Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

- Would you like to join like-minded individuals on the journey? Join us for the FREE! Not Your Average Financial Summit on the afternoons of September 6 and 7, 2023? Register here!

- How about a story?

- Would you like to hear more?

- Would you like to hear previous episodes with Lester Himel?

- How did Les learn about the risks of universal life insurance (UL), indexed universal life insurance (IUL) and variable universal life insurance (VUL)?

- What about the GIC?

- What happened in 1985?

- What did Les learn?

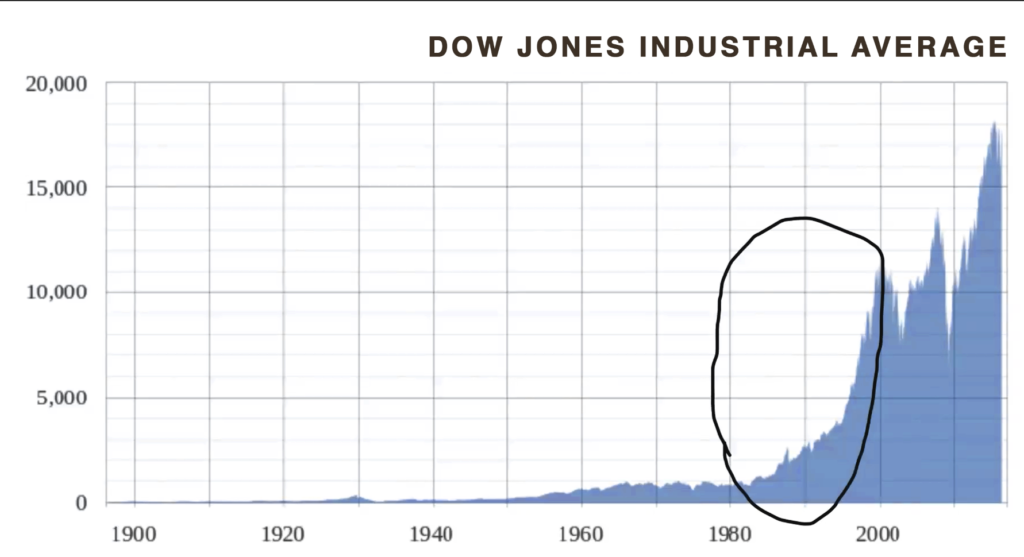

- Can you always get 10% in the stock market?

- What is AG49?

- What is AG49A?

- What is AG49B?

- What is actuarial guidance?

- What about a hypothetical straight line example?

- What about signing the HR clipboard or binder, wherever you find a tab?

- When will the market go down?

- Did you hear last week’s episode, Episode 311?

- Will you wait?

- Is volatility ever your friend?

- Does the market go in a straight line?

- What is an illustration?

- What did the AG49 rules do to the illustrations and projections for universal life insurance?

- What about bonuses, buildups and multipliers?

- Is straight line a joke?

- Are the projections of universal life too rosy?

- What about whole life insurance straight line illustrations?

- What is the business model for whole life insurance carriers?

- What about dividends?

- What about consistency?

- What is the variability inside of a whole life insurance policy?

- What is happening with higher interest rates?

- What about guarantees?

- What group comes to see Les?

- What’s the joke?

- Do you have to think about volatility?

- What about IUL, UL, VUL?

- What about the zeros?

- What about the increasing cost of insurance year after year?

- Will that IUL, UL or VUL lapse?

- Will you be able to live on this in retirement?

- What is gold?

- Would you like to read Lester’s blog?

- Have you heard Episode 311 yet?

- Who refuses to sell universal life products?

- Do these products have unnecessary risks?

Join us this year, as we explore

the roots behind what we’re inheriting

and how we can navigate in the future.

Who: You! + Amazing Speakers, Authors and Industry Leaders

What: The 3rd Annual Not Your Average Financial Summit

When: September 6-7, 2023; 1PM to 4:30PM CT both days

(Please adjust for your timezone.)

Where: Virtual

How: REGISTER HERE!

Lester N. Himel discovered the use of specific types of Life Insurance to enhance and expand the performance of investment portfolios several years ago; this after spending 28 years in a variety of positions on Wall Street. Like most financial professionals, he considered stocks, bonds and similar instruments as the core of a reasonable investment approach. In those last several years, Les has found the better way. Les comes to this field with a very broad financial background. He started as a compliance officer, worked in administration, was an institutional bond trader, developed an Emerging Markets business, and was also involved with “alternative investments”. Les prefers low risk and “guarantees”, and has an ability to simplify explanations of what, why and how. Contact Les at heiratlas.com.

Lester N. Himel discovered the use of specific types of Life Insurance to enhance and expand the performance of investment portfolios several years ago; this after spending 28 years in a variety of positions on Wall Street. Like most financial professionals, he considered stocks, bonds and similar instruments as the core of a reasonable investment approach. In those last several years, Les has found the better way. Les comes to this field with a very broad financial background. He started as a compliance officer, worked in administration, was an institutional bond trader, developed an Emerging Markets business, and was also involved with “alternative investments”. Les prefers low risk and “guarantees”, and has an ability to simplify explanations of what, why and how. Contact Les at heiratlas.com.