Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

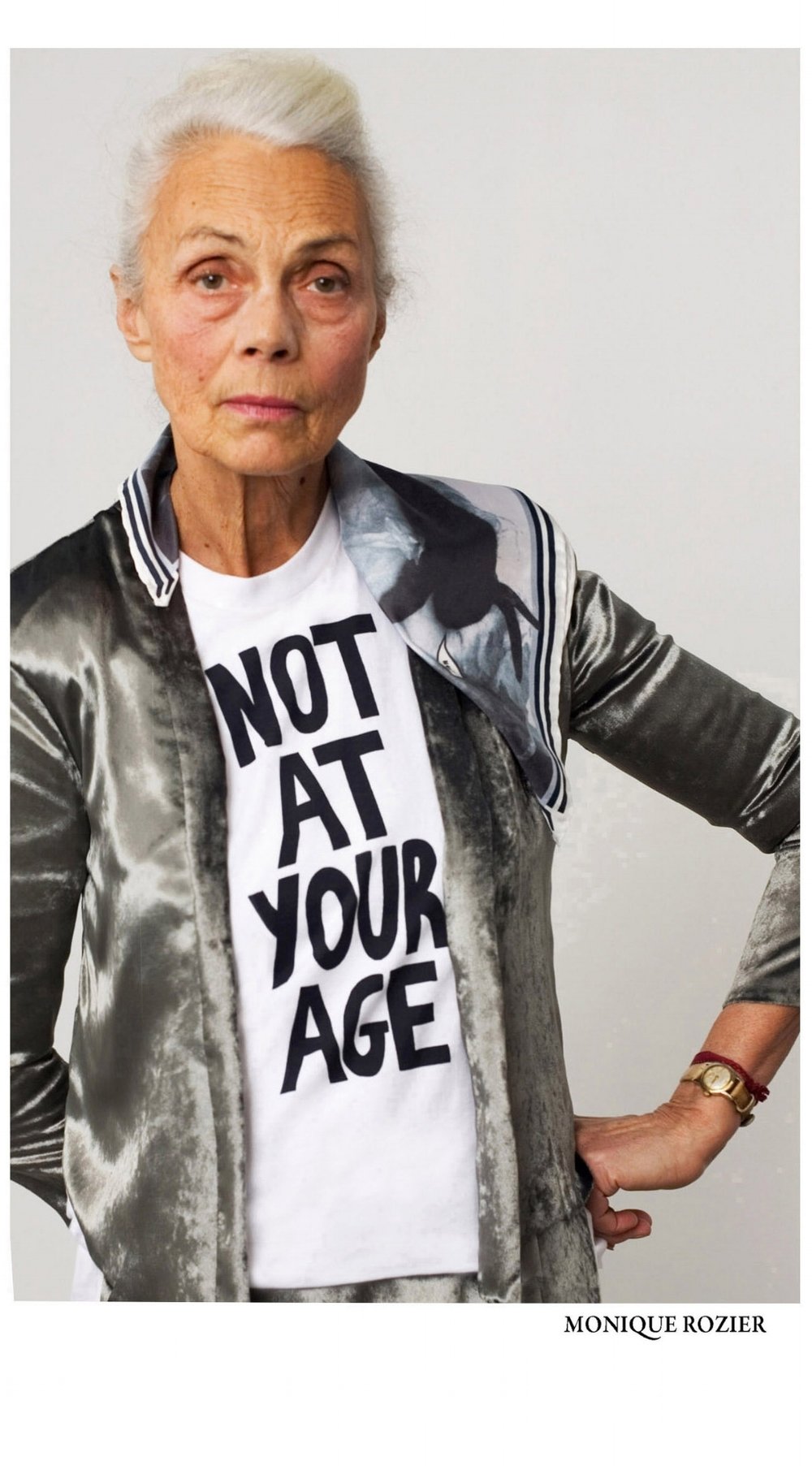

- At your age?

- At that income?

- With that health problem?

- What if I don’t make enough money to start planning?

- How much should I save?

- How do you overcome the paycheck-to-paycheck cycle?

- When will you make the most income?

- Is whole life insurance terrible?

- Does the death benefit on whole life insurance keep up with inflation?

- How has life insurance changed in the last fifteen years?

- What is special about a properly designed, dividend-paying, Bank On Yourself policy?

- Why do life insurance companies keep the cash value upon death?

- How much do life insurance producers make in commission?

- Why do producers take a pay cut to write Bank On Yourself policies?

- What sort of life insurance should you consider, if you’re thrifty?

- Why does life insurance hinge on medical underwriting?

- How can people with health issues get a Bank On Yourself policy?

- What are the possibilities for older individuals?

- What about the cost of insurance?

- Why would I put any money outside of the market? Won’t that money grow slowly?

- What happens if I get disabled?

- What if I can’t keep up with the regular premium payments in a Bank On Yourself policy?

- How can avoid making another mistake with my money?