Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

- What is interest anyway?

- What is the difference between compound interest and simple interest?

- How does compounding frequency affect an account?

- When is compound growth a problem?

- What did Albert Einstein say about compound interest?

- How does compound interest take affect?

- Where do most people look for compound growth?

- What’s wrong with compound growth and risk?

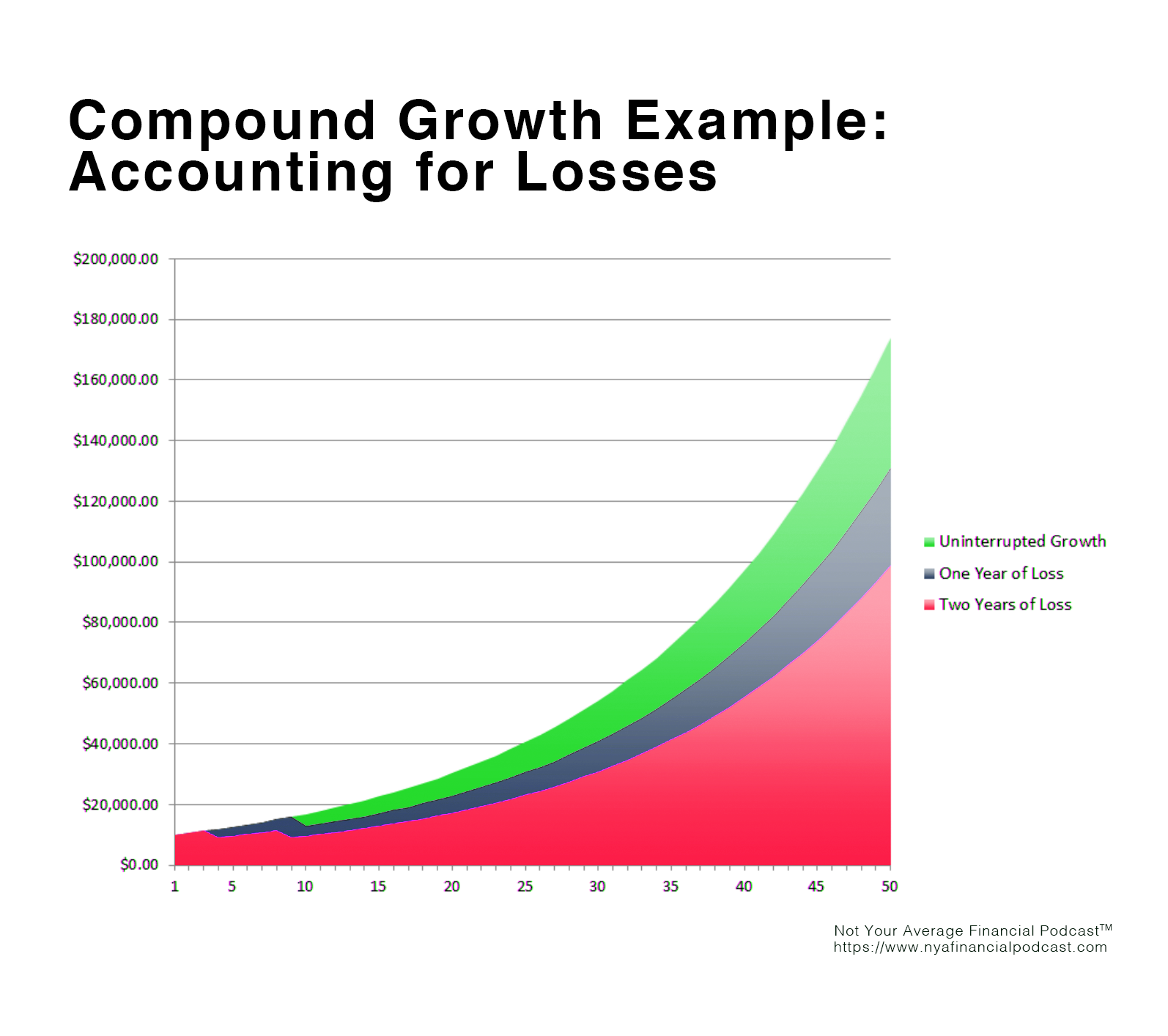

- How does a one year of loss affect compound growth?

- How does a second year of loss affect compound growth?

- What do most 30 to 40 year olds say about managing growth?

- When do you want your market losses to happen?

- What real assets do banks own?

- What is fractional reserve banking?

- What are the capital requirements for banks?

- Why are bank loans considered assets on their ledger?

- Why are our checking accounts considered liabilities?

- What is the power of compound interest?

- If you had a choice between acquiring a penny doubling every day for 30 days or a check for 1 million dollars, which one would you like to take with you?

