Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

- What is the history of Bank on Yourself®?

- What did Nelson Nash find with the Infinite Banking Concept?

- How was Nelson an evangelist?

- What’s the issue with the IBC meaning?

- What standards are in place around the Infinite Banking Concept?

- What did Pamela Yellen learn?

- What does Pamela write on page 247 of the Bank of Yourself® Revolution?

- What is a modified endowment contract (or MEC)?

- How did Pamela Yellen develop the Bank on Yourself® Professionals program?

- How is the Bank on Yourself® language protected?

- What is Bank on Yourself®?

- How does this make a significant difference?

- How might you know if an agent is capable and properly trained in designing a Bank on Yourself® type policy?

- What about investment advisors?

- What about designing riders properly?

- How are these policies different from traditional whole life policies?

- What is the only kind of insurance recommended for the Bank on Yourself® strategy?

- What about captive agents?

- What sort of products are captive agents writing?

- Does it sound too good to be true?

- What is Bank on Yourself® based upon?

- Who owns Bank on Yourself® type life insurance policies?

- Who do you know who is a Bank on Yourself® policy owner?

- Can that advisor truly help you?

- Why didn’t that advisor already tell you about Bank on Yourself®?

- What is Bank on Yourself® NOT?

- What about the knock-off advisors?

- What about advisors who lost their licenses?

- What is happening in the marketplace landscape?

- What about the Infinite Banking Concept?

- What about Private Banking Systems, Family Banking, Circle of Wealth, What Would the Rockefellars Do? and Perpetual Wealth Strategy?

- Have you heard episode 95 and 96?

- When was Nelson Nash’s Becoming Your Own Banker written?

- What’s wrong with outdated numbers?

- Is it about rate of return?

- Is it legal to call an insurance policy a “bank”?

- What about the laws and regulations?

- Did Nelson Nash defend his trademarks?

- How much do we treasure Nelson’s legacy?

- What is a 770 Account?

- What about the other names for a 770, including a President’s Secret Account, a 501(k) Plan, an Invisible Account and Income for Life?

- What about a 702(j) Retirement Plan, attributed to President Ronald Reagan?

- How are the Bank on Yourself® Professionals different?

- What about Wealth Beyond Wall Street?

- What is the promise?

- What are some other names?

- What is a Safe Money Millionaire or a 101 plan?

- What is Indexed Universal Life?

- What is in the fine print?

- What about the warnings and disclaimers?

