Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In this episode, we ask:

- Was the 401(k) meant to be the primary vehicle for retirement?

- Is there more risk early on in a 401(k) or toward the end or retirement phase of the 401(k)?

- How have the 401(k)s improved our retirement outlook?

- What guarantee does the 401(k) present? (Hint: it’s a four letter word.)

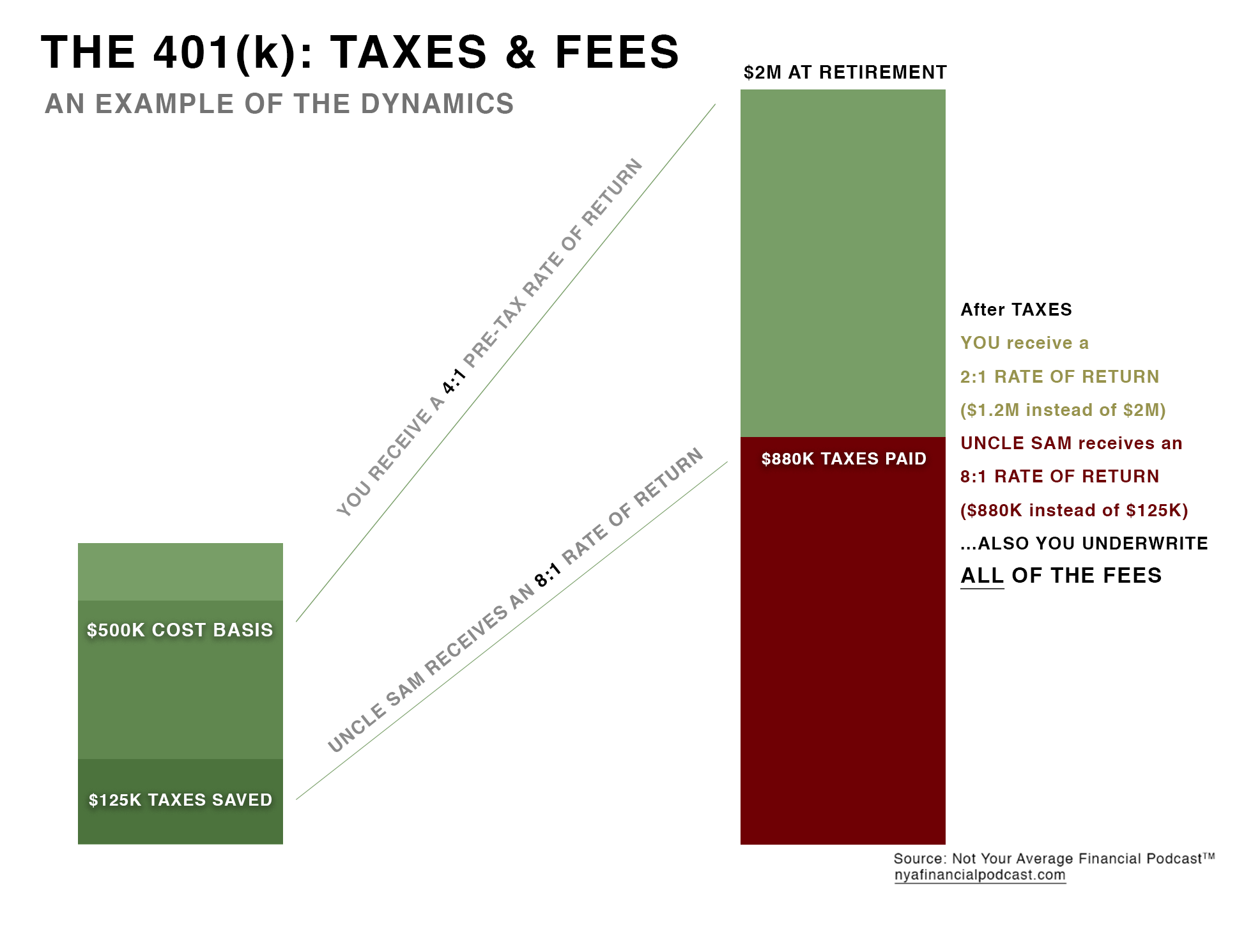

- What are some of the fees on the 401(k)?

- How much does an average investor pay with a 1% fee over the life of the 401(k)?

- How much does an average investor pay with a 3% fee over the life of the 401(k)?

- What is the average investor paying in fees?

- What is a 403(b)?

- What’s Katrina’s story with the 403(b)?

- What about the employer benefit?

- How do different companies handle vesting?

- What did Holly’s husband, Jacob, say when he saw his 401(k) statement?

- How much can you contribute to a 401(k)?

- If you contribute the maximum amount, can you retire on the 401(k) alone?

- What are the taxes on the 401(k)?

- What are the penalties on the 401(k)?

- How long are the penalties active on the 401(k)?

- At what age are you required to take Required Minimum Distributions (RMDs)?

- What happens to those with 401(k)s at age 70.5?

- Can you leave a 401(k) as a legacy to your kids and/or grand kids?

- Is the 401(k) a liquid vehicle?

- … More!

This is the third episode in a three part series on qualified plans, like the 401(k). Continue with us on our deep dive into thinking differently about the 401(k) in Episode 9 and Episode 10, too.