Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

- What is a Required Minimum Distribution (RMDs)?

- What happened when you put your income into the deferred tax account?

- How will the tax be paid?

- When will the tax be paid?

- What is built into the Internal Revenue Code?

- When do Required Minimum Distributions become payable?

- What about age 70.5?

- What about age 59.5?

- What is this magical 11 year time zone?

- Do you own a qualified plan?

- When you can you withdraw funds?

- What about penalties?

- Have you heard about the 70.5 deadline?

- A 50% penalty?! 50%?!

- When do you think taxes will be higher?

- What happens if you pass away with a qualified plan?

- What does your partner have to do?

- Would you like an example?

- How does one calculate an RMD?

- What is your life expectancy?

- What is the balance of the account?

- Are RMDs taxed at ordinary income tax rates?

- Is your spouse 10 years younger than you?

- Will RMDs force you into a higher tax bracket?

- Will RMDs raise your Medicare premiums?

- What if you have assets inside of your qualified accounts?

- Will you have to sell your stocks?

- Will you have to sell your real estate?

- Does the RMD care?

- What happens if you live past your life expectancy?

- What happens if you need it for long term care?

- What about the 4% rule?

- How successful is the 4% rule?

- What about 2.8%?

- What about 6.5%?

- Has the government updated their formula to reflect these new findings?

- Will most run out of money?

- What is the new SECURE ACT in congress?

- What are some ideas to consider?

- Are you in your mid to late 50s?

- How much do you have that will be exposed to ordinary income tax?

- Would you like protection from required minimum distributions?

- Are there multiple accounts that you would like to consolidate?

- How might you leave a substantial legacy for your children?

- What about a life insurance policy?

- Are today’s tax rates historically low?

- How much will you be forced to take out of your retirement accounts?

- How could you leave your family far more than you ever saved?

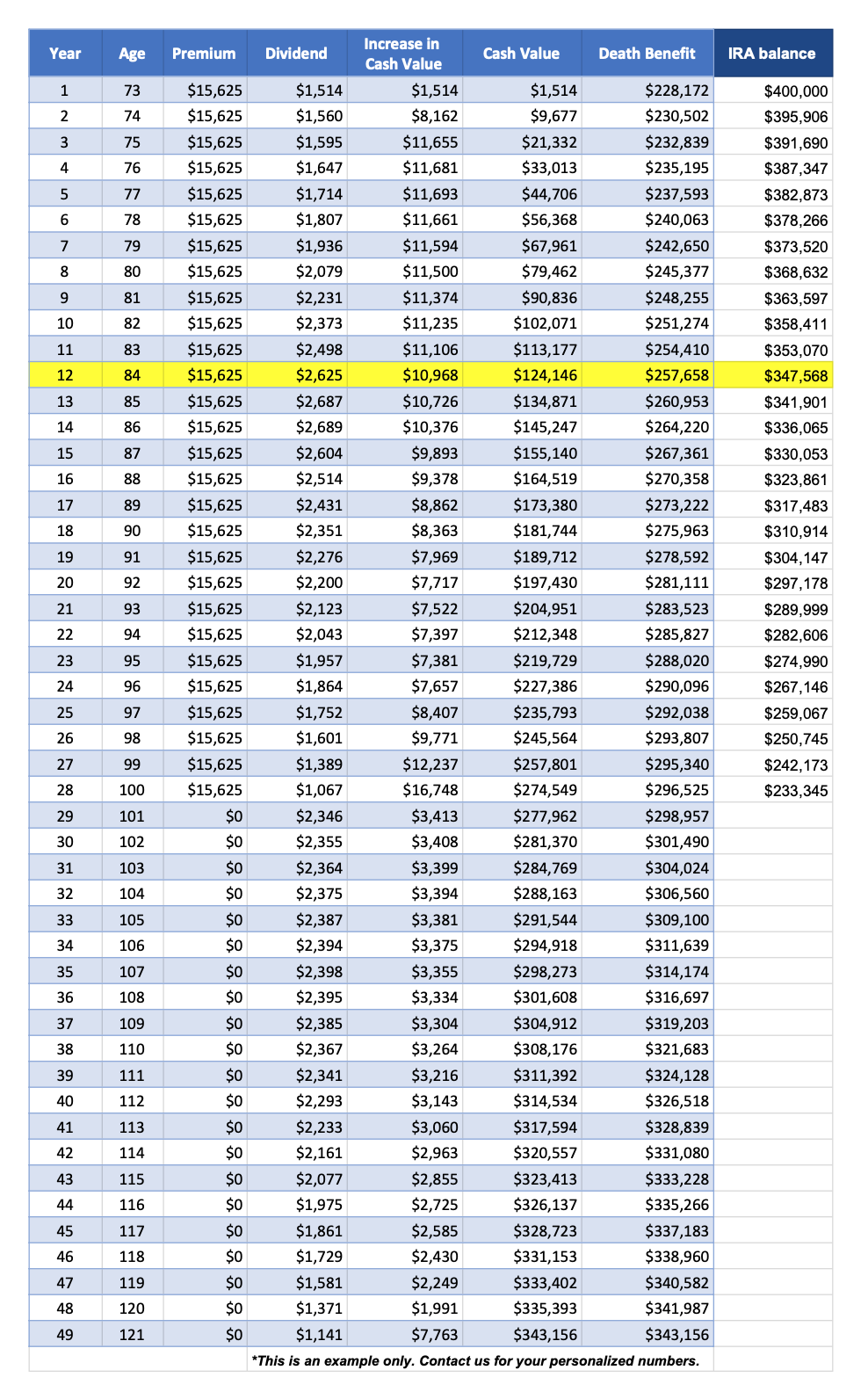

- Would you like to view some example numbers? Note: this is only an example. To see your exact numbers, please contact us.

- How might we help you with an RMD strategy? Hop on our calendar for a FREE 15 minute Introduction Phone Call

- Do you own a Bank on Yourself® type policy? Do you believe that Bank on Yourself is a scam? Leave us a message and let us know your experience!