Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

- What are the core reasons why Bank On Yourself® is the real deal?

- Who is The White Coat Investor, Dr. Jim Dahl?

- What did he write about Bank On Yourself®?

- What did Ted Benna, the father of the 401(k), say?

- Where is Ted Benna parking his money?

- What are Ted Benna’s three reasons why we should be weary of 401(k) plans?

- Who is Jim Harbaugh?

- What is a split dollar loan agreement?

- What is the nature of Jim Harbaugh’s arrangement?

- Could a business own a whole life insurance policy?

- Why would a business want to own a policy?

- Can a life insurance policy act like a deferred compensation plan?

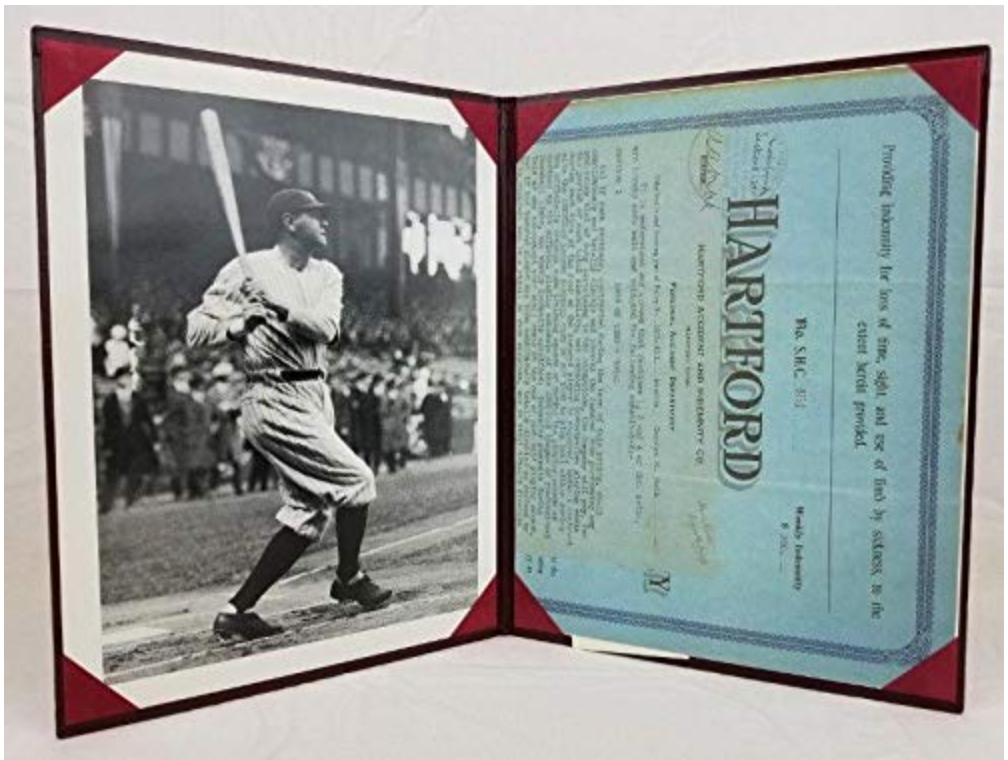

- What about Babe Ruth’s life insurance policy?

- Would you like purchase a replica of Babe Ruth’s policy?

- Have you heard Episode 66?

- Are you still skeptical?

- Have you read the Pirates of Manhattan?

- What do the banks do with their assets?

- What about Enron founder, Ken Lay?

- What about Lehman Brothers?

- What is Tier 1 capital?

- Does life insurance qualify as Tier 1 capital?

- What did your grandparents do with their whole life insurance policies?

- What was the most popular life insurance product from 1940-1970?

- What happened in 1981?

- Have you heard Grandma’s Wealth Wisdom podcast?

- What is 10x safer than a bank’s savings account?

- Why are banks so eager to keep your cash on hand?

- What is fractional reserve banking?

- How much can banks loan out?

- What is the Dodd Frank Act?

- What are the reserve requirements for life insurance companies?

- How much does the well capitalized life insurance company have to have on hand?

- What is the big difference in reserve requirements between banks and life insurance companies?

- Have you read How Privatized Banking Really Works?

