Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

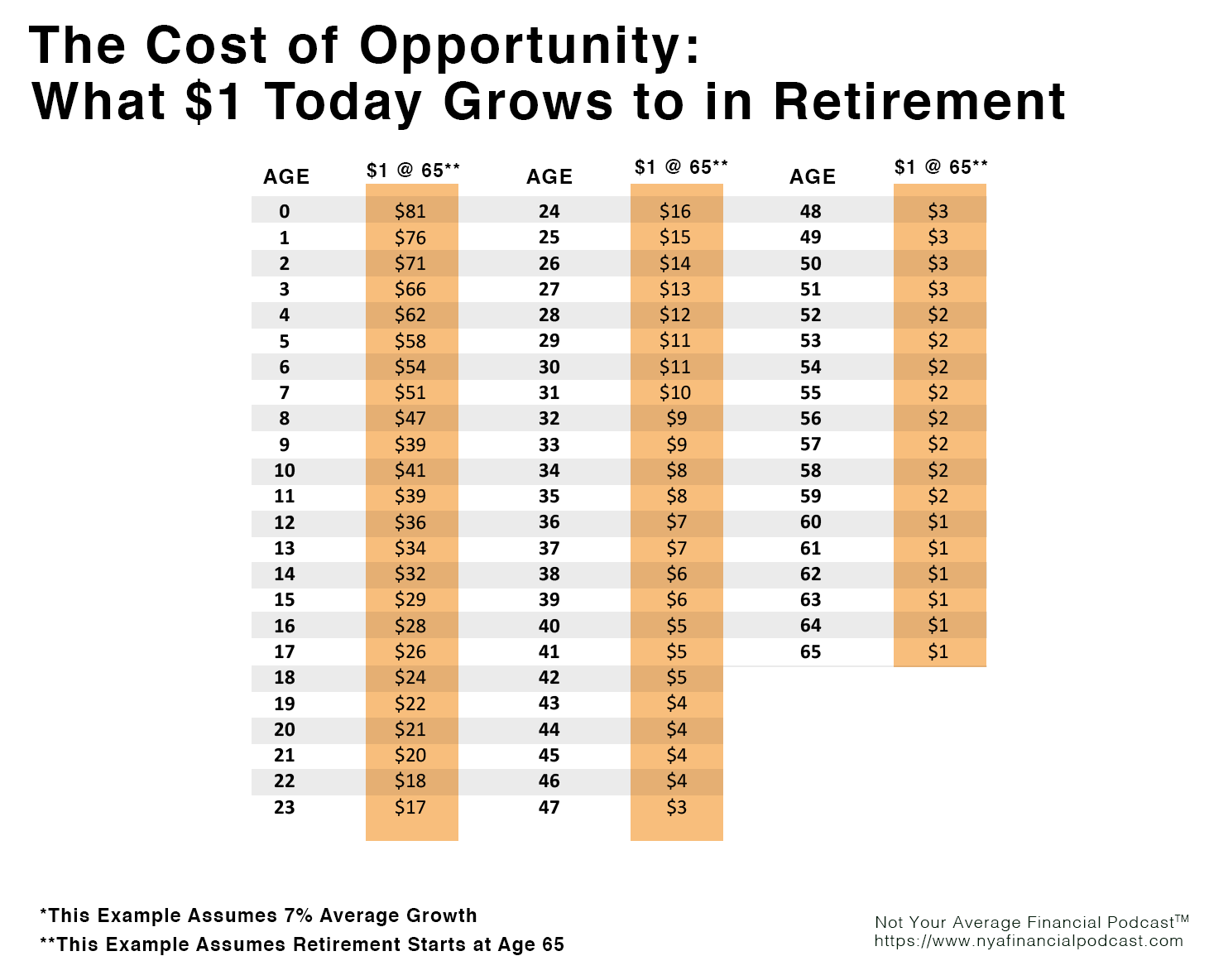

- What is opportunity cost? How does it affect you?

- How does opportunity cost work?

- Small cost! What could a $5 cup of coffee today truly cost later?

- When does opportunity cost affect you the most? When you are younger or older?

- Medium cost! What could a new phone truly cost later?

- Medium cost! What could a vacation truly cost later?

- How does paying cash affect opportunity cost?

- How does paying with debt affect opportunity cost?

- Big cost! What could a new car truly cost later?

- What should we be aware of, when we’re purchasing?

- What happens if you buy a cheap widget and it breaks?

- What reusable household items can cut down on non-monetary opportunity cost?

- What’s more expensive: personal training sessions or a medical bill?

- What’s more expensive: cooking for all of your friends and family or dining out?

- What’s more expensive: disposable cups or the high end, dreamy coffee vessel?

- What’s more expensive: waiting or buying with urgency?

- What is the right way to buy things?

- Who is C. Northcote Parkinson, and what did he say?

- How do we curb irrational decision making?

- Is there a way to eliminate opportunity cost?

- What ways are available to have your money do two things at once?

- … More!

Saturday Night Live Clip: Don’t Buy Stuff You Cannot Afford with Steve Martin and Amy Poehler