Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

- What has Amanda learned as a sample of one?

- Who are Brandon and Amanda Neely?

- What is Mark’s relationship with Brandon and Amanda?

- If we did something different, what would the results be?

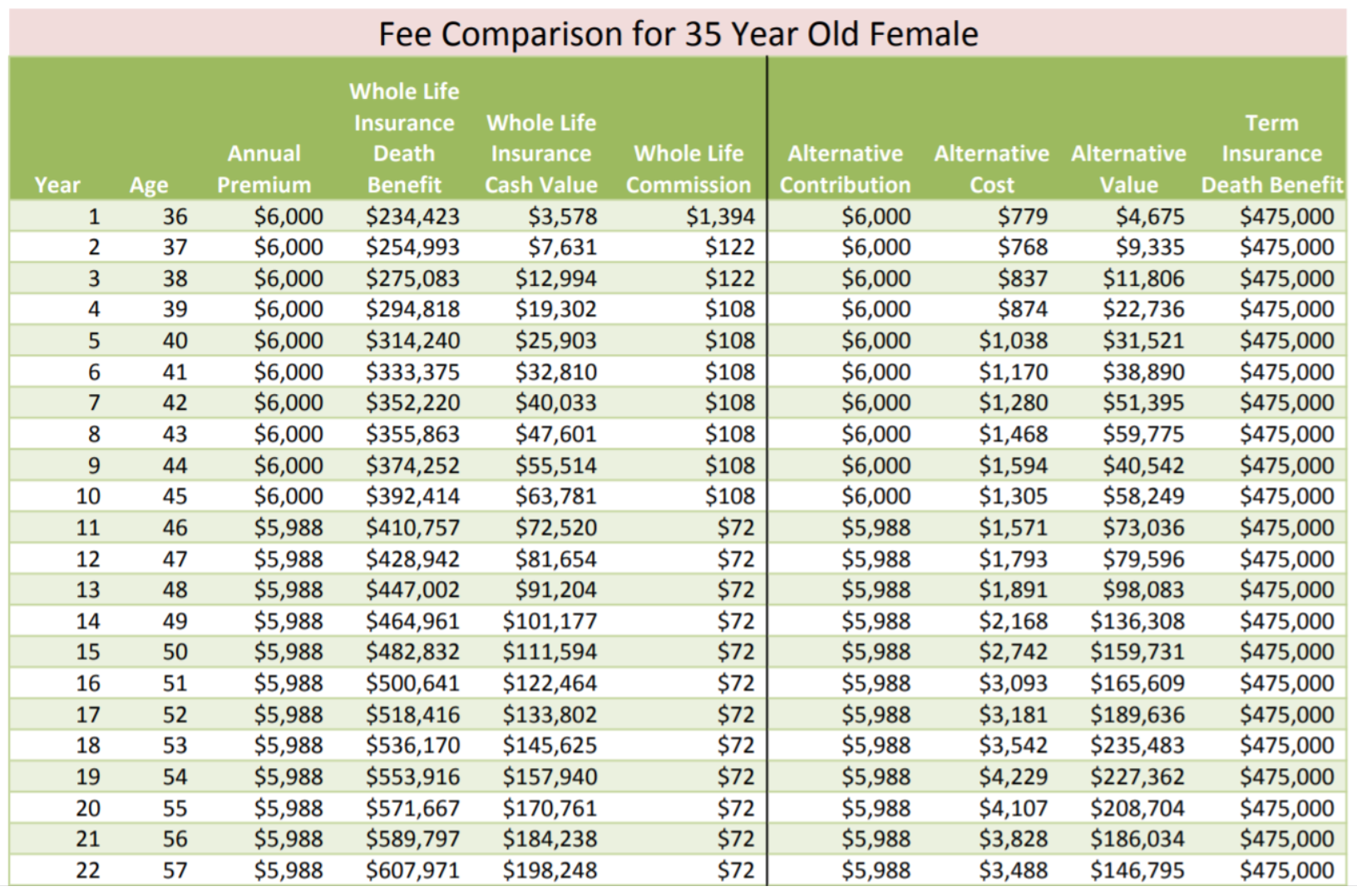

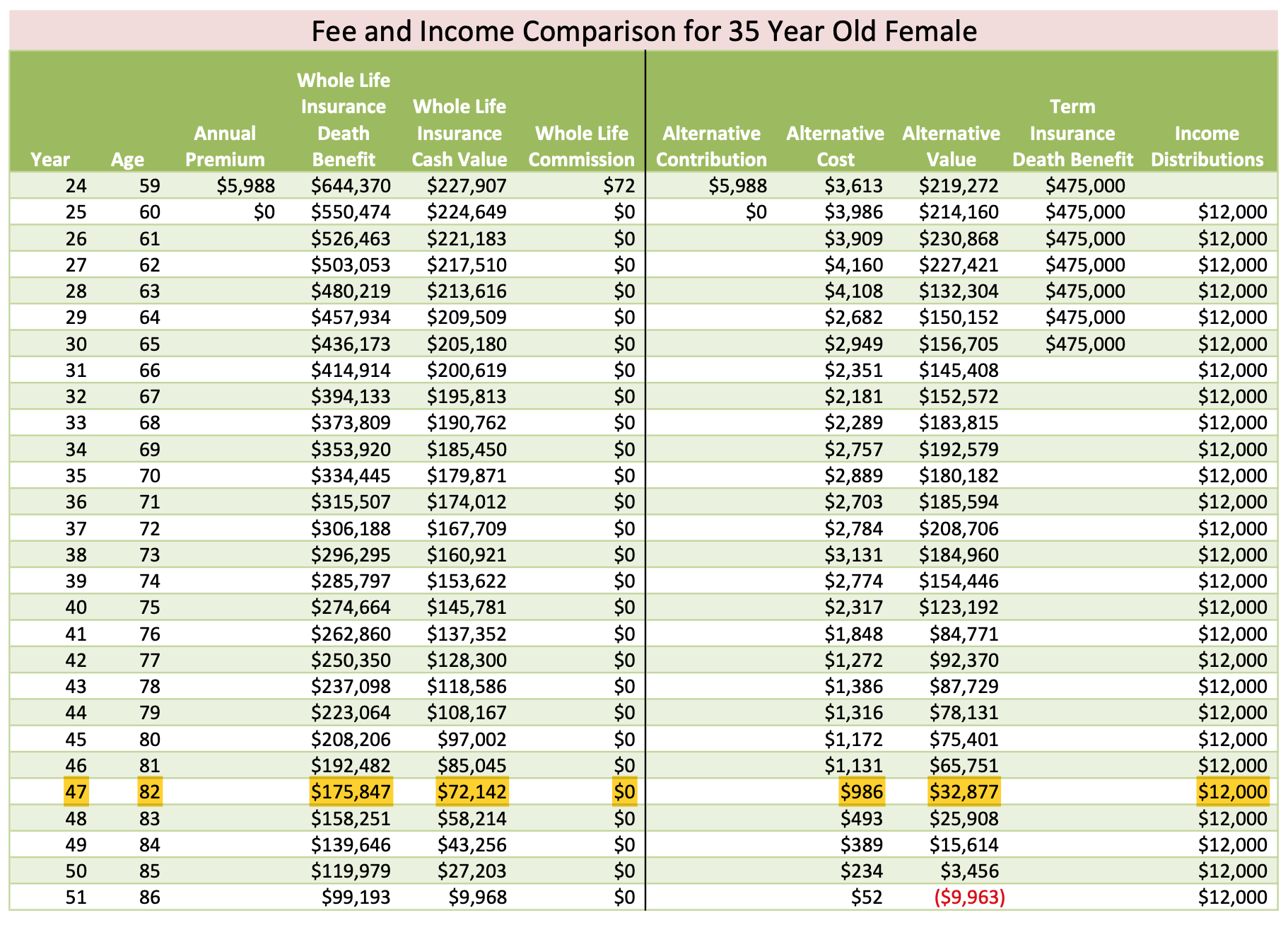

- Would you like to follow along with the numbers? (See tables below)

- Would you like to watch this in video?

- What are Amanda’s numbers?

- Are agent commissions too high?

- What would the assets under management fee be?

- What would the term insurance commission be?

- What happened in 2008?

- How much more would the investment advisor make?

- Why is there a Wolf of Wall Street but no “wolf of insurance”?

- What happens if you need or want your money prior to age 59.5?

- What would your heirs receive when you pass?

- What taxes would your heirs pay?

- What are the tax considerations when you start using the money?

- What happens if you get cancer or some other chronic or terminal illness?

- What happens if you get sued?

- What happens if you die too young?

- What happens if you die too old?

- What happens if the stock market goes down when you’re 36? How about when you’re 60?

- Which side has guarantees?

- Is the amount going in each year flexible?

- What if you wanted to put in more? Or less?

- What are the tax consequences now?

- What are the tax considerations before you’re 59.5?

- How many life insurance policies does the Neely family own?

- How does the Neely family use their policies?

- How can you use these specific policies to more effectively pay taxes?

- Have you seen the webinar on Episode 84 The Past, Present and Future of Paying Your Taxes?

- Have you heard Episode 87, How to Get Wealthy While Paying Your Taxes?

- What income could this 35 yo female expect?

- What is the life expectancy?

- What is the difference between the term / Roth IRA and the Life Insurance policy?

- How much does the fee on the Roth IRA become?

- What about an older person’s strategy?

- Have you heard Episode 91, Great Problems, Giant Piles of Cash?

- How are mutual life insurance companies dealing with the low interest rate environment?

- How do policy loans at 5% interest affect the insurance company’s performance?

- When is the increase always greater than cost?

- Would you like Brandon or Amanda to run this comparison for you with your numbers

- Schedule a Comparison conversation with Brandon or Amanda