Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

- What is finite?

- How do we solve that problem?

- What can be converted into a lifetime stream of income?

- Is there a stream of income that you cannot outlive?

- Would you like to hear Episode 354?

- How can you get through your retirement without coughing up a third of your income into taxes and fees?

- What about the allegory of the cave?

- What about the fear of change?

- Who has a 401(k)?

- Did you know…?

- What could take about half of your life savings away?

- Are you one of the lucky ones?

- Would you like to hear Episode 79?

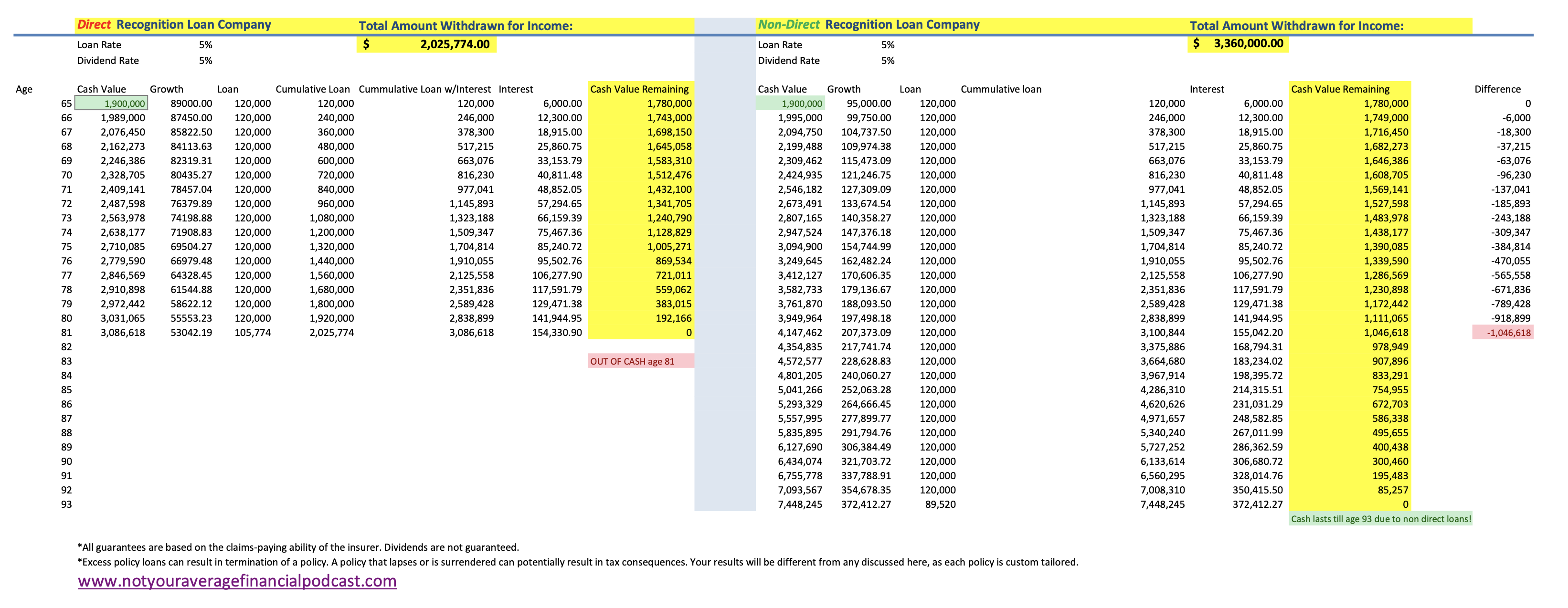

- How much would one have after taxes and fees?

- How much could one take per month?

- What about another way?

- What if one could spread it out slowly?

- What happens in systematic withdrawal?

- What are some possibilities?

- Who would like to preserve the wealth?

- How about an example?

- What about annuities?

- What about fun?

- What would you rather have?

- Would you like to meet with Mark?

Lindsay and Ryan Rice are the entrepreneurial spirits behind Rice Properties Group, a real estate powerhouse built on the foundation of love, partnership, and a steadfast commitment to financial mastery. Their journey began as colleagues, where they not only excelled in sales but also found love, becoming the company’s first couple to transition from quiet dating to marriage. Their shared experiences at the startup, which has since become a multi-billion-dollar enterprise, laid the groundwork for their future endeavors in real estate.

Lindsay and Ryan Rice are the entrepreneurial spirits behind Rice Properties Group, a real estate powerhouse built on the foundation of love, partnership, and a steadfast commitment to financial mastery. Their journey began as colleagues, where they not only excelled in sales but also found love, becoming the company’s first couple to transition from quiet dating to marriage. Their shared experiences at the startup, which has since become a multi-billion-dollar enterprise, laid the groundwork for their future endeavors in real estate.

Jay Helms, Founder of the W2 Capitalist, escaped the rat race after 6 years of side hustling in real estate investing. Jay has a goal to help one million people create multiple streams of income, achieve financial freedom, or build legacy wealth through real estate investing. Jay met his wife Cassie when they were contestants on a reality TV show and when their family of 5 are not traveling the country in their RV, Jay and Cassie reside in Gulf Breeze, FL, with their three kids, Rowland, Stella, and Ellen Anne. Knowing that closing on the first deal is the biggest hurdle and roadblock for new investors, he wrote a book,

Jay Helms, Founder of the W2 Capitalist, escaped the rat race after 6 years of side hustling in real estate investing. Jay has a goal to help one million people create multiple streams of income, achieve financial freedom, or build legacy wealth through real estate investing. Jay met his wife Cassie when they were contestants on a reality TV show and when their family of 5 are not traveling the country in their RV, Jay and Cassie reside in Gulf Breeze, FL, with their three kids, Rowland, Stella, and Ellen Anne. Knowing that closing on the first deal is the biggest hurdle and roadblock for new investors, he wrote a book,