Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

- Are bonds safer than stocks?

- Are you rethinking your philosophy towards finances?

- Do you watch financial advice on TV?

- What is a blend of stocks and bonds?

- Why do people believe in the blend of a 60/40 split?

- What is asset allocation?

- What does it mean when something is negatively correlated?

- What is the 100 minus age rule?

- What is a declining equity glide path?

- Which option gives the worst outcomes?

- Do you have a target date fund inside of your retirement funds?

- Are bonds really the safe money alternative?

- What about falling interest rates?

- How do bonds work?

- How do bond prices improve?

- Do bonds have risk?

- What happens when interest rates go up?

- What is the key question driving investors?

- Do you have a 401(k) or an IRA?

- What about the risk?

- Why do you expect the stock market to get you a better return than a savings account?

- How are bonds like loans?

- Are interest rates likely to go up?

- Do you want to put money in something that’s “at the top”?

- How can you know what’s most likely to happen with interest rates?

- What happens when interest rates go up?

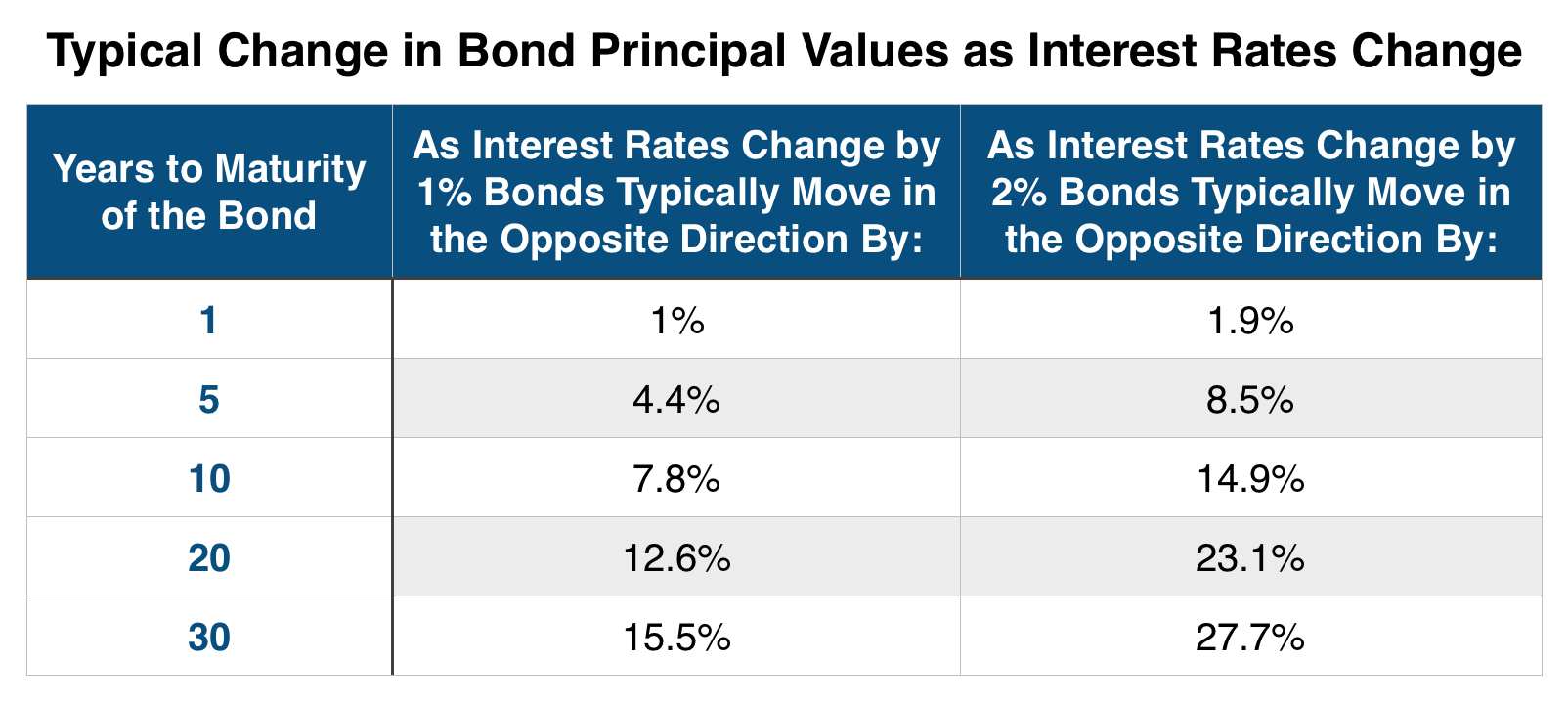

- What happens with bond principal in relation to interest rates?

- Can we control interest rates?

- What about the “deadline” on the bond?

- What happens with a 1% increase?

- What happens with a 2% increase?

- How does the risk go up?

- What else can we do?

- What about the volatility?

- What about the risks baked into bonds?

- What happens if a bond is called?

- Would you like to reach out?

- What are some alternative to bonds?

- What is recurring premium whole life insurance?

- What happens with compounding?

- What happens when you need cash, with liquidity?

- What about dollar cost averaging?

- What about guarantees?

- What about annuities?

- What about the tax treatment?

- What about single premium whole life insurance?

- Have you heard Episode 91?

- What about the tax treatment?

- What about the potential penalties?

- What is your risk score and how does it line up with your goals and objectives?

- Would you like to know your risk score?

- Would you like us to run your numbers?

- What are people saying?

- What does a realistic budget look like?

- Let us know at Speakpipe.com/nyafp and we’ll send you a free book!