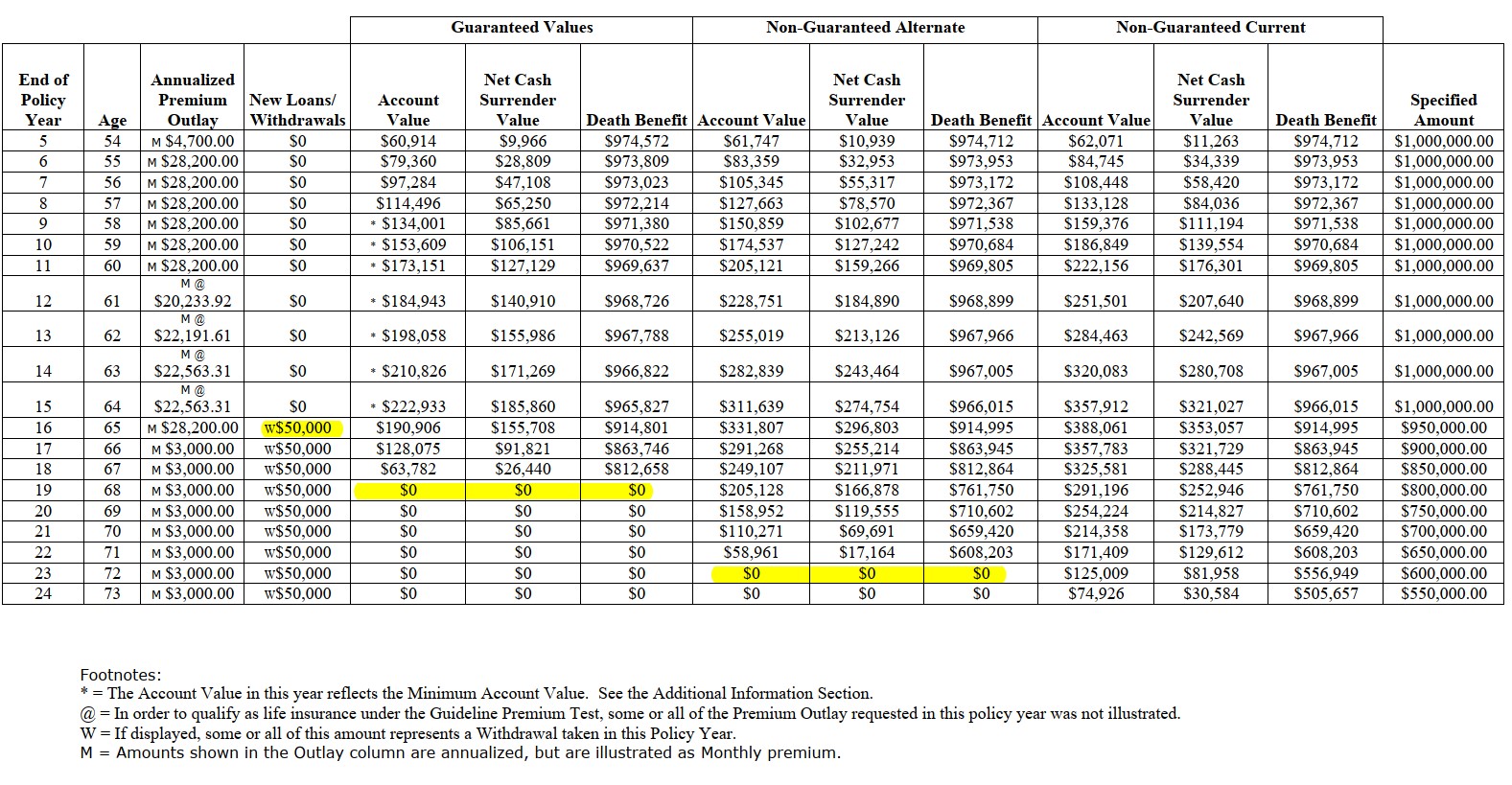

- Why does the cash value on these go to ZERO?

- What about the watchdog investigation?

- Why are the illustrations on IUL and UL products wildly inaccurate?

- What are IUL problems?