- What is the power of simple interest?

- Why do you want to be charged simple interest?

- How do lenders apply your payments on a compound interest loan to the principal?

- How do lenders apply your payments on a compound interest loan to the interest?

- How do lenders apply your payments on a simple interest loan to the principal?

- How do lenders apply your payments on a simple interest loan to the interest?

- What about student loans?

- What about mortgages?

- Who is first in line for your money?

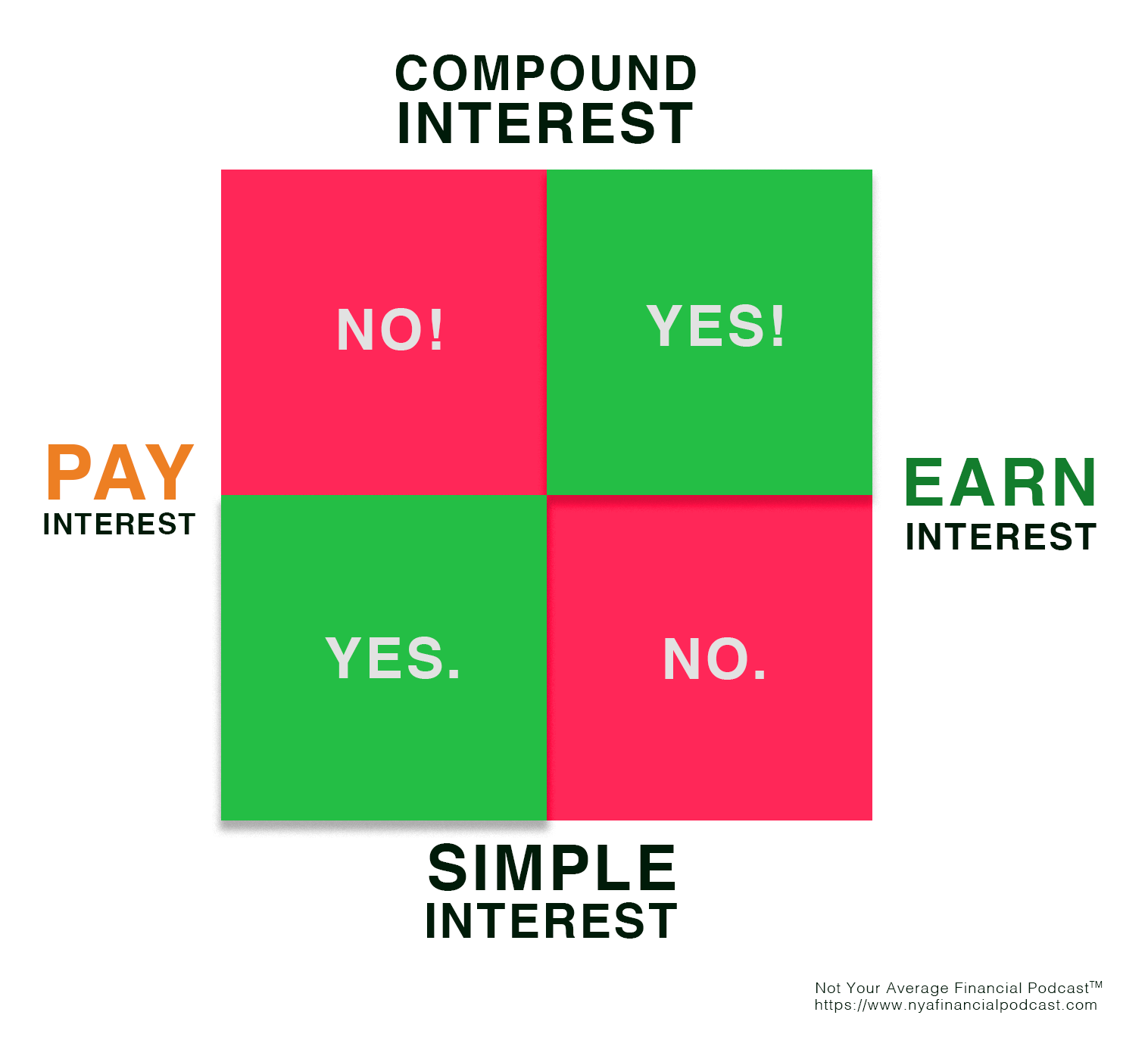

- What sort of interest would you like to earn?

- What sort of interest would you like to pay?

- How does interest work with Bank On Yourself policy loans?

- What type of interest do Bank on Yourself policies earn?

- What type of interest do you pay on a Bank on Yourself policy loan?

- What about buying a car?

- What box would you like to check?