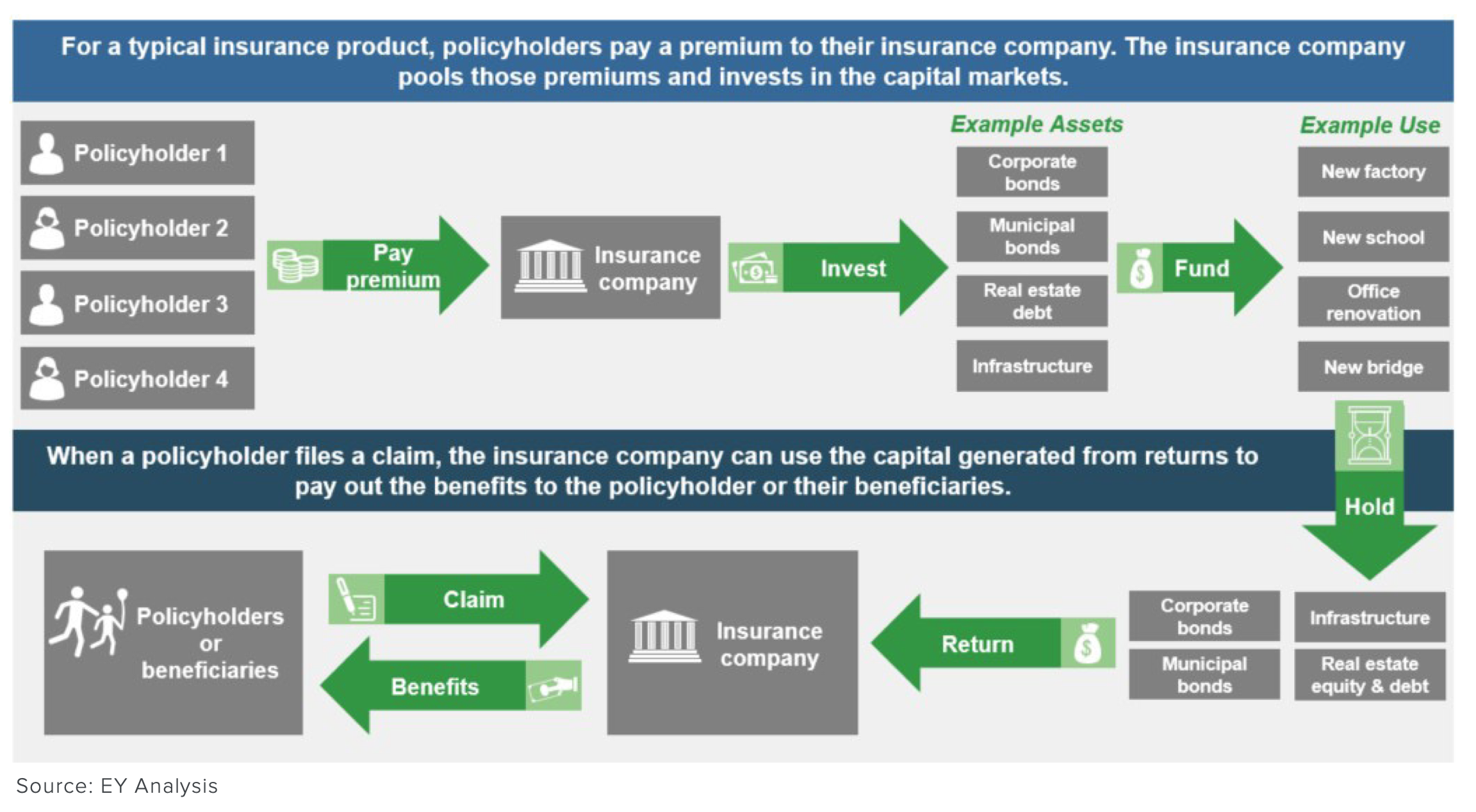

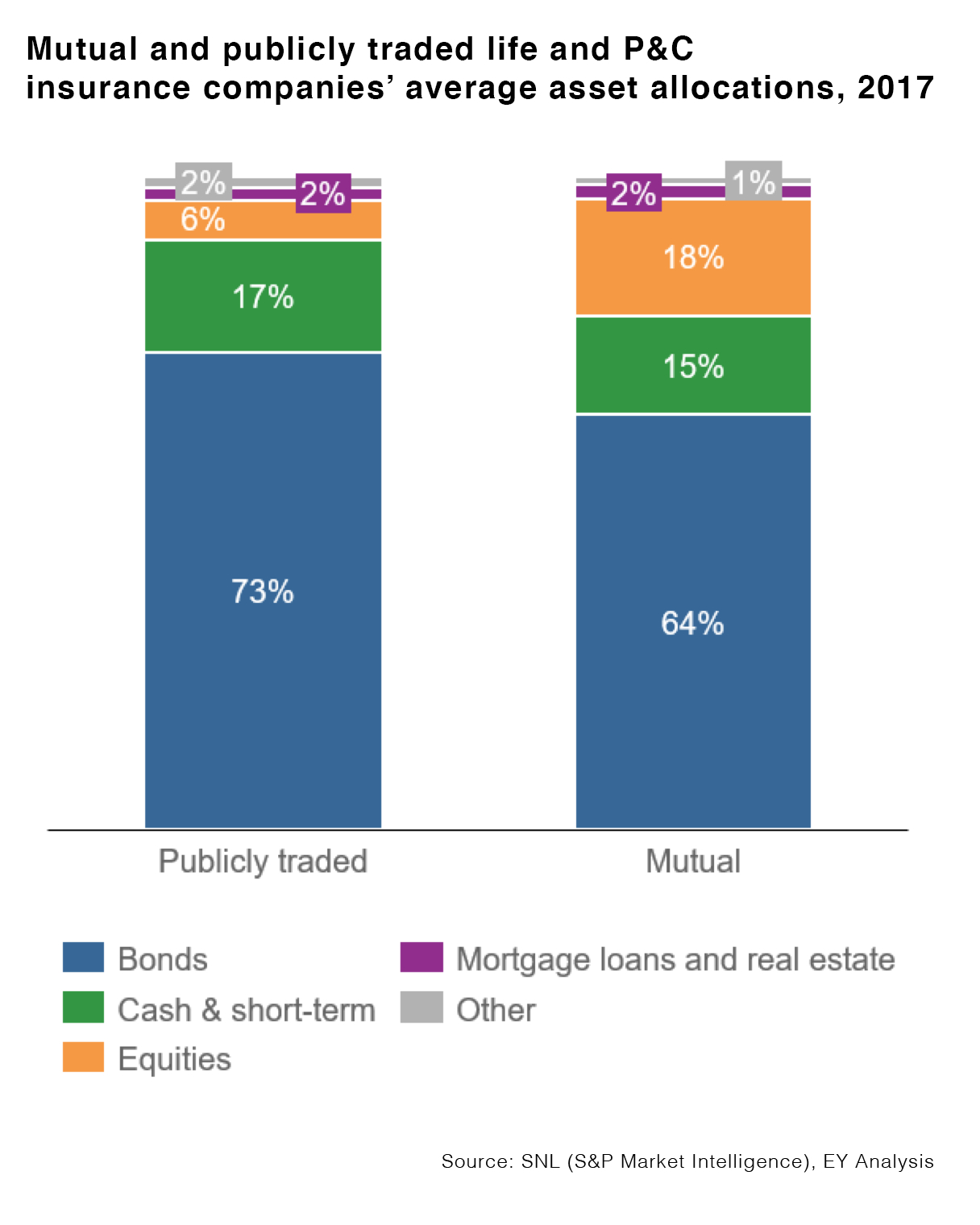

- How do the life insurance companies invest their funds?

- How much do life insurance companies have to keep liquid?

- How much do life insurance companies have to have to pay death benefits?

- How are life insurance companies strictly regulated?

- What happens if a life insurance company gets into difficult times?

- What are the additional protections?

- How have many life insurance companies been able to pay a dividend for over 100 years?

- Why do life insurance companies under promise and over deliver?

- Have you heard Episode 118?

- Have you heard Episode 106 and 107?

- How does the insurance industry support the infrastructure across the U.S.?

- What is the unique business model of the insurance companies?

- How can the insurance companies get a better yield?

- If this was a big scam, how could the insurance company build so much?

- What do the investments of the insurance companies look like?

- Is the money still liquid?

- What usually constitutes a scam?

- When do most people lose their skepticism?

- How does life insurance cash value benefit families, businesses and other individuals?

- What about the disclosures?

- What is concealment?

- What about the paperwork?

- What about the disclosures from a prolific insurer, Mass Mutual?

- What are the myths and truths about life insurance?

- What about subscribing to the research from Pamela Yellen’s work?

- What are some takeaways?

- Should you believe everything you read on the internet?

- What sources have authority?

- Have you read Financial Independence in the 21st Century?

- Would you like to buy this book?

- What about Investopedia’s guide to dividend paying whole life insurance?

- Have you heard Episode 74?

- Have you heard Episode 55?

- Have you heard Episode 6?

- Have you heard Episode 36?

- Have you heard Episode 91?

- Have you heard Episode 110?

- What is your favorite or most memorable money mistake? Leave us a message and let us know!

- Would you like a free copy of Pamela Yellen’s latest book?