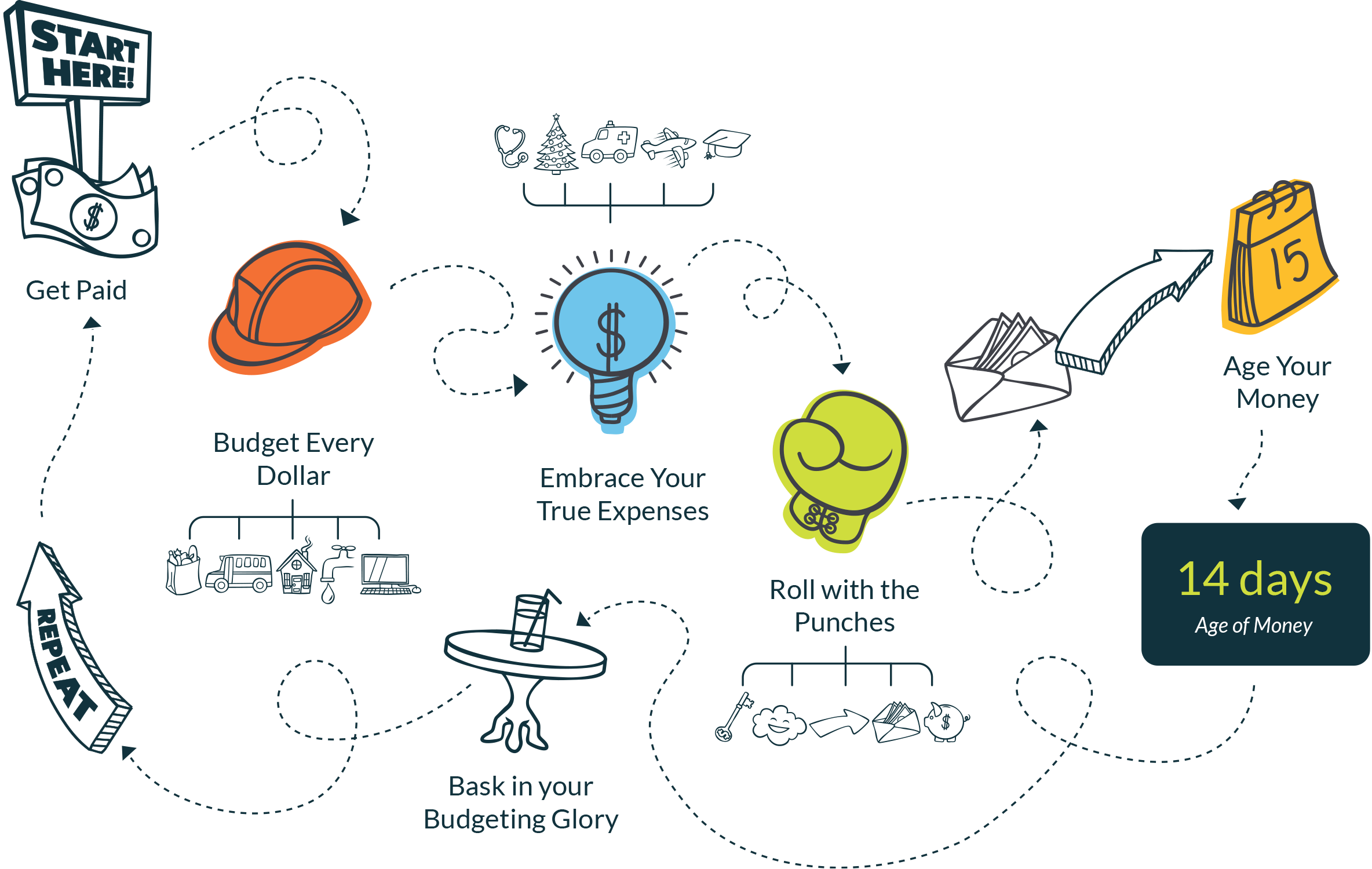

- What are the four rules of budgeting?

- Rule 1: Budget Every Dollar AKA Give Every Dollar A Job

- Have you ever wondered what happened to your money?

- Rule 2: Embrace Your True Expenses

- Have you ever had a “rainy day” expense?

- Have you ever been surprised by the expenses of the holidays?

- Rule 3: Roll with the Punches

- Have you ever overspent?

- Have you ever under budgeted?

- Have you ever considered just giving up?

- Rule 4: Age Your Money

- How long has your money been sitting there before you spend it?

- Are you living paycheck-to-paycheck?

- How long can you wait before spending the income? 30 days?

- Rule 1: Budget Every Dollar AKA Give Every Dollar A Job

- What is budgeting about?

- What is the purpose of budgeting?

- How can you grow your awareness around your finances?

- How can you budget your cash value in a Bank On Yourself policy?

- Can you see how much you’re spending?

- Would you like a hand with a budget? Book a meeting with us.