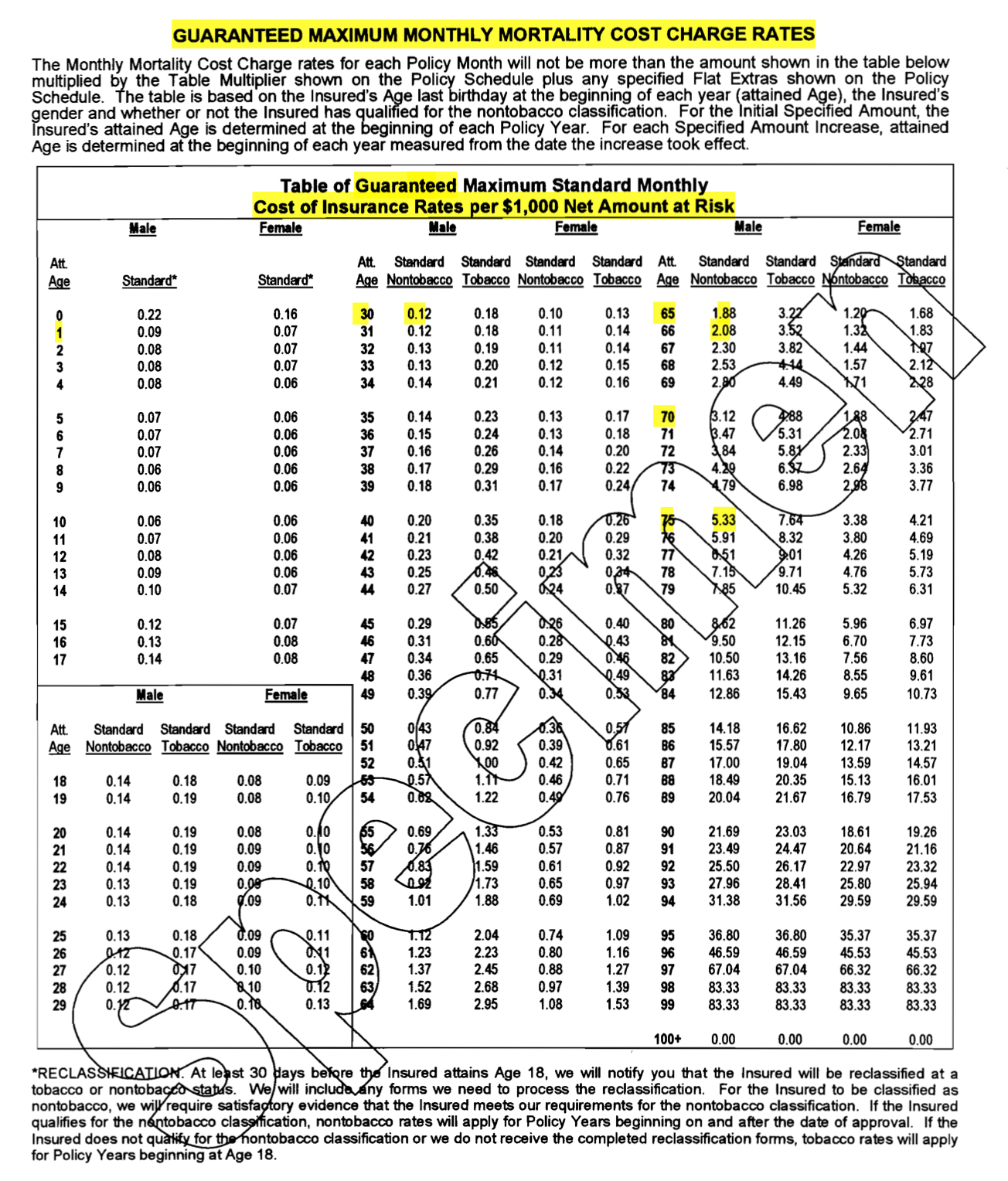

- What about the IUL increasing costs?

- Why is this devastating?

- Why do these policies fall apart?

- Would you like to hear Episode 59?

- Would you like to hear Episode 60?

- Would you like to hear Episode 61?

- How are Bank on Yourself® Professionals different?

- What is Maximum Premium Indexing and why is it so hot right now?

- Why are they recommending buying an IUL and a whole life policy?

- What is this mysterious strategy?

- What is the advantage? What is the downside?

- What is piggy backing?

- Who does this benefit?

- What are the red flags?

- Why is this an ethical crisis?

- Why is borrowing from one policy to buy a new one a bad idea?

- What can you do if you’ve already purchased an inefficient or troubling policy?

- Have you heard of the 1031 exchange in real estate?

- Is there a like kind exchange in insurance?

- What is the 1035 exchange?

- Do you have an in-force illustration?

- Would you like to call your insurer to get an in-force illustration?

- Would you like us to review your in-force illustration for FREE?

- Email us your PDF at hello@nyafinancialpodcast.com

- or hop on Mark’s calendar.

The Problem with Costs Going Crazy in Indexed Universal Life (IUL)

Example of What Might Happen with Retirement Income Using Indexed Universal Life (IUL)