Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

- What are the biases with insurance?

- What misunderstandings exist?

- What’s the truth?

- Why does anyone have a bias against anything?

- Where do we hear information?

- Is this information in line with reality?

- What about my family member’s experience?

- How many mutual funds are out there?

- Why do people have completely different experiences with the same vehicle?

- How can life insurance help you while you’re alive?

- How is a whole life insurance policy more than just a death benefit?

- Why is old fashioned whole life a terrible place to save money?

- Is a model T car a terrible way to drive across the country?

- Is an airplane an effective way to get to the grocery store?

- Is this an investment?

- Should insurance compete with a mutual fund?

- How will you feel when the market crashes to the depths of the ocean?

- When do you want your money growing the fastest?

- When do you want your money in a competitive position?

- Why is whole life insurance so expensive?

- Why is term life insurance so cheap?

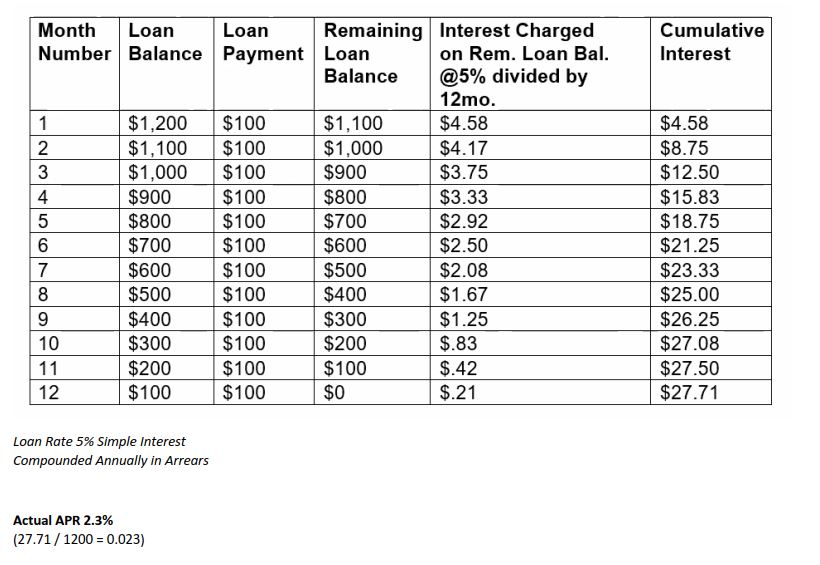

- Is term really cheaper?

- What’s a better deal?

- When would you want to buy term?

- Why is term insurance designed to become too expensive?

- Have you seen your term premium quadruple yet?

- What do you have to show for a dropped term policy?

- Do you want to buy term?

- How are the benefits in whole life stronger than term?

- What guarantees do you have with whole life insurance?

- What guarantees do you have with term life insurance?

- How many term policies actually ever pay a claim?

- What’s the difference between buying a house and renting?

- Which one will provide the greatest value to you and your value?

- How is this unlike most whole life insurance that most people have heard about?

- How much of a pay cut do advisors take?

- How quickly can you use the cash value?

- What are the benefits?

- Would you like tax free access to cash?

- Would you like guaranteed growth every year?

- Would you like the ability to leave your family more than you could ever save?

- Do you need to finance a big purchase?

- Why aren’t insurance companies letting everyone know about this?

- Why are there entire cable channels dedicated to Wall Street?

- Why aren’t we hearing a whole lot about this?

- Where did the term buy term and invest the difference come from?

- How are high net worth clients and leaders allocating their assets?

- What’s too good to be true?

- Is whole life premium payments only for the affluent?

- What if someone can’t afford the premium?

- What about getting “locked” into a premium payment?

- What happens if I miss a premium payment on a whole life insurance policy?

- What flexibility exists?

- Who decides how much goes into premium?

- What happens if I lose my income temporarily?

- Is life insurance a safe place to put money?

- Is a life insurance policy safer than the banks?

- Are life insurance companies FDIC insured?

- What is FDIC insurance?

- What safeguards are on the insurance companies?

- What third parties are involved?

- What happens if a life insurance company goes down?

- What about AIG in 2008?

- What happened to the life insurance subsidiary of AIG?

- Does the FDIC have enough money to cover all of the nation’s banks?

- What percentage of our money is backed up by FDIC?

- In 2008, how much did the FDIC ask for in bailout money?

- Who pays for the bailout?

- If the FDIC raises limits to 1 million, what happens?

- Are banks legally required to keep safe assets?

- How much life insurance do the banks have to purchase themselves?

- What is BOLI?

- What did Nelson Nash say?

- What happens when you change the way you see things?